Golden Entertainment (GDEN): An Undervalued Gem in the Gaming Industry?

Golden Entertainment Inc (NASDAQ:GDEN) has recently experienced a daily gain of 7.77%, despite a 3-month loss of 11.62%. With an Earnings Per Share (EPS) of 1.58, the question arises: is the stock modestly undervalued? This article aims to provide an in-depth analysis of Golden Entertainment's valuation, offering valuable insights for potential investors.

Company Overview

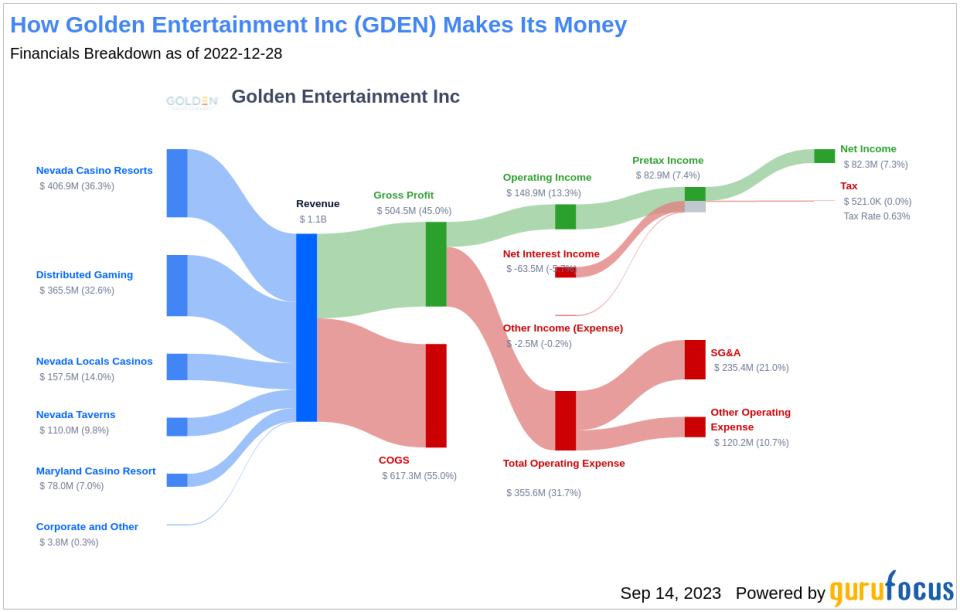

Golden Entertainment, a US-based company, focuses on distributed gaming, casino, and resort operations. Its key revenue sources include Nevada Casino Resorts and Distributed Gaming segments. The former comprises destination casino resort properties offering a variety of food and beverage outlets, entertainment venues, and other amenities. The latter involves operating slot machines and amusement devices in non-casino locations across Nevada and Montana, with a limited number of slot machines in each location, as well as the operation of branded taverns.

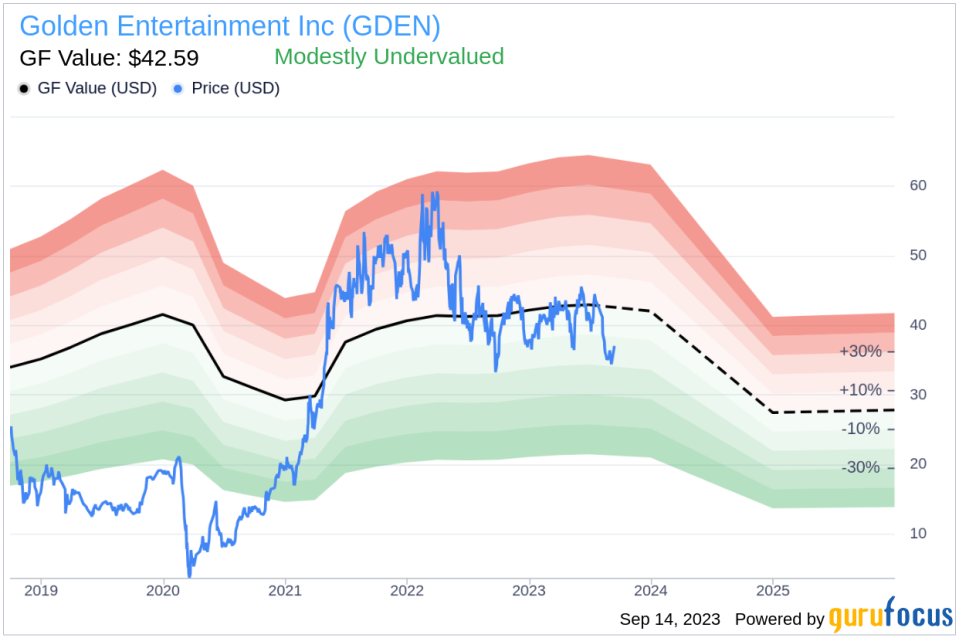

As of September 14, 2023, Golden Entertainment's stock price stands at $37.05, while its GF Value, an estimation of fair value, is $42.59. The company's market cap and sales both stand at $1.10 billion. The income breakdown of Golden Entertainment can be viewed here.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

Golden Entertainment (NASDAQ:GDEN) appears to be modestly undervalued according to the GF Value. The stock's fair value is estimated based on historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. If the share price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. Conversely, if the share price is significantly below the GF Value calculation, the stock may be undervalued and have higher future returns. Given its current price of $37.05 per share, Golden Entertainment stock appears to be modestly undervalued.

Because Golden Entertainment is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

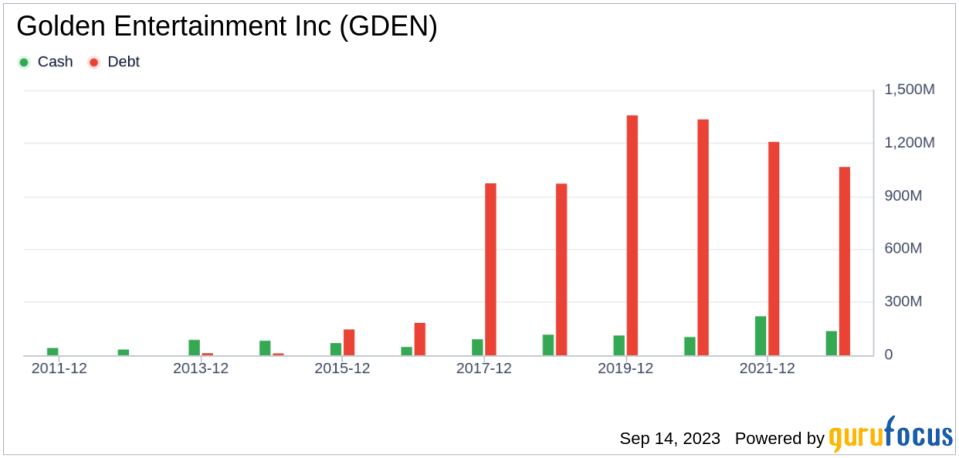

Financial Strength

Investing in companies with poor financial strength has a higher risk of permanent loss. Golden Entertainment has a cash-to-debt ratio of 0.12, which is worse than 76.12% of 825 companies in the Travel & Leisure industry. The overall financial strength of Golden Entertainment is 4 out of 10, indicating that its financial strength is relatively poor.

Profitability and Growth

Golden Entertainment has been profitable 6 over the past 10 years. Over the past twelve months, the company had a revenue of $1.10 billion and Earnings Per Share (EPS) of $1.58. Its operating margin is 12.37%, which ranks better than 64.63% of 820 companies in the Travel & Leisure industry. Overall, the profitability of Golden Entertainment is ranked 6 out of 10, indicating fair profitability.

Golden Entertainment's 3-year average revenue growth rate is better than 56.45% of 767 companies in the Travel & Leisure industry. Its 3-year average EBITDA growth rate is 13.3%, which ranks better than 63.98% of 608 companies in the Travel & Leisure industry.

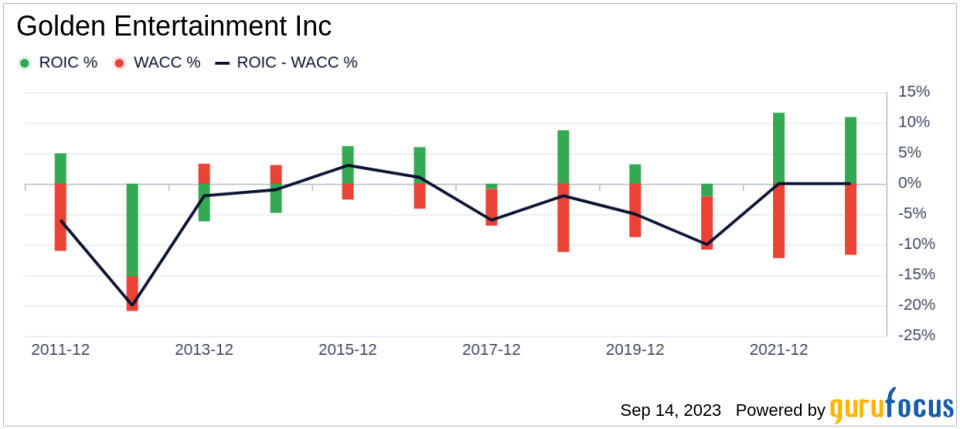

ROIC vs WACC

Golden Entertainment's ROIC is 7.61 while its WACC came in at 9.73. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. The historical ROIC vs WACC comparison of Golden Entertainment is shown below:

Conclusion

In conclusion, the stock of Golden Entertainment (NASDAQ:GDEN) appears to be modestly undervalued. The company's financial condition is poor, and its profitability is fair. However, its growth ranks better than 63.98% of 608 companies in the Travel & Leisure industry. To learn more about Golden Entertainment stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.