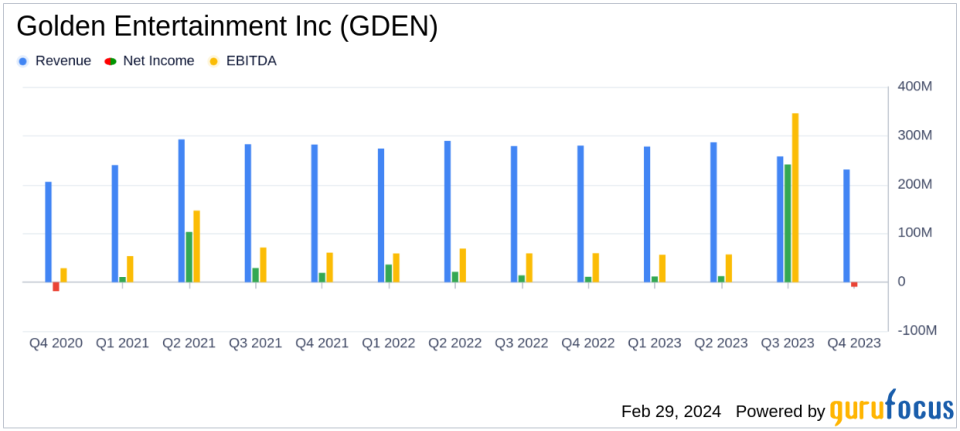

Golden Entertainment Inc (GDEN) Reports Mixed 2023 Financial Results

Revenue: Q4 revenue declined to $230.7 million from $279.7 million in Q4 2022.

Net Income: Full-year net income surged to $255.8 million, largely due to gains from asset sales.

Adjusted EBITDA: Q4 Adjusted EBITDA fell to $48.8 million, down from $63.7 million in the prior year's quarter.

Debt Repayment: Over $60 million of debt repaid in Q4, with a total of $239 million repaid in 2023.

Dividends: Initiated a recurring quarterly cash dividend of $0.25 per share.

Asset Sales: Completed the sale of Nevada distributed gaming business and other non-core assets, generating over $600 million in proceeds.

On February 29, 2024, Golden Entertainment Inc (NASDAQ:GDEN) released its 8-K filing, disclosing its financial results for the fourth quarter and the full year of 2023. The company, known for its distributed gaming, casino, and resort operations, particularly in Nevada, faced a challenging quarter but managed to end the year with significant gains from strategic divestitures.

Company Overview

Golden Entertainment Inc operates in a competitive travel and leisure industry, with its revenue primarily stemming from Nevada Casino Resorts and Distributed Gaming segments. The company's Nevada Casino Resorts include destination casino resort properties, while the Distributed Gaming segment operates slot machines and amusement devices in non-casino locations across Nevada and Montana, as well as branded taverns.

Financial Performance and Challenges

The fourth quarter saw a decline in revenue to $230.7 million, down from $279.7 million in the same quarter of the previous year. This drop was primarily due to the exclusion of results from sold assets, including the Rocky Gap Casino Resort and distributed gaming operations in Montana. The net loss for the quarter was $9.4 million, influenced by an asset impairment charge related to the Colorado Belle Casino Resort. Despite this, the full-year net income reached $255.8 million, boosted by a $303.2 million gain on the sales of non-core assets.

Adjusted EBITDA for the fourth quarter was $48.8 million, a decrease from the $63.7 million reported in the fourth quarter of 2022. The full-year Adjusted EBITDA also saw a decline to $222.5 million from $267.1 million in the previous year, again impacted by the divested businesses.

Debt Repayment and Liquidity

Golden Entertainment made significant strides in strengthening its balance sheet by repaying over $60 million of debt in the fourth quarter and a total of $239 million in 2023. The company's total principal amount of debt outstanding as of December 31, 2023, was $677.7 million. However, liquidity remained robust with cash and cash equivalents of $197.6 million, excluding proceeds from the sale of the Nevada distributed gaming operations.

Strategic Divestitures and Shareholder Returns

The company completed the sale of its Nevada distributed gaming business for approximately $213.5 million, part of a broader strategy to divest non-core assets, which generated over $600 million in total proceeds. These strategic moves not only bolstered the company's financial position but also paved the way for the initiation of a recurring quarterly cash dividend of $0.25 per share, signaling confidence in its ability to generate shareholder value.

Outlook and Management Commentary

Blake Sartini, Chairman and Chief Executive Officer of Golden, expressed optimism about the company's focus on Nevada casino resorts, locals casinos, and taverns, which are expected to benefit from positive economic trends in Nevada. The company's strategic divestitures have created financial flexibility and an opportunity to return capital to shareholders.

Following these transactions, our portfolio is comprised of Nevada casino resorts, Nevada locals casinos and Nevadas largest branded tavern portfolio, all of which are expected to benefit from Nevadas positive economic trends," said Sartini.

Golden Entertainment's performance in 2023 reflects a transformative period with significant asset sales and debt repayment, positioning the company for potential growth in its core markets. While the fourth quarter presented challenges, the full-year results demonstrate the company's ability to navigate a changing landscape and deliver value to its shareholders.

For more detailed information, investors are encouraged to review the full 8-K filing and tune into the company's webcast and conference call to discuss the results.

Explore the complete 8-K earnings release (here) from Golden Entertainment Inc for further details.

This article first appeared on GuruFocus.