Globalstar Inc's Meteoric Rise: Unpacking the 33% Surge in Just 3 Months

Globalstar Inc (GSAT) has been making waves in the stock market with a significant price change over the past week and the past three months. The company's stock price has seen a gain of 40.95% in the past week and a remarkable 33.33% over the past three months. This surge in stock price has caught the attention of investors and market analysts alike, prompting a closer look at the company's performance and valuation.

Understanding Globalstar's Stock Performance and Valuation

Globalstar's current market cap stands at $2.66 billion, with a stock price of $1.48. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The GF Value for Globalstar is currently at $1.79, indicating that the stock is modestly undervalued. This is a significant shift from the GF Value three months ago, which was $1.62, suggesting that the stock was a possible value trap. This change in GF Valuation indicates a positive outlook for potential investors.

Introduction to Globalstar Inc

Globalstar Inc is a leading player in the Telecommunication Services industry. The company provides mobile satellite services, primarily used where existing terrestrial wireline and wireless communications networks are impaired or do not exist. The company offers two-way voice and data transmission services, as well as one-way data transmission, using mobile or fixed devices. The majority of Globalstar's revenue is generated within the United States.

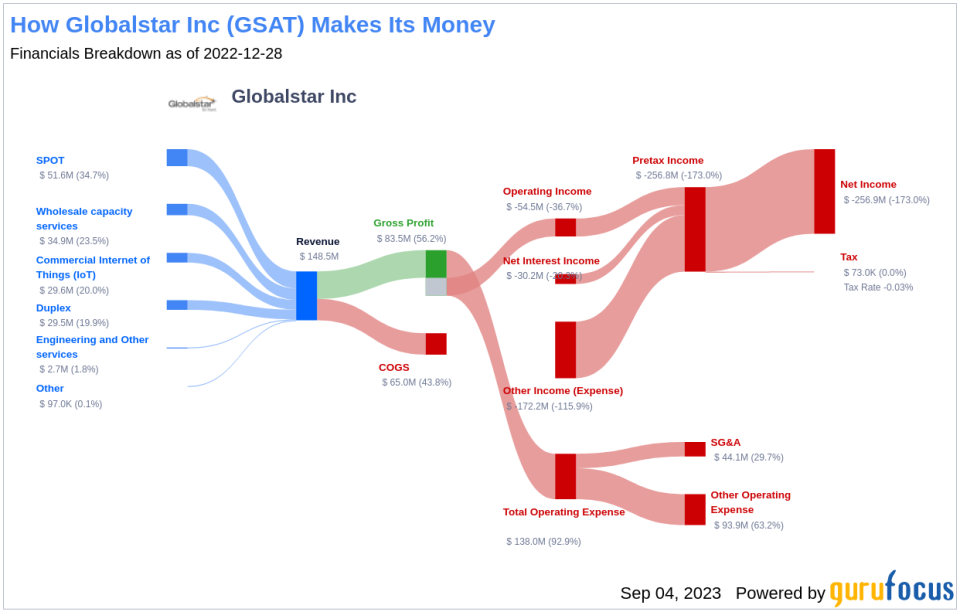

Profitability Analysis of Globalstar Inc

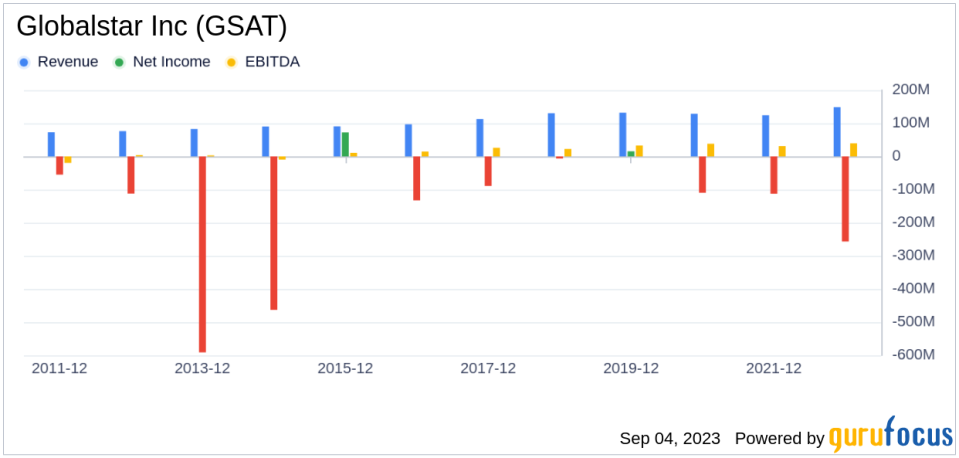

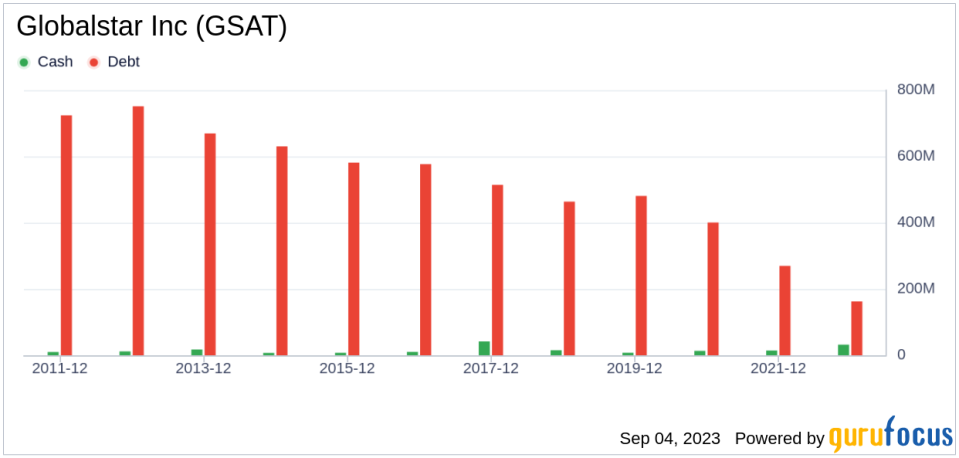

Globalstar's Profitability Rank is 3/10, indicating that the company's profitability is relatively low compared to other companies in the industry. The company's Operating Margin is -10.46%, which is better than 11.63% of the companies in the industry. The ROE is -75.87%, ROA is -25.37%, and ROIC is -2.33%, all of which are better than a small percentage of companies in the industry. Over the past 10 years, Globalstar has had 2 years of profitability, which is better than 13% of the companies in the industry.

Globalstar's Growth Prospects

Globalstar's Growth Rank is 4/10, indicating moderate growth prospects. The company's 3-Year Revenue Growth Rate per Share is 0.80%, which is better than 36.84% of the companies in the industry. However, the 5-Year Revenue Growth Rate per Share is -5.50%, which is better than only 21.84% of the companies in the industry. The 3-Year and 5-Year EPS without NRI Growth Rates are -26.00% and -26.30% respectively, which are better than a small percentage of companies in the industry.

Top Holders of Globalstar Inc's Stock

Jim Simons (Trades, Portfolio) is the top holder of Globalstar Inc's stock, holding 1,323,374 shares, which accounts for 0.07% of the company's shares. The second-largest holder is Steven Cohen (Trades, Portfolio), who holds 108 shares, accounting for a negligible percentage of the company's shares.

Globalstar Inc's Competitors

Globalstar Inc operates in a competitive industry with several key players. Liberty Latin America Ltd (NASDAQ:LILA) has a stock market cap of $1.82 billion, Telephone and Data Systems Inc (NYSE:TDS) has a market cap of $2.41 billion, and InterDigital Inc (NASDAQ:IDCC) has a market cap of $2.27 billion. Compared to these competitors, Globalstar Inc's market cap of $2.66 billion is relatively high.

Conclusion

In conclusion, Globalstar Inc's stock has seen a significant surge over the past three months, making it an interesting prospect for investors. Despite its low profitability and moderate growth prospects, the company's stock is currently modestly undervalued according to the GF Value. However, potential investors should also consider the company's competitive landscape and the holdings of top investors before making investment decisions.

This article first appeared on GuruFocus.