The world's super-rich are hoarding physical gold

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Bullion is the only real hedge

Gold has had a great run in 2019.

Over the last year, gold prices are up nearly 20%. The yellow metal is on pace for its best year since 2010.

In a note to clients published over the weekend, analysts at Goldman Sachs outlined why the strategic case for owning gold remains strong. The firm cites political uncertainty and recession fears that are unlikely to abate as primary catalysts, among other worries among the global elite like wealth taxes and increasing talk about MMT and central bank effectiveness.

By 2020, the firm thinks the price of gold will reach $1,600 an ounce; on Monday, gold was trading near $1,460.

But the firm also surfaces some really interesting data on how investors have expressed their desire to own gold. Which is that owning the physical metal seems to be the global elite’s preferred way to hedge against tail events.

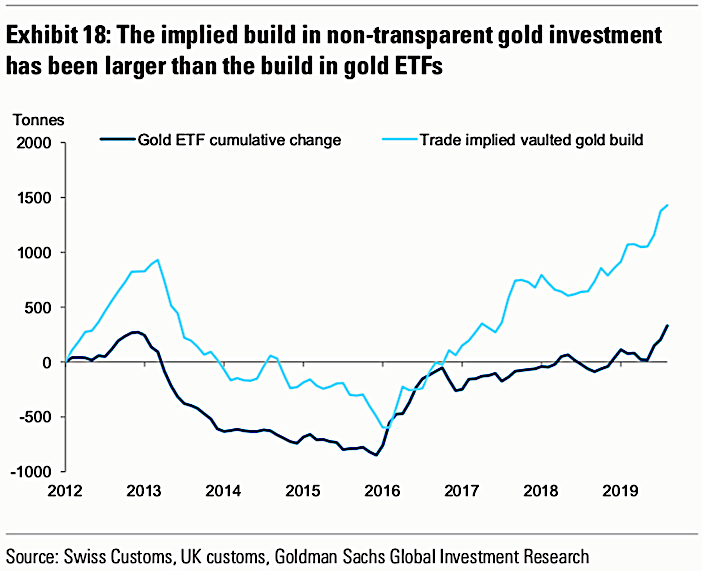

"Since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs," the firm writes, citing the chart below.

In plain English, this means that for those including gold in their end-of-the-world trade, owning gold bullion is a must.

"This [data] is consistent with reports that vault demand globally is surging," the firm writes.

"Political risks, in our view, help explain this because if an individual is trying to minimize the risks of sanctions or wealth taxes, then buying physical gold bars and storing them in a vault, where it is more difficult for governments to reach them, makes sense.”

"Finally, this build can also reflect hedges by global high net worth individuals against tail economic and political risk scenarios in which they do not want to have any financial entity intermediating their gold positions due to the counter-party credit risk involved."

This thesis also brings to mind Evan Osnos' 2017 New Yorker story that chronicled efforts from the super rich to prepare luxurious hideaways that will see them through the apocalypse.

The head of an investment firm told Osnos that, "A lot of my friends do the guns and the motorcycles and the gold coins. That's not too rare anymore."

As Osnos chronicled, underground bunkers with air-filtration systems and helicopters that are gassed up and ready to go are now the real differentiators in the prepper community.

If you want to be truly prepped, then owning gold is just table stakes.

And for Goldman Sachs, that reality helps round out the already strong thesis for investing in gold.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

-

To sign up for Morning Brief, click HERE or on the button below.

By subscribing, you are agreeing to Yahoo's Terms and Privacy Policy

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.