Goldman Sachs: Reviewing Key Variables After a Solid 6 Months

Goldman Sachs's stock has experienced an exhilarating six months, gaining by more than 20% and outpacing the Invesco KBW Bank ETF by approximately 5%.

Despite struggling with funding cost to lending spreads, it's been a successful period for both the commercial and retail banking industries. Moreover, indicators suggest corporate finance activity could increase later this year. As such, it makes for a good time to review Goldman Sachs' prospects.

Here are a few factors to consider regarding the American banking giant.

Assessing Goldman's Latest Earnings Release

Goldman Sachs released its third-quarter earnings in January, revealing a $ 370.54 revenue beat and a $1.21 earnings-per-share triumph.

The earnings beat was a welcome surprise. However, numerous talking points surfaced upon releasing the bank's results.

Intermediary and Management Fee Support Garnered from Equity and Debt Markets

Firstly, the bank's global banking & markets equity revenues rose by 26% year-over-year to $2.61 billion as intermediation and financing activities experienced higher uptake due to an unexpected rise in public equity market activity in the latter stages of 2023. Furthermore, Goldman's net revenues from asset and wealth management rose to 22% year-over-year to $4.39 billion as management fees from both equity and debt offerings increased amid higher market volumes.

The sub-segments above will likely experience sustained growth throughout 2024 as Goldman is well-placed to expand its assets under management. A lower implied interest rate curve is luring a lot of capital into the debt markets, while a continuous rally in high-beta technology stocks has raised optimism among investors.

Certain Drawbacks in Corporate Finance

While experiencing solid performance from recovering debt and equity markets, Goldman's corporate finance activities struggled during its fourth quarter. The bank's investment banking activities stalled, leading to $6.22 billion in investment banking fees, 16% lower than in 2022. Even though debt underwriting and structuring activities phased out some of the downturns, lower merger and acquisition volumes upended the segment.

It might take time for merger and acquisition volume to increase because resilient interest rates have priced many leveraged acquirers out of the market. I expect mergers and acquisitions to pick up in late 2024 or early 2025 when capital is less scarce and valuations have bottomed.

Stabilization in investment banking advisory is probably. However, increased activity still seems a mile down the road.

Platform Solutions

Goldman Sachs' platform solutions sustained momentum in the company's fourth quarter, achieving 12% year-over-year growth to deliver $577 million in revenue.

This segment is aligned for growth due to two reasons. Firstly, modern offerings, such as an ETF accelerator program, merchant point-of-sale lending, and digital enterprise partnerships, are suited to modern commerce as the flourishing ETF business, consumer credit, and cloud-based solutions are in hypergrowth mode. Moreover, the segment follows a growth-by-acquisition approach, allowing it to scale at a rate of knots.

Goldman's Platform Solutions segment provides diversified revenue, making it a key asset leading forward.

Controversies

Goldman's latest endeavors have mostly been positive. However, controversies regarding trading fees and David Solomon's remuneration have surfaced.

It was made public earlier this month that Goldman Sachs' commodity futures trading department is under investigation regarding improper fee charges. Goldman paid about $50 million in fines in 2023 to settle at least four other cases of a similar nature. As such, additional penalties are highly probable. However, based on my experience, futures trading fees are highly elastic, making it difficult to deem what's fair.

Furthermore, David Solomon received a 24% pay bump in 2023 to raise his compensation to $31 million. Although Solomon's work as a CEO substantiates such a comprehensive salary, the timing of the pay bump is questionable, given that the economic outlook is somewhat gloomy and much of the bank's segments experienced negative growth in the past year.

Goldman is never shy of controversy, meaning these latest debacles aren't too big of a deal. Nevertheless, they are influencing variables worth considering.

Valuation and Dividends

The price-to-book ratio is salient to banking stocks as banks hold marketable assets. Therefore, a bank's book value provides a fair reflection of the organization's fair value.

Goldman's price-to-book ratio of 1.08 is below its mean of 1.5, indicating relative value. In addition, interest and discount rates could pivot in late 2024, concurrently marketing Goldman's asset base up. Thus, conventional measures suggest the bank's stock is relatively undervalued.

Goldman Sachs' dividend is compelling. Its trailing dividend yield of 2.7% is above the U.S.'s target inflation rate, suggesting it possesses the latitude to phase out inflationary risk on a pre-tax basis. Although an investor holding assets in a taxable account will experience lower post-tax dividend earnings, Goldman's dividend still provides solid income.

Risk Appraisal

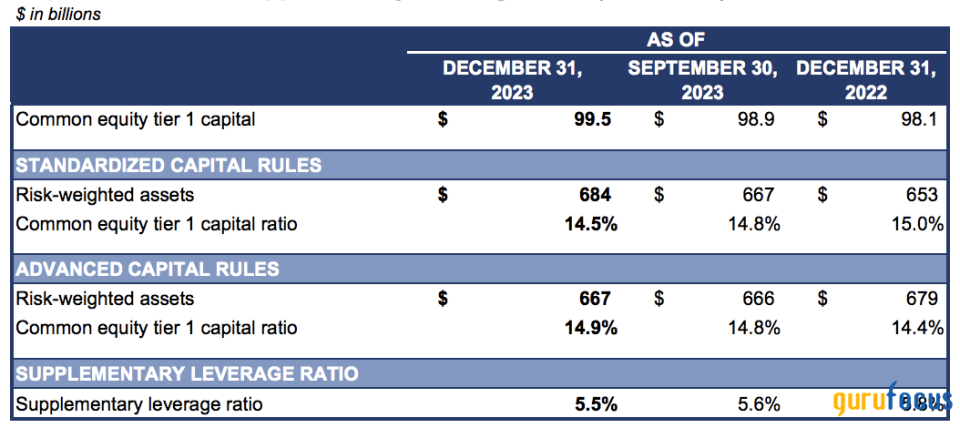

Goldman Sachs is looking good from a risk-based vantage point. The bank's Common Equity Tier 1 Capital Ratio of 14.5% standardized and 14.9% advanced is well above industry requirements. Capital adequacy is critical when assessing a bank because it shows how well it is covered against adverse market events. Goldman's data is solid, likely providing most market participants with confidence.

Source: Goldman Sachs

Final Word

Goldman Sachs' impressive run looks set to continue as its salient variables align toward additional growth. Moreover, Goldman Sachs' risk-based measures are on solid ground, while key metrics suggest its stock is undervalued on a relative basis.

This article first appeared on GuruFocus.