Globe Life Inc (GL) Reports Solid Growth in Q4 2023 Earnings

Net Income: $2.88 per diluted common share, a 17% increase from $2.46 in Q4 2022.

Net Operating Income: $2.80 per diluted common share, up 10% from $2.55 in Q4 2022.

Annual Net Income: Reached $10.07 per diluted common share for 2023, compared to $9.04 in 2022.

Insurance Underwriting Income: Grew by 4% to $327.8 million in Q4 2023.

Net Investment Income: Increased by 6% over the year-ago quarter.

Share Repurchases: 660,170 shares bought back in Q4 2023.

Guidance for 2024: Net operating income projected between $11.30 to $11.80 per diluted common share.

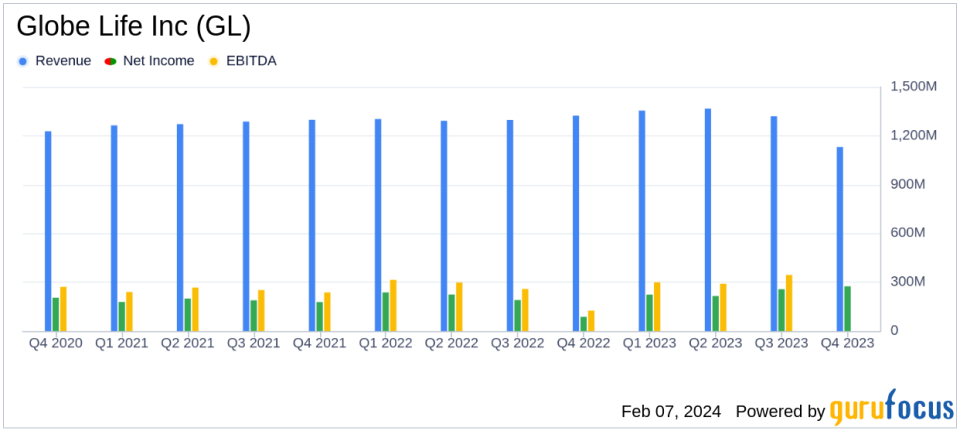

On February 7, 2024, Globe Life Inc (NYSE:GL) released its 8-K filing, announcing a robust performance for the fourth quarter ended December 31, 2023. The insurance holding company, which offers life and supplemental health insurance products, annuities, and investments, reported a significant increase in both net income and net operating income per share compared to the same quarter in the previous year. This performance underscores the company's financial resilience and operational efficiency in a competitive insurance market.

Financial Highlights and Operational Performance

Globe Life Inc's net income for the quarter was $2.88 per diluted common share, a 17% increase from $2.46 in the year-ago quarter. Net operating income also rose to $2.80 per diluted common share, marking a 10% improvement from the previous year's $2.55. For the full year, net income reached $10.07 per diluted common share, compared to $9.04 in the prior year, while net operating income for the year was $10.65 per diluted common share, up from $9.71.

The company's insurance underwriting income grew by 4% to $327.8 million in the fourth quarter, driven by an 8% increase in insurance underwriting income per share. Net investment income also saw a healthy 6% growth over the year-ago quarter. These financial achievements are particularly significant for Globe Life Inc as they reflect the company's ability to generate stable and growing profits from its core operations, which is a key indicator of success in the insurance industry.

During the quarter, Globe Life repurchased 660,170 shares of its common stock, highlighting the company's commitment to delivering shareholder value. Looking ahead, Globe Life projects net operating income to be between $11.30 to $11.80 per diluted common share for the year ending December 31, 2024, signaling confidence in its future performance.

Insurance Operations and Investment Performance

The company's life insurance segment accounted for 75% of the insurance underwriting margin for the quarter and 70% of total premium revenue, while health insurance contributed 24% of the underwriting margin and 30% of premium revenue. Life insurance premiums increased by 4%, and health insurance premiums grew by 3% compared to the same quarter in the previous year.

Globe Life's investment operations also performed well, with net investment income increasing by 6.3% and average invested assets growing by 3.7%. The fixed maturity portfolio earned an annual taxable equivalent effective yield of 5.23% during the fourth quarter of 2023, which is a testament to the company's prudent investment strategy.

"The results included herein reflect the adoption of ASU 2018-12, Financial Services - Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI). Globe Life Inc. implemented the standard on January 1, 2023 using the modified retrospective transition method at adoption. As a result of this election, the prior year figures have been restated as of January 1, 2021 with impacts to Shareholders' Equity, underwriting margins and net income."

It is important to note that the reported results reflect the adoption of new accounting standards, which have been applied retrospectively, affecting shareholders' equity, underwriting margins, and net income figures from previous periods. This transparency in financial reporting provides investors with a clearer picture of the company's performance and financial position.

Conclusion

Globe Life Inc's strong fourth-quarter performance, highlighted by growth in net income and operating income, demonstrates the company's robust business model and strategic positioning in the insurance industry. With a positive outlook for 2024, Globe Life continues to focus on delivering value to its policyholders and shareholders alike.

For more detailed financial information and insights into Globe Life Inc's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Globe Life Inc for further details.

This article first appeared on GuruFocus.