GoDaddy (GDDY) Boosts Small Business Focus with Instant Video

GoDaddy GDDY adds a new AI-powered feature called Instant Video to its Studio App in a bid to aid small businesses.

The feature enables small businesses to meet their need for video-based digital marketing and social commerce at no extra cost.

GoDaddy Studio Instant Video is an ideal tool for creating promotional, product demo, or tutorial videos for businesses or brands online.

With this AI-powered feature, customers can choose relevant video styles and auto-generate slogans based on uploaded video clips or images. This, in turn, will enable businesses to drive customer engagement and sales.

Moreover, the customers will now be able to create and post watermark-free and influencer-quality videos without the need to be tech-savvy.

Also, GoDaddy Studio users, who create content, will now be able to use royalty-free music from independent artists, thanks to the partnership with Melodie, promoting global music production and brand personality.

We believe the latest move will likely drive GDDY’s momentum across various businesses, especially the small ones.

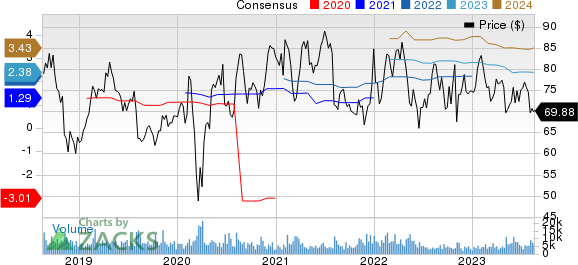

GoDaddy Inc. Price and Consensus

GoDaddy Inc. price-consensus-chart | GoDaddy Inc. Quote

Growing Focus on Small Businesses

Apart from the latest initiative discussed above, the compay recently infused generative AI technology into the company’s Website Builder tool, providing a conversational environment for creators to reduce the time taken by them to write content for their websites.

Further, it introduced three new products to its generative AI portfolio, allowing the small businesses to complete time-consuming tasks with reduced effort, thereby enabling business growth.

Additionally, the company’s integration of Apple's Tap to Pay feature into its free mobile app to allow small businesses to accept contactless payments seamlessly just with an iPhone remains a plus. This move removes the requirement of a dongle or a card reader for small entrepreneurs to accept contactless payments.

Furthermore, GDDY’s introduction of a Small Business Generative AI Prompt Library, which contains over 35 prompts, remains noteworthy.

The new generative AI-backed library is designed to provide small firms access the same level of expertise and capability typically available to huge enterprises. Moreover, it tackles some of the most common issues that small business owners encounter when starting or running their ventures.

In addition to these product offerings, GoDaddy will host 'Beginner's Guide to AI for Small Business' to aid small businesses in adopting AI techniques and leveraging them to bring efficiency in their business operations.

To Conclude

GoDaddy's abovementioned efforts are expected to help it acquire numerous small businesses as customers, which in turn, will drive its top-line growth in the days ahead.

Management expects 2023 revenues in the band of $4.250-$4.325 billion. The Zacks Consensus Estimate is pegged at $4.26 billion, implying a rise of 4.09% from 2022 levels.

The Consensus mark for 2023 earnings is pegged at $2.38 per share, indicating an improvement of 7.69% from a year ago.

Strengthening financial performance is expected to instill investors’ optimism in the stock.

However, softness in the company’s core platform remains a headwind.

GDDY has lost 6.6% in the year-to-date period against the industry’s growth of 8.5%.

Zacks Rank & Key Picks

GoDaddy currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader technology sector can consider some better-ranked stocks like BILL Holdings BILL and Broadcom AVGO and NetEase NTES. While NTES currently sports a Zacks Rank #1 (Strong Buy), BILL and AVGO carry Zacks Rank #2 (buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

BILL Holdings has lost 6.8% in the year-to-date period. The long-term earnings growth rate for BILL is currently projected at 30%.

Broadcom has gained 47.9% in the year-to-date period. The long-term earnings growth rate for AVGO is currently anticipated at 13.52%.

NetEase has risen 39.7% in the year-to-date period. The long-term earnings growth rate for NTES is currently estimated at 13.18%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report