Is it a Good Idea to Invest in AC Immune (ACIU) Stock Now?

AC Immune SA ACIU is making rapid progress in the development of its lead pipeline candidate, ACI-24.060, for various neurodegenerative diseases.

ACI-24.060, an anti-amyloid-beta immunotherapy, is currently being evaluated in a phase Ib/II ABATE study to treat Alzheimer’s patients and individuals with Down’s syndrome. ACIU anticipates interim data from the Alzheimer’s disease cohort of the ABATE study in the second half of 2023.

Important data from the Abeta-PET imaging analyses on amyloid plaque reduction in Alzheimer’s disease following six months of treatment is expected in the first half of 2024. The Abeta-PET data will be an important catalyst for the stock as amyloid clearance as measured by PET imaging is now established as a reliable surrogate for efficacy

A phase II study is ongoing on ACI-7104.056, AC Immune’s wholly-owned anti-a-syn active immunotherapy for treating Parkinson’s disease with initial safety findings expected by year end. The company also plans to initiate a new Alzheimer’s disease study on its anti-pTau (phosphorylated Tau) active immunotherapy ACI-35.030 later this year. The initiation of the study should result in a milestone payment.

AC Immune has strategic partnerships with big drugmakers like Roche and Eli Lilly LLY, which helps fund its pipeline and makes it eligible for more than $3 billion in potential milestone payments.

AC Immune is also co-developing crenezumab — an anti-amyloid-beta antibody with Genentech, a member of Roche Group — for the potential treatment of Alzheimer’s disease. With Lilly, AC Immune has a partnership to develop Morphomer Tau small molecules for the treatment of Alzheimer’s disease and other neurodegenerative diseases.

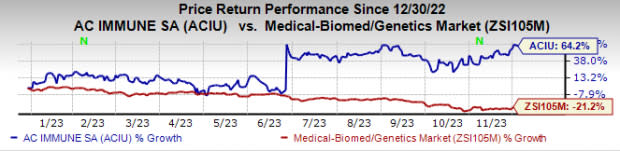

AC Immune’s stock has risen 64.2% so far this year against a decrease of 21.2% for the industry.

Image Source: Zacks Investment Research

AC Immune has a Zacks Rank #2 (Buy) currently. In the past 60 days, estimates for AC Immune’s 2023 loss per share have narrowed from 71 cents to 68 cents. During the same period, loss per share estimates for 2024 have narrowed from 63 cents to 58 cents per share.

Though an Alzheimer’s disease stock is a risky investment, if the data from the studies discussed above are positive, the stock could see a further jump and benefit investors.

AC Immune Price and Consensus

AC Immune price-consensus-chart | AC Immune Quote

Other Stocks to Consider

Other top-ranked biotech companies worth considering are Puma Biotech PBYI and CytomX Therapeutics CTMX, both with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Puma Biotech’s 2023 earnings per share have increased from 67 cents to 73 cents over the past 60 days. Estimates for 2024 have jumped from 55 cents per share to 62 cents over the same timeframe. PBYI’s stock has declined 10.2% year to date.

Earnings of Puma Biotech beat estimates in three of the last four quarters, missed in one, delivering an earnings surprise of 76.55% on average.

In the past 30 days, estimates for CytomX Therapeutics’ 2023 loss per share have narrowed from 37 cents to 6 cents per share. During the same period, loss per share estimates for 2024 have improved from 51 cents to 21 cents. Year to date, shares of CTMX have declined 10%.

CTMX’s earnings beat estimates in three of the last four quarters, missed in one, delivering an earnings surprise of 45.44% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

AC Immune (ACIU) : Free Stock Analysis Report