Globus Medical (GMED) Gains From NuVasive Deal, Macro Woes Stay

Globus Medical GMED continues to gain from the surging demand for its Musculoskeletal Solutions products. However, we are worried about the challenging pricing scenario that continues to plague Globus Medical. The stock carries a Zacks Rank #3 (Hold).

Globus Medical is gaining market share in the musculoskeletal solutions space, banking on the strong performance of its implantable devices, biologics, accessories and unique surgical instruments used in an expansive range of spinal, orthopedic and neurosurgical procedures.

The company is particularly seeing notable gains across its product portfolio in expandables, biologics, MIS screws, 3D printed implants and cervical offerings. Over the past couple of quarters, this business has registered above-market growth, driven by competitive rep recruiting from prior quarters and robotic pull-through.

In September 2023, Globus Medical completed the merger with NuVasive. The combined company is expected to create a global musculoskeletal company focused on rapid innovation, addressing unmet clinical needs and improving offerings to surgeons and patients. The combination capitalizes on GMED’s complementary commercial organization and should allow the company to accelerate its globalization strategies to increase customer reach and strengthen surgeon relationships.

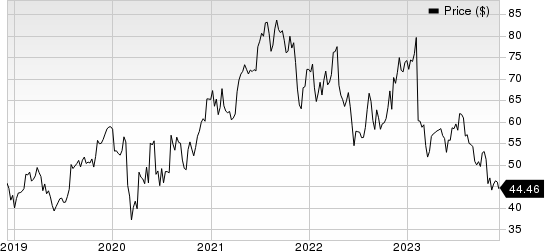

Globus Medical, Inc. Price

Globus Medical, Inc. price | Globus Medical, Inc. Quote

According to Globus Medical, both the companies’ operational footprints are highly complementary, allowing them to better leverage each other's manufacturing and supply-chain resources to increase internal production while reducing the amount of capital investment required as stand-alone. This way, they can redirect investment and improve cash flow.

In line with the company’s business strategy to focus on its integrated product development, Globus Medical is consistently making efforts in research and development. Per the company, its team-oriented approach, active surgeon input and demonstrated capabilities position it to maintain a rapid rate of product launches.

In September 2023, Globus Medical launched the Precice Bone Transport system commercially in the targeted areas by NuVasive Specialised Orthopaedics (“NSO”). The most recent addition to the less intrusive NSO portfolio received CE marking and approval, and it is now offered in a few regions.

Meanwhile, like other industry players, GMED is currently grappling with negative trends in the global economy, including interest rate fluctuations, increases in inflation and financial market volatility. These factors are adversely affecting the company’s operations and financial performance. Global inflation, in particular, has led to a significant rise in the cost of raw materials for GMED. In the third quarter, Globus Medical incurred a 139.6% surge in the cost of goods sold.

These macroeconomic factors, along with the rising wage and raw material costs, are also leading to a significant escalation in the company’s operating expenses. SG&A expenses in the reported quarter were up 46.6% from the year-ago quarter. Research and development expenses increased 56.8% year over year.

Further, the presence of a large number of players made the musculoskeletal device market intensely competitive. The orthopedic industry, in particular, is highly competitive with the presence of more prominent players like Zimmer Biomet, Stryker, Johnson & Johnson’s DePuy, Smith & Nephew and Medtronic. Globus Medical needs to constantly introduce or acquire new products to withstand competitive pressure and maintain its market share.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. Haemonetics and DexCom each presently carry a Zacks Rank #2 (Buy), and Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has decreased 1% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.89 in 2023 and $4.07 to $4.15 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have risen from $1.61 to $1.91 in the past 30 days. Shares of the company have dropped 36.5% in the past year compared with the industry’s decline of 3.3%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.39 to $1.43 in the past 30 days. Shares of the company have advanced 0.1% in the past year compared with the industry’s decline of 4.7%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report