Globus Medical (GMED) Gains on Innovation, Strategic Deal

Globus Medical GMED continues to experience surging demand for its Musculoskeletal Solutions products. The stock carries a Zacks Rank #2 (Buy).

Globus Medical exited the first quarter of 2023 with earnings and revenue beat. The robust growth of organic revenues in both the United States and the international market is impressive. Rapid market interest and customer demand have positioned Excelsius3D, the company’s latest addition to the Excelsius Ecosystem, as a major growth driver in 2023.

Spine grew 14% in the quarter with notable gains across the company’s product portfolio in expandables, biologics, MIS screws, 3D printed implants and cervical offerings. This above market growth was driven by competitive rep recruiting from prior quarters, robotic pull-through and a normalization of post-COVID procedures compared to the prior year performance. In the first quarter, Globus Medical launched its MARS TLIF pedicle-based retractor as part of the company’s focus on procedural efficiency to offer specialized options to meet surgeon preferences. The company has also continued to make significant progress in launching its prone lateral patient positioning system.

Within Enabling technology sales improved 91% on a constant currency basis, driven by robotic and imaging system sales. This represented the company’s highest first-quarter robot sales. Globus Medical continued to see increased interest in sales with significant international gains of ExcelsiusGPS in EMEA and Asia Pacific that will lead to future implant pull-through and strong market share gains. Robotic procedures continue to accelerate, growing 51% from the prior year and exceeding 49,000 robotic procedures performed till the first-quarter earnings call.

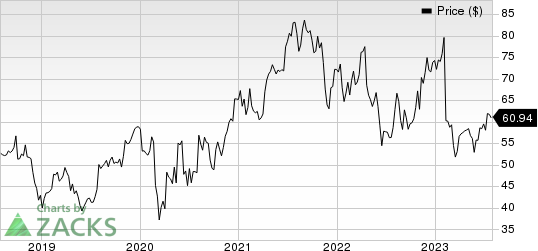

Globus Medical, Inc. Price

Globus Medical, Inc. price | Globus Medical, Inc. Quote

In terms of NuVasive’s acquisition deal, with the complementary strengths of Globus Medical engineering and NuVasive relations, education and training, GMED aims to outpace market growth, leading to accelerated EPS growth and an increase in cash flows for investors. This all-stock structure preserves cash to deleverage the company and accelerate investment in assets to fuel growth. The combination capitalizes on GMED’s complementary commercial organization and should allow the company to accelerate its globalization strategies to increase customer reach and strengthen surgeon relationships.

A strong solvency position is an added positive.

On the flip side, related to the antitrust approval on the company’s planned merger with NuVasive, both the companies recently received an SEC request from the U.S. Federal Trade Commission regarding the Hart-Scott-Rodino (HSR) filing. As a result, the expected close of the merger has been delayed from mid-2023 to the third quarter of 2023.

Meanwhile, escalating expenses are putting pressure on the operating margin. SG&A expenses in the reported quarter were up 21.5% from the year-ago quarter. The increase reflected higher personnel-related expenses, primarily driven by sales compensation, as well as higher meetings, travel and training expenses. In consequence, the adjusted operating margin contracted 55 bps in the quarter to 22.5%. Further, stiff competition and pricing pressure continue to pose challenges.

Further, the musculoskeletal devices industry is characterized by intensifying competitive pricing pressure. Pricing continues to remain a major headwind for Globus Medical. We remain concerned about the pricing scenario as it will be affected by cost containment efforts by governmental healthcare, local hospitals and health systems.

Further, the musculoskeletal devices industry faces intense competition as well as challenges of third-party coverage and reimbursement practices. Management believes that there will be continued pricing pressure in the future. If competitive forces drive down the prices the company charges for its products, its profit margins will shrink, thus affecting Globus Medical’s ability to maintain its profitability and invest in growing its business.

Over the past year, shares of Globus Medical have underperformed its industry. The stock has rallied 5.9% compared with the 6.6% rise of the industry.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Zimmer Biomet ZBH, Haemonetics HAE and McKesson MCK.

Zimmer Biomet has an earnings yield of 5.35% compared to the industry’s -3.65%. Zimmer Biomet’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 7.38%. Its shares have increased 26.9% compared with the industry’s 0.9% increase over the past year.

ZBH carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics, carrying a Zacks Rank #2 at present, has an earnings yield of 3.85% against the industry’s -3.65%. Haemonetics’ shares have risen 26.8% compared with the industry’s 0.9% increase over the past year.

HAE’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 12.21%.

McKesson, sporting a Zacks Rank #2 at present, has an estimated earnings growth rate of 14.33% for the next year. Shares of MCK have risen 17.6% compared with the industry’s 15% growth over the past year.

MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 4.48%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report