Globus' (GMED) NUVA Buyout Seems Strategic, Cost Woe Stays

Globus Medical GMED continues to gain from surging demand for its Musculoskeletal Solutions products. However, a challenging pricing scenario that continues to plague Globus Medical is a concern. The stock carries a Zacks Rank #3 (Hold).

Globus Medical exited the fourth quarter of 2022 with an earnings beat. The robust growth of organic revenues in both the United States and the international market is impressive. Rapid market interest and customer demand have positioned Excelsius3D, the company’s latest addition to the Excelsius Ecosystem, as a major growth driver in 2023. The company delivered its 12th consecutive quarter of sequential growth in the Trauma business, with 70% growth in the reported quarter. Internationally (excluding Japan), Globus’ spinal implant business also delivered double-digit growth in most markets.

Higher net sales and the acquisition of in-process research and development contributed to the quarter’s GAAP net income, which increased 231.4% from the prior-year quarter figure.

Globus Medical and NuVasive (NUVA) are currently planning to combine in an all-stock transaction to create a global musculoskeletal company focused on rapid innovation, addressing unmet clinical needs and improving offerings to surgeons and patients.

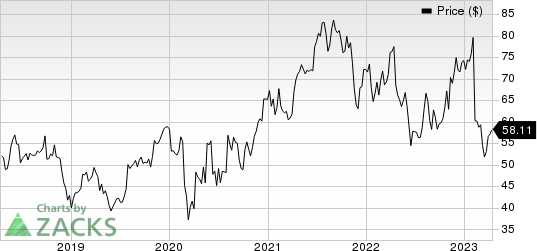

Globus Medical, Inc. Price

Globus Medical, Inc. price | Globus Medical, Inc. Quote

The combined company expects to bring best-in-class technologies to create a differentiated and comprehensive procedural solution offering as part of its approach to address unmet clinical needs and support surgeons and patients. According to Globus Medical, both companies’ operational footprints are highly complementary, allowing them to better leverage each other's manufacturing and supply chain resources to increase internal production while reducing the amount of capital investment required as stand-alone. This way, they can redirect investment and improve cash flow.

On the flip side, Globus Medical exited the fourth quarter of 2022 with a revenue miss. Escalating costs are building pressure on the gross margin. The Q4 gross margin contracted 100 basis points (bps) to 74.3% due to a product mix and higher freight costs. SG&A expenses in the reported quarter were up 10.8% from the year-ago quarter. Selling costs increased due to high compensation expenses from recruiting and mounting traveling expenses.

The continued impact of non-operating headwinds is a major downside.

We note that the musculoskeletal devices industry is characterized by intensifying competitive pricing pressure. Pricing continues to remain a major headwind for Globus Medical. We remain concerned about the pricing scenario as it will be affected by cost-containment efforts by governmental healthcare, local hospitals and health systems.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

Hologic has inched up 3.1% against the industry’s 16% decline in the past year.

Henry Schein has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched once, the average beat being 2.9%.

Henry Schein has lost 7.7% compared with the industry’s 5.5% decline in the past year.

Avanos has an estimated growth rate of 1.8% for 2023. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 11.8% compared with the industry’s 15.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report