GoDaddy Inc (GDDY) Reports Stellar Growth in Q4 and Full Year 2023 Earnings

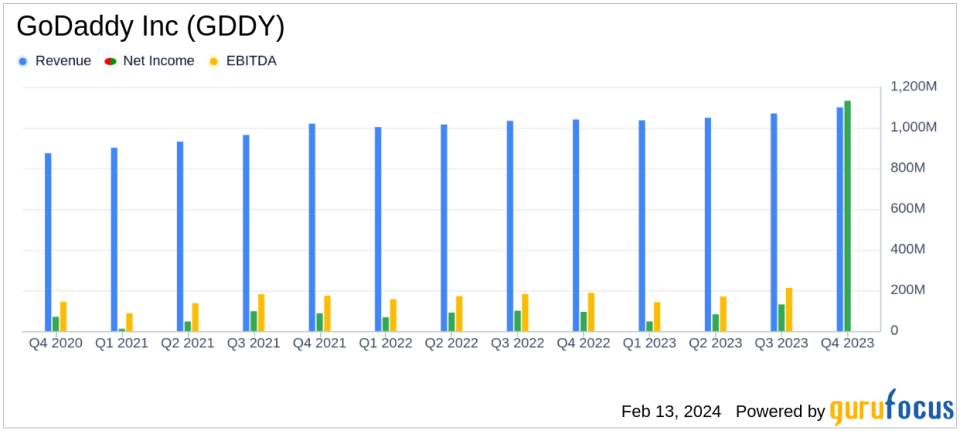

Total Revenue: Reached $4.3 billion for the full year, a 4% increase year-over-year.

Net Income: Surged to $1.4 billion, a 295% jump from the previous year.

Normalized EBITDA: Grew by 12% year-over-year to $1.1 billion.

Free Cash Flow: Rose by 12% year-over-year to $1.1 billion.

Applications & Commerce Revenue: Increased by 13% in Q4, signaling strong segment growth.

Customer Growth: Total customers reached over 21,000 by year-end, a 0.6% increase.

Share Repurchases: GoDaddy repurchased 34.2 million shares, reducing fully diluted shares by approximately 20%.

On February 13, 2024, GoDaddy Inc (NYSE:GDDY) released its 8-K filing, detailing a robust financial performance for the fourth quarter and the full year of 2023. The company, known for providing a suite of services including domain registration, website hosting, and business productivity tools, has shown significant growth, particularly in its Applications & Commerce segment, which saw a 13% revenue increase in Q4.

Financial Performance and Strategic Highlights

GoDaddy's financial results for 2023 reflect a strong operational execution and a commitment to empowering entrepreneurs. The company's total revenue for the year was $4.3 billion, marking a 4% increase from the previous year, with a notable 5% growth on a constant currency basis. The Applications & Commerce segment was a significant contributor to this growth, with an 11.8% increase in annual revenue.

The company's profitability also saw an impressive surge, with net income reaching $1.4 billion, a substantial 295% increase from the previous year, resulting in a net income margin of 33%. This remarkable growth in net income was partly due to the release of a valuation allowance on U.S. and state deferred tax assets, contributing to a non-routine non-cash benefit of approximately $1 billion.

Operational Excellence and Customer-Centric Innovations

GoDaddy's operational discipline and innovative product offerings have been central to its success. The launch of GoDaddy AiroTM in the U.S. market, an AI-powered solution that provides a business-in-a-box experience, is a testament to the company's focus on leveraging technology to support its customers. This initiative, along with a 125% year-over-year increase in Gross Payments Volume (GPV) from commerce offerings, underscores GoDaddy's strategic positioning in the market.

Financial Health and Shareholder Value

GoDaddy's financial health remains robust, with net cash provided by operating activities up by 7% year-over-year to $1,047.6 million. The company's free cash flow also increased by 12% to $1.1 billion, reflecting its ability to generate liquidity and return value to shareholders. In line with this, GoDaddy repurchased 34.2 million shares for an aggregate purchase price of $2.6 billion, reducing its fully diluted shares by approximately 20%.

Looking Ahead

For the upcoming year, GoDaddy has set a positive business outlook, with expected total revenue in the range of $4.480 billion to $4.560 billion, representing a 6% growth at the midpoint compared to 2023. The company also anticipates a Normalized EBITDA margin of approximately 29% for the full year, with a target of at least $1.4 billion in unlevered free cash flow.

GoDaddy's strong performance in 2023, coupled with its strategic initiatives and customer-centric approach, positions the company well for continued growth and innovation in the dynamic online services industry.

Investor and Analyst Engagement

GoDaddy will hold an in-person Investor Day on March 6, 2024, at its Tempe, Arizona headquarters, where company leaders will discuss long-term strategies, financial frameworks, and capital allocation strategies. Additionally, the company will host a webcast to discuss the Q4 and full year 2023 results, providing an opportunity for investors and analysts to gain deeper insights into GoDaddy's performance and future plans.

For detailed financial tables and reconciliations of non-GAAP financial measures, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from GoDaddy Inc for further details.

This article first appeared on GuruFocus.