GoDaddy Inc CEO Amanpal Bhutani Sells 3,164 Shares: An Insider Sell Analysis

GoDaddy Inc (NYSE:GDDY), a leading company in the internet domain and web hosting industry, has recently witnessed a significant insider sell by its CEO, Amanpal Bhutani. On December 4, 2023, Amanpal Bhutani sold 3,164 shares of the company, a move that has caught the attention of investors and market analysts alike. This article delves into the details of this transaction, the insider's history, and the potential implications for GoDaddy's stock price and valuation.

Who is Amanpal Bhutani?

Amanpal Bhutani serves as the Chief Executive Officer of GoDaddy Inc. He joined the company in 2019, bringing with him a wealth of experience from his previous role as President of Brand Expedia Group. Bhutani's leadership has been instrumental in steering GoDaddy through the evolving digital landscape, focusing on innovation and customer experience. His recent sell-off of company shares has raised questions about his confidence in GoDaddy's future performance.

GoDaddy Inc's Business Description

GoDaddy Inc is a global leader in domain registration and web hosting services. The company provides a suite of online tools and solutions for small businesses, entrepreneurs, and individuals to establish and grow their online presence. GoDaddy's offerings include domain registration, website building, web hosting, email marketing, and security services. With a customer-centric approach, GoDaddy has established a strong brand and a significant market share in the internet services industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable insights into a company's health and future prospects. Over the past year, Amanpal Bhutani has sold a total of 31,991 shares and has not made any purchases. This one-sided activity could signal a lack of confidence from the insider in the company's near-term growth potential or could be part of a personal financial planning strategy.

The insider transaction history for GoDaddy Inc shows a trend of more insider sells than buys over the past year, with 50 insider sells and 0 insider buys. This trend may cause concern among investors, as it suggests that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

On the day of the insider's recent sell, shares of GoDaddy Inc were trading at $102.23, giving the company a market cap of $14.67 billion. The price-earnings ratio stands at 44.70, which is higher than the industry median of 26.85 but lower than the company's historical median price-earnings ratio. This indicates that while GoDaddy's shares are trading at a premium compared to the industry, they are somewhat more reasonably priced in the context of the company's own trading history.

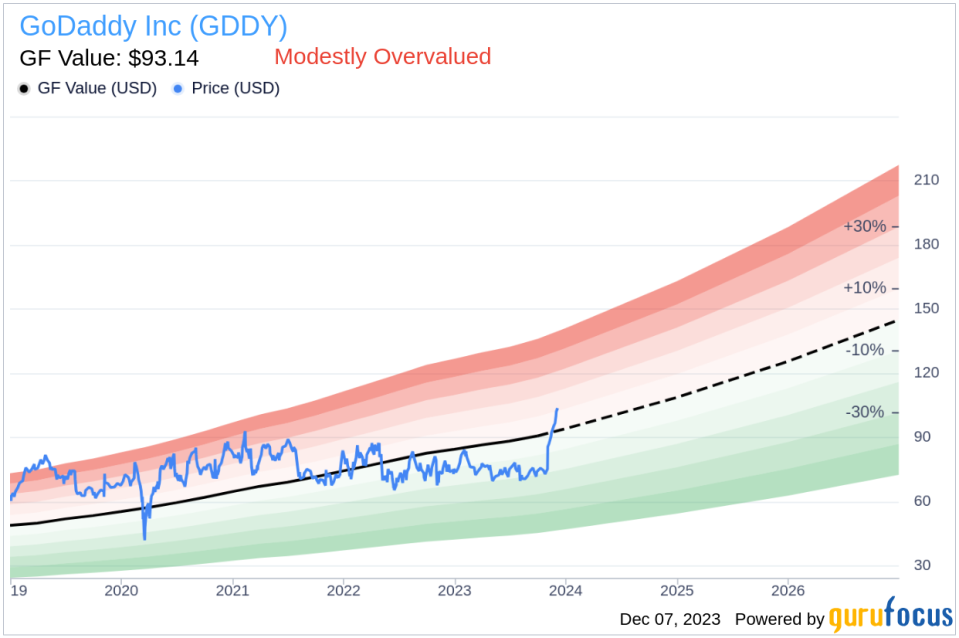

With a stock price of $102.23 and a GuruFocus Value of $93.14, GoDaddy Inc has a price-to-GF-Value ratio of 1.1. This suggests that the stock is modestly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The modest overvaluation of GoDaddy's stock could be a contributing factor to the insider's decision to sell shares.

Conclusion

The recent insider sell by CEO Amanpal Bhutani may raise questions among GoDaddy Inc's investors. While the sell-off could be interpreted as a lack of confidence in the company's short-term prospects, it is also important to consider the broader context, including the insider's personal financial planning needs. The current valuation metrics suggest that GoDaddy's stock is slightly overvalued, which could justify the timing of the sell. Investors should monitor further insider transactions and company performance indicators to better understand the potential direction of the stock.

As with any insider activity, it is crucial to consider the overall market conditions, the company's strategic initiatives, and the insider's historical transaction patterns before drawing conclusions. While insider sells can be a red flag, they do not always signify underlying issues within the company. A comprehensive analysis of GoDaddy Inc's financial health and market position will provide a more complete picture for investors looking to make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.