Globalstar Inc's Meteoric Rise: Unpacking the 29% Surge in Just 3 Months

Globalstar Inc (GSAT), a leading telecommunications company, has seen a significant shift in its stock performance over the past few months. With a current market cap of $2.47 billion and a stock price of $1.35, the company has experienced a 4.29% decrease over the past week. However, the past three months have seen a remarkable 28.85% increase in the stock price. According to the GF Value, the stock is currently modestly undervalued at $1.79, compared to its past GF Value of $1.62. This indicates that the stock was previously a possible value trap, warranting careful consideration from investors.

Company Overview

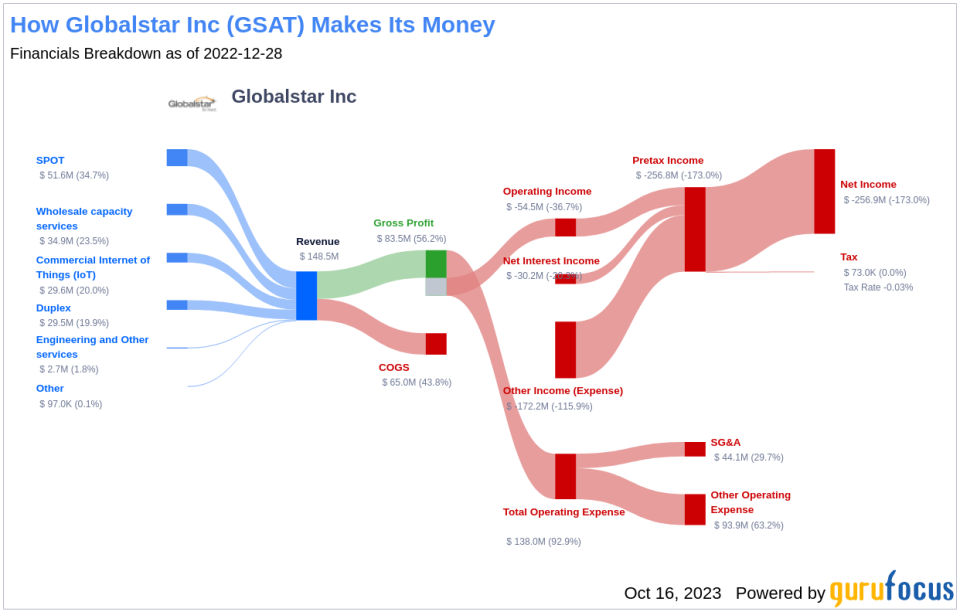

Globalstar Inc operates primarily in the United States, providing mobile satellite services. The company's business model revolves around its ownership of satellite assets and the provision of two-way voice and data transmission services. In addition, it offers one-way data transmission using mobile or fixed devices. The majority of its revenue is generated within the United States.

Profitability Analysis

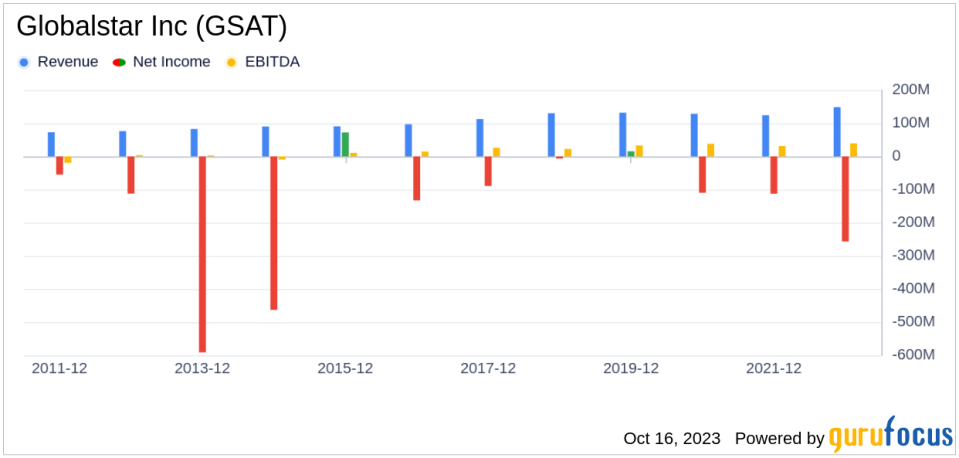

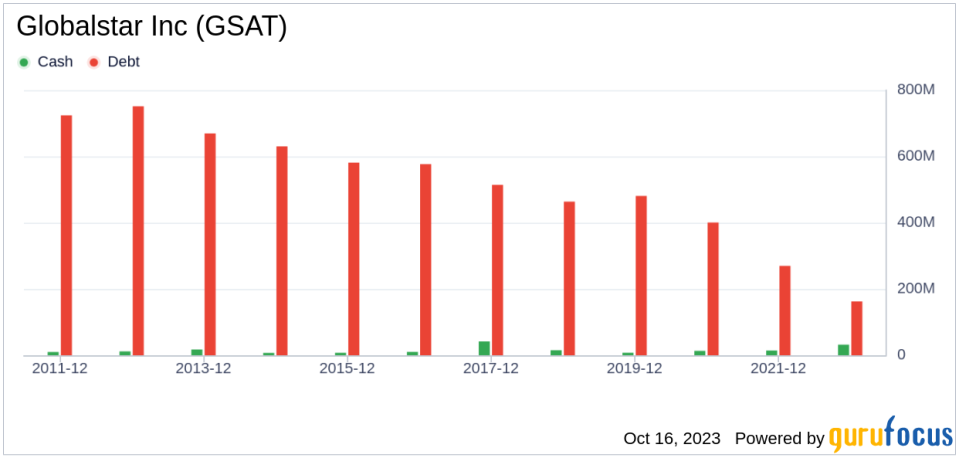

Globalstar Inc's profitability rank stands at 3/10, indicating that it is less profitable than many of its peers. The company's operating margin is -10.46%, which is lower than the industry average. Similarly, its ROE (-75.87%), ROA (-25.37%), and ROIC (-2.33%) are all below the industry average. Over the past 10 years, the company has only achieved profitability in 2 years.

Growth Prospects

Globalstar Inc's growth rank is 4/10, indicating moderate growth compared to its peers. The company's 3-year and 5-year revenue growth rates per share stand at 0.80% and -5.50% respectively. Furthermore, its 3-year and 5-year EPS without NRI growth rates are -26.00% and -26.30% respectively.

Major Shareholders

Jim Simons (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) are among the major shareholders of Globalstar Inc. Simons holds 1,323,374 shares, accounting for 0.07% of the company, while Cohen holds 108 shares, representing less than 0.01% of the company.

Competitive Landscape

Globalstar Inc operates in a competitive telecommunications industry. Its main competitors include InterDigital Inc (NASDAQ:IDCC) with a market cap of $2.14 billion, Telephone and Data Systems Inc (NYSE:TDS) with a market cap of $2.09 billion, and Millicom International Cellular SA (NASDAQ:TIGO) with a market cap of $2.68 billion.

Conclusion

In conclusion, Globalstar Inc's stock performance, profitability, growth, holders, and competitors all play a significant role in its current market position. Despite its recent stock price surge, the company's profitability and growth rates are below the industry average. However, with its modest undervaluation and the backing of major shareholders, Globalstar Inc may still hold potential for future growth in the telecommunications industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.