GlycoMimetics Inc (GLYC) Posts Quarterly Loss, Aligns with Analyst Projections

Estimated Earnings Per Share: Analysts predicted a loss of $0.155 per share, GLYC reported a loss of $0.14 per share.

Estimated Net Income: Analysts estimated a net loss of $9.8455 million, GLYC's reported net loss was slightly lower at $9.079 million.

Estimated Revenue: Consistent with estimates, GLYC reported revenue of $10 thousand from collaboration and license agreements.

Research and Development Expenses: GLYC reported R&D expenses of $5.289 million for the quarter.

Cash Position: As of December 31, 2023, GLYC had cash and cash equivalents totaling $41.793 million.

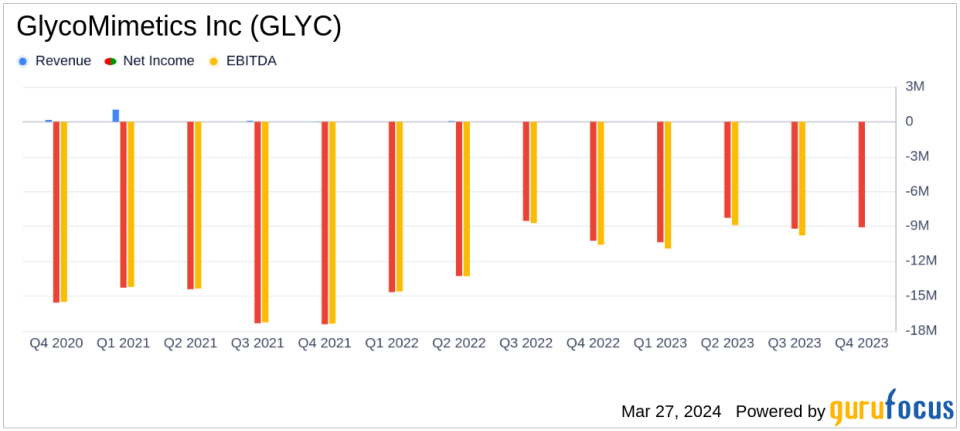

GlycoMimetics Inc (NASDAQ:GLYC) released its 8-K filing on March 27, 2024, detailing the financial results for the fourth quarter and full year of 2023. The company, a clinical stage biotechnology firm focused on developing glycomimetic drugs for diseases with unmet medical needs, reported a net loss of $9.079 million, or $0.14 per share, for the quarter ended December 31, 2023. This performance aligns closely with analyst expectations, which forecasted a loss of $0.155 per share and a net loss of $9.8455 million.

GlycoMimetics' cash and cash equivalents stood at $41.8 million at the end of the year, providing the company with a solid financial footing to continue its clinical programs. The company's CEO, Harout Semerjian, highlighted the imminent time-based analysis for their pivotal Phase 3 study of uproleselan in R/R AML and the potential submission of an NDA before the year's end. The company also announced an agreement with the ASH RC for GMI-1687, a highly potent E-selectin antagonist for the treatment of sickle cell disease.

Financial Performance and Highlights

The company's financial results reflect its ongoing commitment to research and development (R&D), with $5.289 million spent in the fourth quarter and a total of $20.072 million for the year. These investments are critical for advancing GLYC's pipeline, including the uproleselan and GMI-1687 programs. Despite the losses, which are typical for clinical-stage biotech companies, the progress in GLYC's clinical trials is a significant achievement, indicating potential future revenue streams and advances in medical treatments.

General and administrative expenses accounted for $4.312 million in the fourth quarter, contributing to the total costs and expenses of $9.601 million. The company's loss from operations was $9.591 million for the quarter, with a net loss and comprehensive loss of $9.079 million after accounting for interest income.

Future Outlook and Developments

GlycoMimetics' focus on developing therapies for cancers and inflammatory diseases positions it within a critical area of unmet medical need. The company's specialized chemistry platform and scientific approach allow for the discovery of novel glycomimetics, which could lead to transformative therapies. With the FDA and Chinese National Medical Products Administration granting Breakthrough Therapy and Fast Track designations for uproleselan, GLYC is poised to make significant strides in the treatment of AML.

As the company continues to advance its clinical programs and engage in strategic collaborations, investors and industry watchers will be closely monitoring the progress of its lead drug candidates. The potential impact of these therapies on patients' lives underscores the importance of GLYC's financial health and its ability to sustain long-term R&D efforts.

For further details on GlycoMimetics' financial results and operational highlights, investors are encouraged to review the full 8-K filing and the upcoming conference call and webcast information provided on the company's website.

Explore the complete 8-K earnings release (here) from GlycoMimetics Inc for further details.

This article first appeared on GuruFocus.