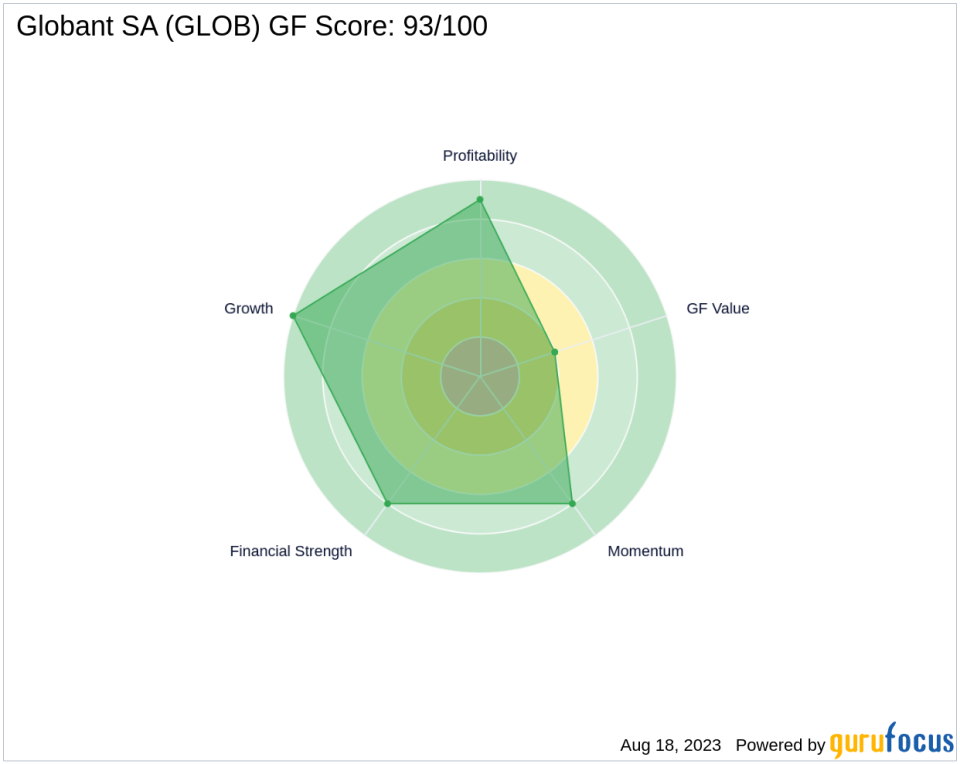

Globant SA (GLOB): A High-Performing Software Giant with a GF Score of 93

Globant SA (NYSE:GLOB) is a leading player in the software industry, with a market capitalization of $7.71 billion. As of August 18, 2023, the company's stock price stands at $181.75, marking an 11.52% gain for the day. However, over the past four weeks, the stock has seen a slight dip of 8.55%. Despite this short-term fluctuation, Globant's overall performance remains robust, as reflected in its impressive GF Score of 93 out of 100. This score indicates the highest outperformance potential, making Globant a compelling consideration for value investors.

Financial Strength: A Solid Foundation

Globant's Financial Strength rank stands at 8 out of 10, indicating a strong financial situation. The company's interest coverage ratio is 14.90, suggesting that Globant is well-equipped to meet its debt obligations. Furthermore, its debt to revenue ratio is a mere 0.07, indicating a low debt burden. The company's Altman Z score of 9.36 further underscores its financial stability.

Profitability Rank: Consistent and Growing

The company's Profitability Rank is 9 out of 10, reflecting its consistent profitability. Globant's Operating Margin is 11.41%, and its Piotroski F-Score is 2, indicating a healthy operating environment. The company has maintained profitability for the past ten years, and its operating margin has seen a positive trend with a 5-year average of 1.60%. Its Predictability Rank of 4.5 further attests to its consistent performance.

Growth Rank: A High-Flying Trajectory

Globant's Growth Rank is a perfect 10 out of 10, reflecting its impressive growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 29.00%, and its 3-year revenue growth rate is 33.40%. Additionally, its 5-year EBITDA growth rate stands at 33.80%, indicating a strong upward trajectory in its business operations.

GF Value Rank: A Fair Valuation

The company's GF Value Rank is 4 out of 10, suggesting that the stock is fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric that takes into account historical multiples and an adjustment factor based on past returns, growth, and future business performance estimates.

Momentum Rank: Strong Momentum

Globant's Momentum Rank is 8 out of 10, indicating strong momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators, reflecting the stock's performance over the past 12 months.

Competitor Analysis: Leading the Pack

When compared to its competitors in the software industry, Globant stands out with its high GF Score. Dolby Laboratories Inc (NYSE:DLB) has a GF Score of 85, Dun & Bradstreet Holdings Inc (NYSE:DNB) has a GF Score of 75, and Concentrix Corp (NASDAQ:CNXC) has a GF Score of 65. This comparison further underscores Globant's strong performance and potential for outperformance.

Conclusion: A High-Performing Investment Prospect

In conclusion, Globant SA's overall GF Score of 93 indicates a high potential for outperformance, making it an attractive investment prospect. Its strong financial strength, consistent profitability, impressive growth, fair valuation, and strong momentum, coupled with its superior performance compared to its competitors, make it a compelling consideration for value investors.

This article first appeared on GuruFocus.