‘The Golden Opportunity’: Jefferies Suggests 2 Gold Stocks to Buy on the Dip

Five centuries ago, the search for gold was a driving force behind the exploration and colonization of North America. That search overthrew empires, turned Mexico into one of the world’s leading silver producers, and eventually led to the famous California Gold Rush of 1849. And today, North American gold mining companies remain sound choices for investors.

That doesn’t mean the sector is without risk. Mines get played out, expected deposits can fail to materialize, the price of gold can turn volatile, labor disputes can disrupt production – there are many reasons why gold miners’ stocks can turn south. But, if the company is fundamentally sound, then its fortunes can turn around – after all, these mining companies can literally dig money out of the ground.

This suggests that beaten-down gold stocks may be the right place to go to ‘buy the dip,’ and at least one Wall Street analyst would agree.

Sector expert Matt Murphy, covering gold miners from Jefferies, describes the share discounts in the North American gold mining industry as a ‘golden opportunity,’ and in his note on the sector, Murphy writes: “We initiate coverage on the gold mining and streaming sector with a positive view. Gold has been supported near all-time highs by foreign central bank buying, despite high real rates and falling inflation. A slowing global economy could serve as the next tailwind. Meanwhile, equities have detached from near-record gold prices and sit at discounted levels. We think miner margin expansion can soon resume, driving FCF growth.”

The 5-star analyst has specifically tagged 2 of the beaten-down gold stocks as Buys. We ran them both through the TipRanks database to see what the rest of the Street thinks. Let’s take a closer look.

Newmont Corporation (NEM)

First up is Newmont Corporation, a Colorado-based company whose active mining operations have made it one of the world’s leading producers of gold. The company has a $36 billion market cap and has active mining and exploration projects around the world – in Australia and New Guinea, in the West African nation of Ghana, and most extensively in North and South America. Newmont is best known as a supplier of gold, but its mines also produce economically viable amounts of silver, copper, zinc, and lead.

Newmont recently reported on its 2023 year-end metal reserves, and the results show that the company has significant resources to support its future activities. Gold mineral reserves at the end of 2023 totaled 135.9 million attributable ounces, a hefty gain from the 96.1 million ounces reported at the end of 2022. In other metals, Newmont had particularly strong silver and copper reserves to report; in silver, the company is sitting on 600 million recoverable ounces, and in copper, on 30 billion pounds.

In November of last year, Newmont completed its acquisition of Newcrest Mining, a move that pushed it into a leading position among the world’s gold producers. The acquisition cost approximately $16.8 billion.

In other news, the mining company in February of this year announced that it will act to streamline its operations through the sale of multiple non-core assets. The asset divestiture – six in all, located on several continents – will allow the company to focus on its ‘tier 1’ mining ops.

Against that background, we can look at Newmont’s most recent set of financial results, from 4Q23. In that final quarter of the year, Newmont generated $4 billion in total revenue, up 24% year-over-year and coming in some $613 million over the forecast. At the bottom line, Newmont’s adjusted net income, the non-GAAP EPS, was 50 cents per share, or 6 cents better than had been expected. For the full-year 2023, Newmont produced 5.5 million gold ounces, and 891,000 gold equivalent ounces in commercially viable copper, silver, lead, and zinc.

Despite these positive indicators, Newmont’s shares have faced headwinds, experiencing a year-to-date decline of ~19%.

All of this brings us to analyst Murphy’s write-up on Newmont. This top-ranked analyst is upbeat, despite several acknowledged headwinds. He notes that the company’s ability to streamline ops, build through acquisition, and boost production all bode well going forward.

“As a sector leader that also often gets an S&P500 premium it is surprising to see NEM trade down so significantly. Last year was a challenging one for NEM with a strike at Penasquito, Yanacocha Sulfides being moved to the back-burner, the girth gear issue at Ahafo, and Boddington moving into a stripping campaign. NEM has done two major gold deals in the last five years with both Goldcorp and Newcrest being integrated. This diluted the share count and impacted returns, however we see the core portfolio as impressive with good growth over the next several years, falling AISC, growing margin, and upside opportunity through Full Potential, and most importantly an amazing list of assets,” Murphy opined.

These comments back up the analyst’s Buy rating on NEM, and his price target, of $38, points toward a one-year potential gain of 14% for the stock. (To watch Murphy’s track record, click here)

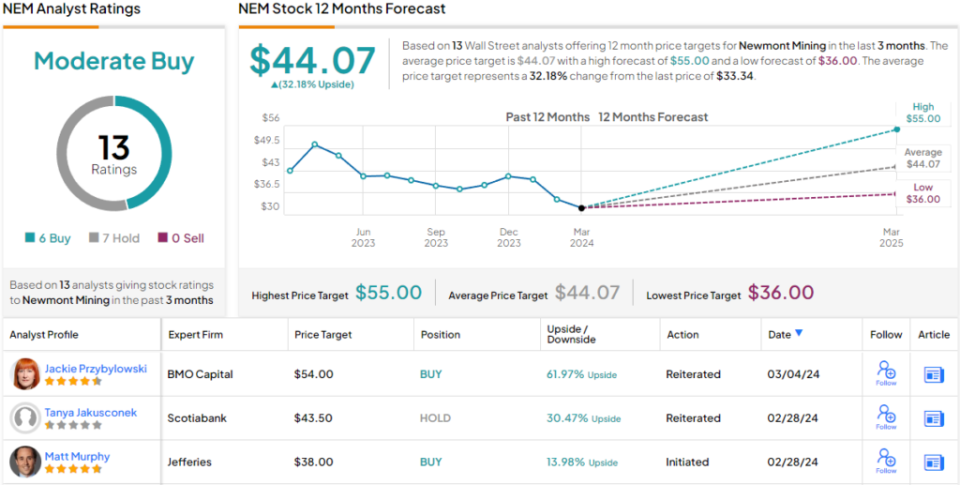

Overall, Newmont shares have a Moderate Buy rating from the analyst consensus, based on 13 recent reviews that include 6 Buys against 7 Holds. The shares are currently trading for $33.3,4 and their $44.07 average price target is more bullish than Murphy’s, implying a share appreciation of 32% on the one-year horizon. (See Newmontstock stock forecast)

B2Gold Corporation (BTG)

The second gold miner we’ll look at is B2Gold, a mining firm based in Vancouver, Canada, from where it controls a series of active operations around the world. These include active mines in the Philippines, Mali, and Namibia; exploration projects in those three countries plus Colombia, Finland, and Uzbekistan; and development projects in Canada, Colombia, and Mali. B2Gold can boast of high gold production, totaling 1,061,060 ounces for 2023.

In addition to its sound production figures, the company is actively working to expand its production areas. At the end of January, B2Gold announced that exploration drilling at the Otjikoto mine, in Namibia, has returned positive results. The drilling, into the Antelope deposit of the mine area, discovered high-grade mineralization in several zones. The company reports that the Antelope deposit is favorable for underground mining development and could begin contributing to the total Otjikoto output as early as 2026.

Late last year, B2Gold announced positive drilling results from exploration activities in Canada. This exploration drilling marked the start of activity in the Black River Gold District, in the territory of Nunavut. Additional drilling in the Goose project showed high-grade mineralization deposits and advanced the company’s plans for further development of mining operations at Goose.

In a report from Mali, the company recently acknowledged the deaths of three workers from the Fekola mine. The workers were killed off-site when a transport convoy was attacked on a route that has been the subject of increased presence by Malian government security forces. The company has said that the incident did not affect the mine directly and that management is working with the Malian government to address the safety issues.

For now, we can look at the company’s current results to see the base it’s building from. B2Gold’s 4Q23 report showed a total of 288,665 ounces of gold production for the quarter, representing more than 27% of the annual total. The company’s gold revenue for the quarter came to nearly $512 million. While down 13% year-over-year, this was in line with the pre-release expectations. At the bottom line, quarterly earnings came to 7 cents per share by non-GAAP measures, missing the forecast by a penny.

Shares in BTG have been volatile recently, and the stock is down 16% so far this year.

With this as background, we can turn to Murphy’s notes on B2G. The Jefferies analyst says of this gold miner: “BTG has lagged the gold miner index for three years running now and still faces challenges with the duration of its portfolio, with Otjikoto running short on mine life and uncertainty over the profile, timing and economics of Fekola regional opportunities. Most recently a capex increase at Goose and other inflationary pressures led to further share price weakness. 2024 remains a challenging year with continued spending on Goose, spending at Fekola on a tailings pond, and impacts to the production from Fekola given permit delays in Mali. In order to reduce downside risk BTG brought in some financing with a $500M gold prepay on ~11% of production in 2025 and 2026. While there are still risks in delivering Goose, we see the shares as fairly attractively priced at this time. We believe BTG could have a positive inflection later in 2024 as the market becomes more comfortable with the delivery of Goose.”

Looking ahead, Murphy rates B2Gold shares a Buy, and sets a $3.50 price target that implies a one-year upside potential of ~33%.

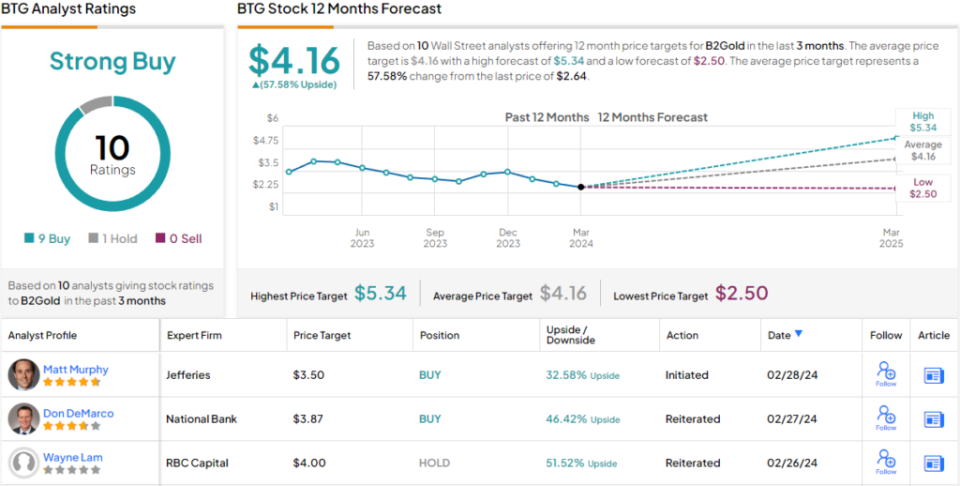

Overall, some stocks make a roundly positive impression on Wall Street’s analysts, and BTG is one of those. The company has a Strong Buy consensus rating, based on 9 Buys and 1 Hold. At $4.18, the average price target implies one-year shares appreciation of ~58%. (See B2Gold stock forecast)

To find good ideas for gold stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.