Gold Miners Report Q4 2023 Earnings Results

This article was originally published on ETFTrends.com.

The fourth-quarter reporting period is still in full swing for many sectors, including gold miners. While one or two have yet to report, the lion's share of the big earnings releases from the mining sector are in, revealing some critical trends for the sector as a whole.

Unfortunately, the fourth quarter brought mixed results for gold miners, although with the gold price generally trending higher as the quarter progressed, any minor hiccups appear set to reverse in the current quarter.

Earnings Results From Largest Gold Miners

Starting with the largest gold miner in the world, Newmont beat expectations for profits in the fourth quarter, reporting adjusted earnings of 50 cents per share, versus the consensus estimate of 44 cents. Revenue came in at $3.96 billion, also beating expectations of $3.42 billion.

The fourth quarter marked a significant reversal for Newmont, which missed estimates widely in the second and third quarters. Looking ahead, the miner is targeting production of almost 6.9 million gold ounces for 2024, versus the 5.5 million gold ounces it produced last year.

Barrick Gold posted mixed results for the fourth quarter, smashing estimates for earnings but missing slightly on revenue. The miner posted adjusted earnings of 27 cents per share on $3.06 billion in revenue, versus the consensus estimates of 21 cents per share on $3.14 billion in revenue.

Barrick reported higher-than-expected production in the fourth quarter, resulting in preliminary gold production of 4.05 million ounces for 2023, in line with its guidance shared in its third-quarter release. For all of 2024, the miner is targeting higher gold production of 3.9 million to 4.3 million ounces of gold, although it narrowly missed expectations with its outlook due to operational issues.

Agnico Eagle Mines beat estimates on both the top and bottom lines, posting 57 cents per share in adjusted earnings on $1.76 billion in revenue. Analysts had been expecting 49 cents per share on $1.71 billion in revenue.

Kinross Gold also beat both earnings and revenue estimates for the fourth quarter, coming in at 11 cents per share in adjusted earnings on $1.12 billion in revenue, versus expectations of 10 cents per share on $1.07 billion in revenue.

Gold Miner ETFs

Earnings in the gold-mining sector rely heavily on changes in the gold price. Goldman Sachs analysts said in a recent report that they expect the price of the yellow metal to rise about 6% over the next 12 months, hitting $2,175 per troy ounce. However, they added that gold prices could remain range-bound in the near term amid ongoing uncertainty about the Federal Reserve's plans for interest-rate policy.

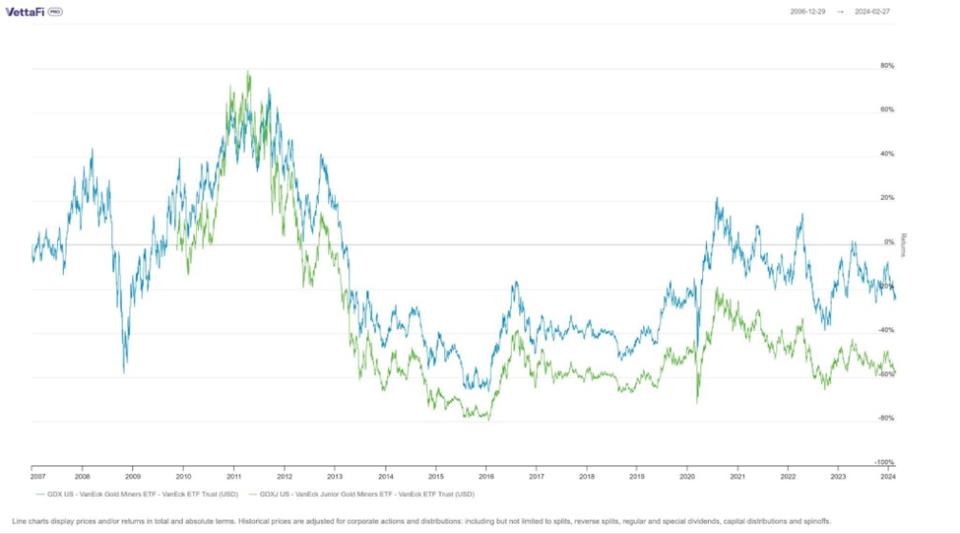

[caption id="attachment_559791" align="aligncenter" width="625"]

Source: VettaFi Pro[/caption]

Of course, exchange-traded funds enable investors to hold a portfolio of gold miners without having to pick and choose their own stocks within the sector. Two of the most well-known and best-capitalized options are the VanEck Gold Miners ETF (GDX), which has $11.1 billion in assets, and the VanEck Junior Gold Miners ETF (GDXJ), which has $3.5 billion in assets.

GDX was the first gold miners ETF in the U.S., and it contains shares of the largest gold miners in the world. As of March 1, the fund’s top holdings included Newmont (which is 12.48% of the ETF's net assets), Barrick Gold (8.96%), Agnico Eagle Mines (8.38%), Franco-Nevada (7.02%) and Wheaton Precious Metals (6.49%).

Meanwhile, GDXJ holds some of the world's leading junior gold miners, meaning they aren't quite as large as the miners found in GDX. The smaller-cap fund’s top holdings include Pan American Silver (6.62% of the ETF's net assets), Kinross Gold (6.31%), Alamos Gold (5.87%), B2gold (4.97%) and Evolution Mining (4.66%).

GDX is down 1.39% during the past 12 months, while GDXJ is down 3.14%. However, both funds are up more than 8% over the last month.

ETFs for Gold Exposure

In addition to using ETFs to invest in a portfolio of gold miners, some investors may also want to consider gold-backed ETFs, which hold physical gold either directly or via derivative contracts. Investors who want to own gold but don't want to store it physically may want to look at ETFs like the SPDR Gold Trust (GLD) or the iShares Gold Trust (IAU).

Of course, there are many different gold-related ETFs to choose from, and it's always a good idea to consider interest rates and other macro-type factors when considering investing in this sector. However, given gold's status as a safe-haven asset, some investors like to keep some exposure to the sector most of the time.

Finally, as interest rates fall, gold could become a more attractive holding to a wider array of investors.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM