Goldman Sachs Group Inc Reports Mixed Full Year and Q4 Earnings for 2023

Annual Revenue: $46.25 billion, a slight decrease from 2022.

Q4 Revenue: $11.32 billion, up 7% from Q4 2022.

Annual Net Earnings: $8.52 billion, with a notable EPS drop from 2022.

Q4 Net Earnings: $2.01 billion, EPS at $5.48.

Annual ROE and ROTE: 7.5% and 8.1%, respectively, indicating profitability challenges.

Book Value Per Share Growth: Increased by 3.3% in 2023.

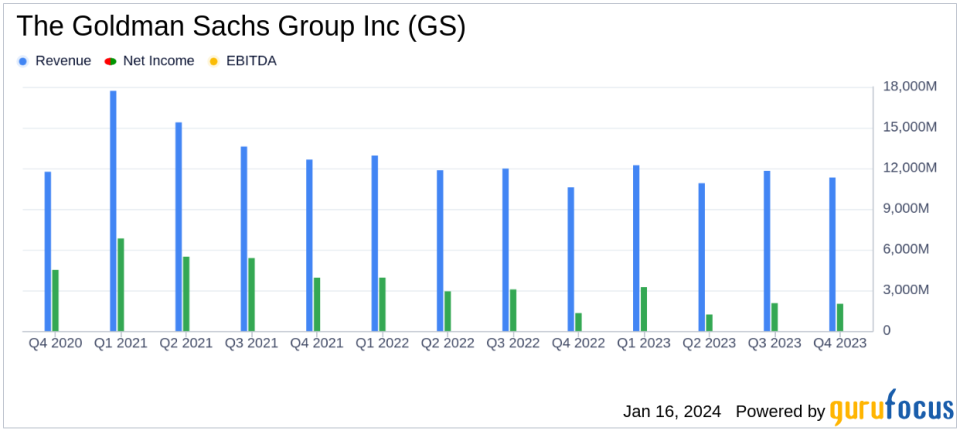

The Goldman Sachs Group Inc (NYSE:GS) released its 8-K filing on January 16, 2024, disclosing its full-year and fourth-quarter earnings for 2023. The company, a leading global investment banking and asset management firm, reported a mixed financial performance with a year-over-year decline in earnings per share (EPS) despite a revenue increase in the fourth quarter.

For the full year, Goldman Sachs posted net revenues of $46.25 billion, a 2% decrease from the previous year, primarily due to lower net revenues in Global Banking & Markets, which was largely offset by gains in Platform Solutions and Asset & Wealth Management. The firm's net earnings for the year stood at $8.52 billion, with diluted EPS falling to $22.87 from $30.06 in 2022. The return on average common shareholders' equity (ROE) was recorded at 7.5% for 2023, and the return on average tangible common shareholders' equity (ROTE) was 8.1%, reflecting profitability challenges.

In the fourth quarter, Goldman Sachs achieved net revenues of $11.32 billion, a 7% increase from the same period in the previous year, driven by higher net revenues in Asset & Wealth Management and Platform Solutions. However, this was partially offset by lower revenues in Global Banking & Markets. The fourth quarter net earnings were $2.01 billion, with an EPS of $5.48, compared to $3.32 in the fourth quarter of 2022.

Chairman and CEO David Solomon highlighted the firm's strategic execution in 2023, stating:

This was a year of execution for Goldman Sachs. With everything we achieved in 2023 coupled with our clear and simplified strategy, we have a much stronger platform for 2024. Our strategic objectives underscore our relentless commitment to serve our clients with excellence, further strengthen our leading client franchise and continue to deliver for shareholders.

The company's book value per share also saw growth, increasing by 3.3% in 2023, indicating a solid balance sheet position. However, the reported ROE and ROTE suggest that the firm is facing profitability pressures, which is a critical metric for investors, particularly in the capital markets industry where return on equity is a key measure of financial performance.

Goldman Sachs' performance in 2023 reflects the challenges and competitive dynamics of the financial services industry. While the firm has shown resilience in some of its business segments, the overall decline in EPS and profitability ratios may raise concerns among investors about the company's ability to maintain its leadership position and deliver shareholder value in a changing economic landscape.

For a more detailed analysis of Goldman Sachs' financial performance and future outlook, investors and interested parties are encouraged to review the full earnings report and listen to the conference call hosted by the company.

Explore the complete 8-K earnings release (here) from The Goldman Sachs Group Inc for further details.

This article first appeared on GuruFocus.