Goldman Sachs smashes expectations, despite the Brexit

Goldman Sachs’ (GS) second quarter was much stronger than expected.

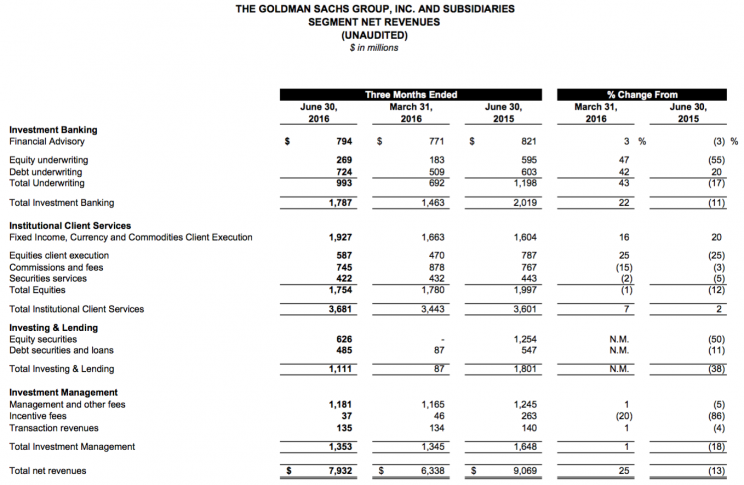

The Wall Street giant generated $7.93 billion in revenue, which was better than the $7.55 billion expected by analysts. On the bottom line, the bank earned $3.72 per share, which compares to analysts expectation for $3.08.

“Despite the uncertainty created by Brexit, we achieved solid results by continuing to serve our clients across our diversified franchise and by managing our business efficiently,” CEO Lloyd Blankfein said.

Investment banking revenues totaled $1.79 billion during the quarter, down 11% from the same period a year ago but up 22% from Q1.

Due to the lackluster environment for mergers and acquisitions, financial advisory revenues came in at just $794 million, down 3% from a year ago.

Bond trading revenues were very strong

Trading revenues improved modestly as reflected by institutional client services revenue climbing 2% year-over-year to $3.68 billion. This was driven by a fixed income, currency and commodities trading revenue jumping 20% to $1.93 billion. Meanwhile, equities trading revenue fell 12% to $1.75 billion.

“[Goldman Sachs] has shown skill in the past when volatility ratchets higher,” Morgan Stanley analyst Betsy Graseck said earlier this month.

Like many of its Wall Street peers, Goldman Sachs has been trimming its business. According to the earnings announcement, total staff was reduced by 5% during the quarter.

“[Goldman Sachs is] clearly focused on driving down expenses given recent headlines on both comp and non-comp cost reductions,” Graseck continued.

Shares are up 1% in pre-market trading.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

There’s something ‘animal’ about the stock market right now

Everyone complaining about P/E ratios is using them wrong

Stocks today are reminiscent of 2 of history’s most exciting buying opportunities – RBC