Globus Medical (GMED) to Gain From NUVA Merger Amid Margin Woe

Globus Medical GMED continues to gain from surging demand for its Musculoskeletal Solutions products. However, escalating expenses are putting pressure on operating margin. The stock carries a Zacks Rank #3 (Hold).

Globus Medical exited the first quarter of 2023 with earnings and revenue beat. The robust growth of organic revenues in both the United States and the international market is impressive. Rapid market interest and customer demand have positioned Excelsius3D, the company’s latest addition to the Excelsius Ecosystem, as a major growth driver in 2023.

Spine grew 14% in the quarter, with notable gains across the company’s product portfolio in expandables, biologics, MIS screws, 3D printed implants and cervical offerings. In the first quarter, Globus Medical launched its MARS TLIF pedicle-based retractor as part of the company’s focus on procedural efficiency to offer specialized options to meet surgeon preferences. The company also continued to make significant progress in launching its prone lateral patient positioning system.

Within Enabling technology, sales improved 91% on a constant currency basis, driven by robotic and imaging system sales. This represented the company’s highest first-quarter robot sales.

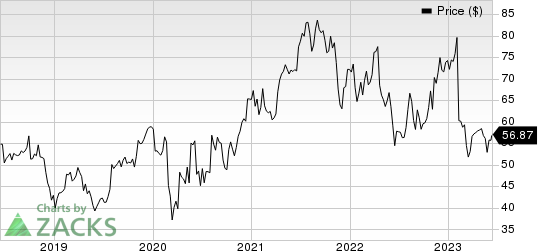

Globus Medical, Inc. Price

Globus Medical, Inc. price | Globus Medical, Inc. Quote

In terms of the NuVasive acquisition deal, with the complementary strengths of Globus Medical engineering and NuVasive relations, education and training, GMED aims to outpace market growth, leading to accelerated EPS growth and an increase in cash flows for investors.

On the flip side, as related to the antitrust approval on the company’s planned merger with NuVasive, both the companies recently received a SEC request from the U.S. Federal Trade Commission regarding its HSR filing. As a result, the expected close of the merger has been delayed from mid-2023 to the third quarter of 2023.

Meanwhile, escalating expenses are putting pressure on operating margin. SG&A expenses in the reported quarter were up 21.5% from the year-ago quarter. The increase reflected higher personnel-related expenses, primarily driven by sales compensation, as well as higher meetings, travel and training expenses. In consequence, adjusted operating margin contracted 55 basis points in the quarter to 22.5%. Further, stiff competition and pricing pressure continue to pose challenges.

Over the past year, shares of Globus Medical have underperformed its industry. The stock has lost 2.8% against 11.3% rise of the industry.

Key Picks

Some better-ranked stocks in the overall healthcare sector are Penumbra PEN, Lantheus LNTH and Haemonetics HAE. While Penumbra and Lantheus each sport a Zacks Rank #1 (Strong Buy), Haemonetics carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra’s stock has risen 175.8% in the past year. The Zacks Consensus Estimate for Penumbra’s earnings per share (EPS) has remained constant at $1.56 for 2023 and at $2.56 for 2024 in the past 30 days.

PEN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 109.42%. In the last reported quarter, the company registered an earnings surprise of 109.09%.

The Zacks Consensus Estimate for Lantheus’ 2023 EPS has remained constant at $5.60 in the past 30 days. Shares of the company have improved 34.2% in the past year against the industry’s 22.7% decline.

LNTH’s earnings beat estimates in each of the trailing four quarters, the average surprise being 25.77%. In the last reported quarter, the company recorded an earnings surprise of 13.95%.

Estimates for Haemonetics’ EPS have increased from $3.29 to $3.55 for 2023 in the past 30 days. Shares of the company have increased 40.5% in the past year against the industry’s 22.7% decline.

HAE’s earnings beat estimates in each of the trailing four quarters, the average surprise being 12.21%. In the last reported quarter, Haemonetics delivered an earnings surprise of 13.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report