Is Golden Minerals Co (AUMN) a Hidden Value Trap? Unpacking the Risks and Rewards

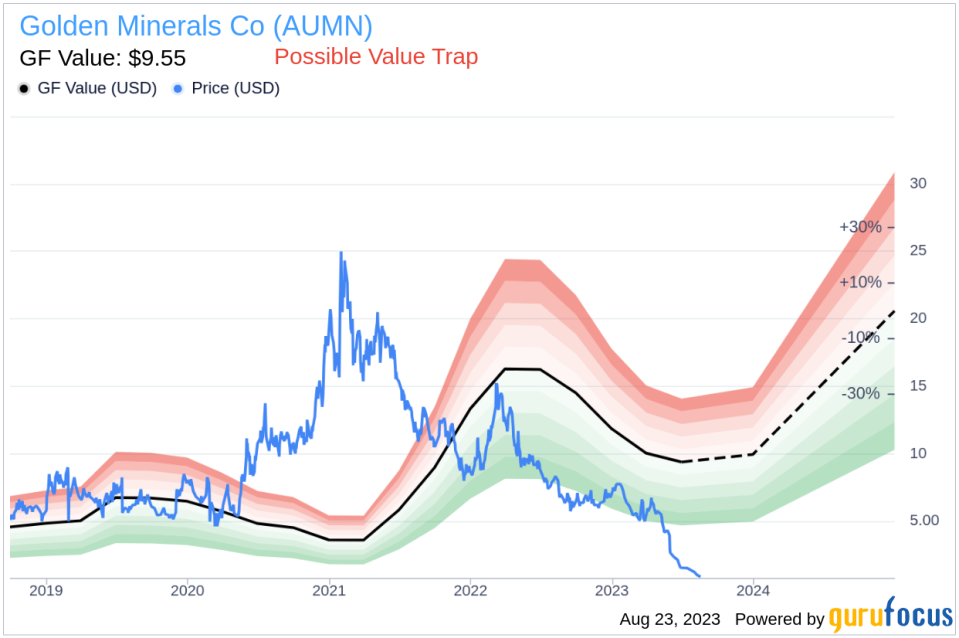

Value investors are always on the lookout for stocks priced below their intrinsic value. One such stock that warrants attention is Golden Minerals Co (AUMN). The stock, currently priced at 1.03, recorded a daily gain of 16.38% and a 3-month decrease of 76.66%. According to its GF Value, the stock's fair valuation is $9.55.

Understanding the GF Value

The GF Value is a representation of the current intrinsic value of a stock, derived from our exclusive method. The GF Value Line on our summary page provides an overview of the stock's fair value. It is calculated based on three factors: historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

We believe the GF Value Line is the fair value at which the stock should be traded. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Despite its seemingly attractive valuation, investors need to consider a more in-depth analysis before making an investment decision. Certain risk factors associated with Golden Minerals Co should not be overlooked. These risks are primarily reflected through its low Piotroski F-score of 2, Altman Z-score of -50.5, and a Beneish M-Score of 0.43 that exceeds -1.78, the threshold for potential earnings manipulation. These indicators suggest that Golden Minerals Co, despite its apparent undervaluation, might be a potential value trap. This complexity underscores the importance of thorough due diligence in investment decision-making.

Decoding the Piotroski F-score, Altman Z-score, and Beneish M-score

The Piotroski F-score, created by accounting professor Joseph Piotroski, is a tool used to assess the strength of a company's financial health. The score is based on nine criteria that fall into three categories: profitability, leverage/liquidity/source of funds, and operating efficiency. The overall score ranges from 0 to 9, with higher scores indicating healthier financials. Golden Minerals Co's current Piotroski F-Score, however, falls in the lower end of this spectrum, indicating potential red flags for investors.

The Altman Z-score, invented by New York University Professor Edward I. Altman in 1968, is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. The Altman Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Developed by Professor Messod Beneish, the Beneish M-Score is based on eight financial variables that reflect different aspects of a company's financial performance and position. These are Days Sales Outstanding (DSO), Gross Margin (GM), Total Long-term Assets Less Property, Plant and Equipment over Total Assets (TATA), change in Revenue (?REV), change in Depreciation and Amortization (?DA), change in Selling, General and Admin expenses (?SGA), change in Debt-to-Asset Ratio (?LVG), and Net Income Less Non-Operating Income and Cash Flow from Operations over Total Assets (?NOATA).

Golden Minerals Co: A Snapshot

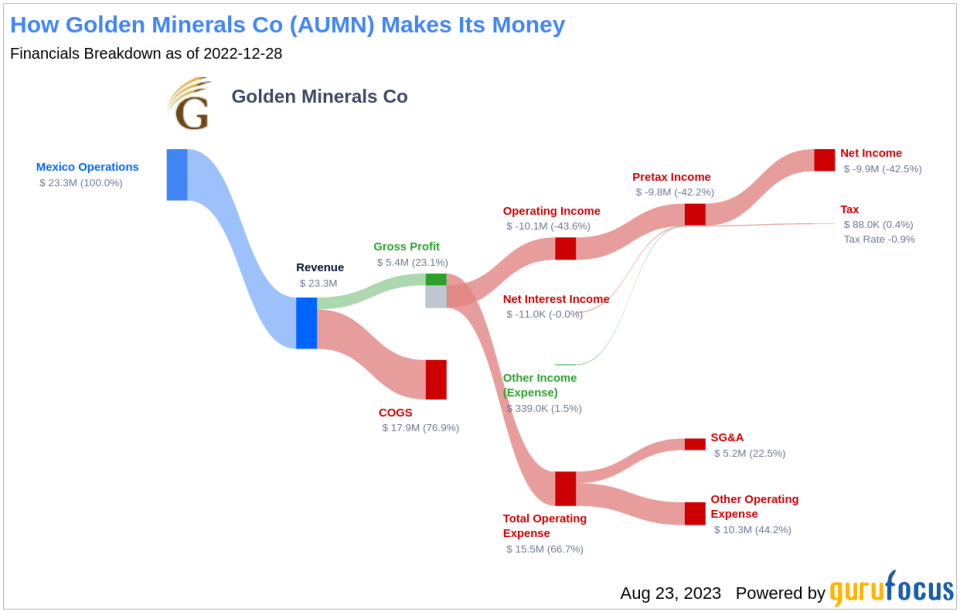

Golden Minerals Co is an exploration stage company engaged in the mining, construction, and exploration of precious metals and mineral properties. It owns and operates Velardena and Chicago precious metals mining properties and associated oxide and sulfide processing plants in the State of Durango, Mexico, the El Quevar exploration property in the province of Salta, Argentina, and a diversified portfolio of precious metals and other mineral exploration properties located in or near historical precious metals producing regions of Mexico.

Analysis of Golden Minerals Co's Profitability

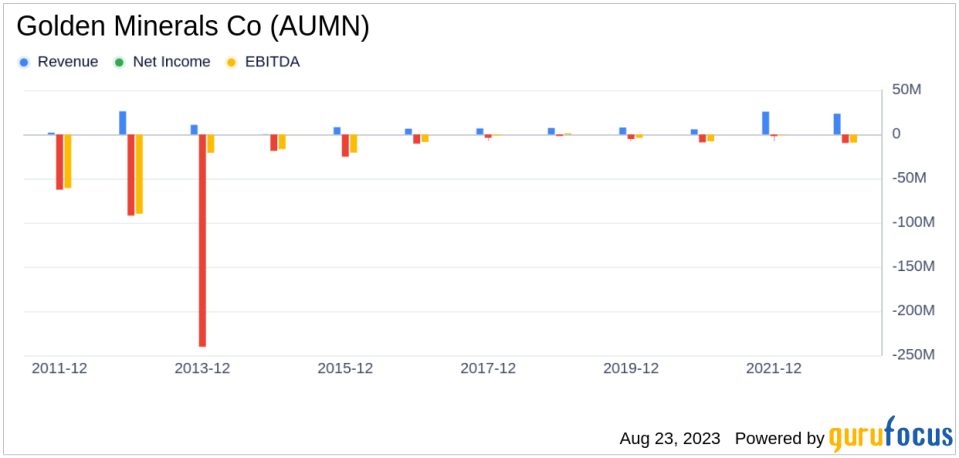

A positive return on assets (ROA) is a significant component of the F-Score. A closer look at Golden Minerals Co's ROA reveals a worrying trend of negative returns. This indicates the company's inability to generate profit from its assets - a fundamental concern for any investor.

Examining the decline in its return on assets (ROA) over the past three years, the data indicates 2021: -44.05; 2022: -5.75; 2023: -68.97, expressed in percentages. Such a decrease is concerning, as the Piotroski F-Score penalizes companies with lower current ROA compared to the previous period. This ongoing decline highlights another potential risk associated with investing in Golden Minerals Co.

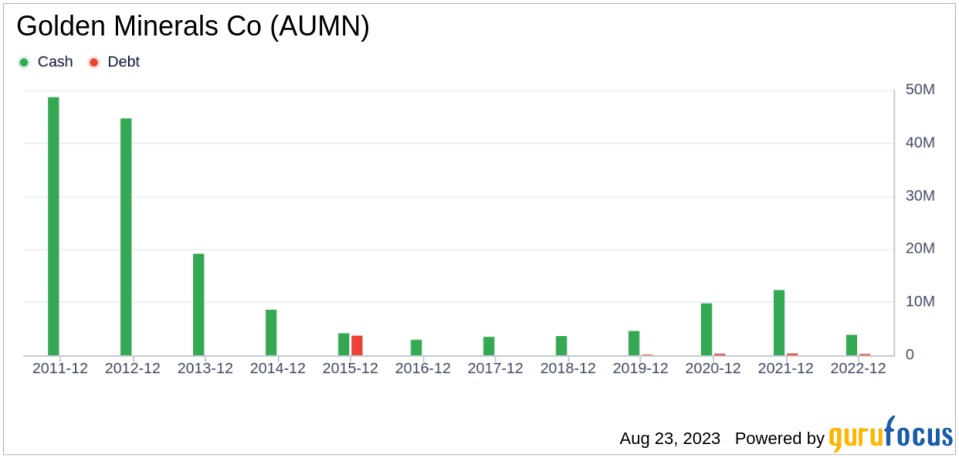

Observing the financials of Golden Minerals Co, the cash flow from operations over the trailing twelve months (TTM) stands at $-10.32 million, whereas the net income in the same period is significantly higher at $-11.53 million. The Piotroski F-score considers this discrepancy as a potential red flag. The rationale behind this is that a company's operating cash flow is a more direct and less manipulated measure of its cash-generating ability than net income. If a company consistently shows lower cash flows from operations relative to its net income, it could indicate that the earnings quality is poor and the company might have difficulties sustaining its operations or financing its obligations, a fact which could negatively impact its financial stability and investor confidence.

Leverage, Liquidity and Source of Funds: A Worrying Trend

Operating Efficiency: A Darker Picture

Examining the data provided: 2021: 6.50; 2022: 6.64; 2023: 7.12, it becomes evident that Golden Minerals Co has seen an increase in its Diluted Average Shares Outstanding over the past three years. This trend signals that the company has issued more shares. While issuing additional shares can provide immediate capital for the business, it can also lead to the dilution of existing shares' value.

Lastly, concerning operating efficiency, the Piotroski F-score examines changes in gross margin and asset turnover. Regrettably, Golden Minerals Co follows a discouraging trajectory with a decrease in gross margin percentage over the past three years, as demonstrated by the data provided: 2021: 39.13; 2022: 43.13; 2023: 11.08 (expressed in percentages). This contraction in gross margin suggests that Golden Minerals Co is grappling with either an escalation in the cost of goods sold or dwindling prices - both of which are inauspicious indicators for profitability.

Conclusion: Is Golden Minerals Co a Value Trap?

While the Piotroski F-score is not the only lens through which to view a potential investment, it is a robust and comprehensive tool for evaluating a company's financial health. Unfortunately for Golden Minerals Co, its current score suggests potential troubles.

A dissection of Golden Minerals Co's Altman Z-score reveals Golden Minerals Co's financial health may be weak, suggesting possible financial distress:

Given the negative indicators highlighted by the Piotroski F-score, Altman Z-score, and Beneish M-score, it appears that Golden Minerals Co might indeed be a value trap. Therefore, potential investors should exercise caution and conduct thorough due diligence before making an investment decision.

GuruFocus Premium members can find stocks with high Piotroski F-score using the following Screener: Piotroski F-score screener . GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen . To find out the high quality companies that may deliver above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.