GOLDMAN: 3 reasons why the US housing market is slowing down

The U.S. housing market is slowing.

Expect this trend to continue.

In a note to clients published last week, Goldman Sachs economists outlined their view on the housing market for the years ahead and the message for investors is clear — the post-2012 boom in home prices is over.

“The U.S. housing market appears to have shifted into a lower gear in 2018H2,” the firm writes. And this lower gear is the new reality for the housing market.

From 2014-2017, home prices’ appreciation accelerated from a roughly 4% annual increase to around 7%. Over the next three years, Goldman expects home price appreciation to slide back to a 3%-4% annual pace of increases.

“There are three fundamental drivers of the slowdown in the housing market, none of which are likely to soon reverse,” the firm writes. “(1) mortgage rates have increased 100bp since 2017, putting pressure on affordability; (2) house prices have grown faster than rents and incomes since 2012, exacerbating the impact of rising rates; and (3) the 2017 tax law changes reduced the tax benefits of owner-occupied housing relative to renting.”

In late 2016, national home prices overtook their pre-crisis peak, according to the S&P/Case-Shiller home price index. Since then, national home prices have accelerated to new records. Last month, however, Robert Shiller told Yahoo Finance the housing market reminds him of 2006, which marked the beginning of the national housing bubble bursting.

In July and August, the last two months for which we have data from the Case-Shiller report, home prices rose less than 6% nationally for the first time since September 2017. As of August, home price appreciation nationally has slowed for six straight months. The latest Case-Shiller data is set for release Tuesday morning.

A slowdown, but not a crisis

Goldman, however, does not see a slowing in the pace of home price appreciation leading to a new crisis for the U.S. and global economy.

“Despite the headwinds facing the housing market going into 2019 (higher mortgage rates, unfavorable recent tax policy changes), we expect U.S. house prices to generally achieve a soft landing,” Goldman writes. “While we are likely to see more than a few metros experience negative house price growth in the coming years, we expect national average price appreciation to remain positive.”

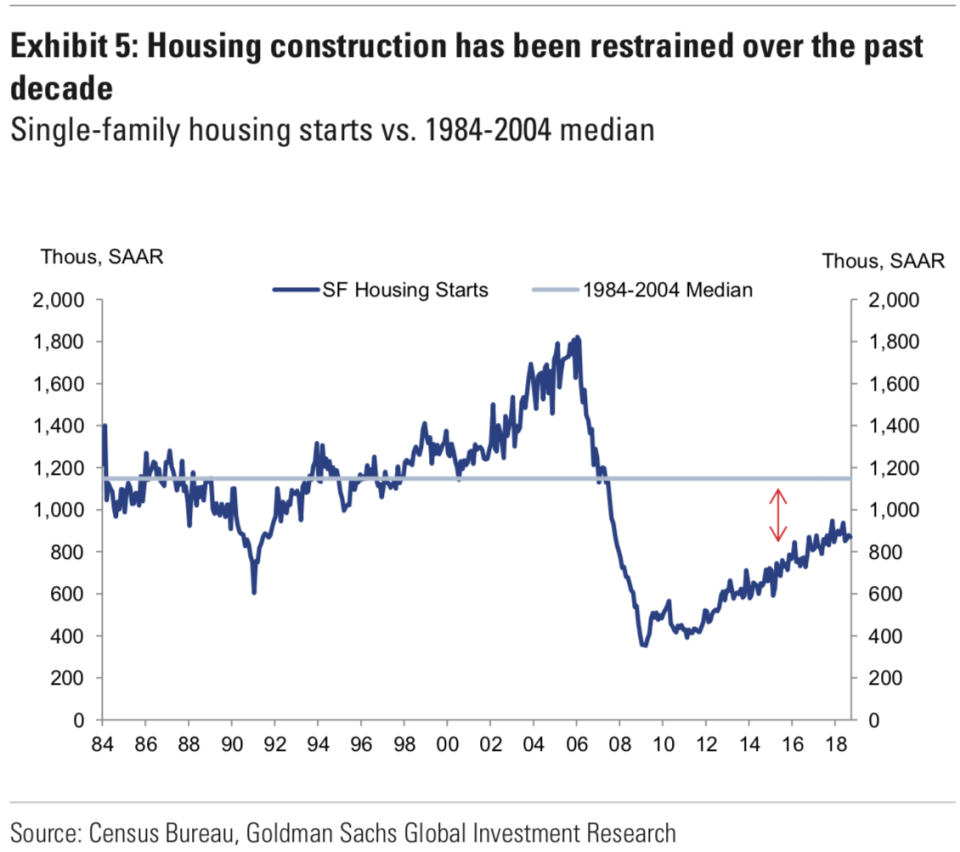

Among the drivers of this soft landing is the restrained amount of housing construction since the crisis, with single-family housing starts having now run well below the 1984-2004 median level for almost a decade. This has kept a lid on inventories, particularly at the lower end of the housing market.

Goldman also notes that this lack of supply of more affordable homes is already being reflected in the path of home price appreciation, with houses in the lower-third of their respective city’s market up 10% over the last year while those in the top tier have risen in value by 5%.

“Though the top price tier, by construction, represents 33% of the housing stock, over 50% of homes listed for sale come from the top price tier, vs. 21% for the low price tier,” Goldman writes. “The scarce supply of affordable homes has caused these houses to get bid up quickly, contributing to the strong price growth in that market segment.”

The overall economy also provides a tailwind to the lower end of the housing market. Among workers at the 25th percentile of the income distribution, wages have risen 4.1% over the last two years, faster than the 2.6% pace of growth for those in the 75th percentile of the income distribution. The improving fortunes of lower earners should bolster demand for lower-priced homes and is also a sign that consumer spending should remain strong despite concerns about the health of the overall U.S. economy.

Goldman also argues that if home appreciation in some of the country’s hottest markets were to cool off, it could be “a healthy development to the extent that the slowdown helps prevent more extreme challenges with affordability.” Those hot markets include Seattle, San Jose, and Nashville, all of which saw home prices rise more than 11% from December 2016 to December 2017.

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland