Is it a Good Idea to Invest in Intellia (NTLA) Stock Now?

Intellia Therapeutics, Inc. NTLA is a clinical-stage genome editing company focused on developing CRISPR/Cas9-based therapeutics.

The company is evaluating its leading in vivo genome-editing candidates — NTLA-2001 for the treatment of transthyretin (ATTR) amyloidosis and NTLA-2002 for the treatment of hereditary angioedema (HAE). Intellia is also developing NTLA-3001 for the treatment of alpha-1 antitrypsin deficiency (“AATD”)-associated lung disease.

Earlier this month, the company outlined key strategic priorities for 2024 and milestones that it looks to achieve through 2026.

NTLA-2001 is Intellia’s first candidate to enter clinical development. The company is collaborating with Regeneron Pharmaceuticals REGN for developing NTLA-2001.

The company has initiated and enrolled patients in the pivotal phase III MAGNITUDE study evaluating NTLA-2001 for the treatment of ATTR amyloidosis with cardiomyopathy (ATTR-CM), with the first patient likely to be dosed later in the first quarter of 2024.

Intellia is also planning to prepare for a phase III study evaluating NTLA-2001 for the treatment of ATTR amyloidosis with polyneuropathy (ATTRv-PN).

NTLA-2001 is part of the company’s co-development and co-promotion agreement with Regeneron. While NTLA is the lead party in the deal, REGN shares some of the development costs and commercial profits.

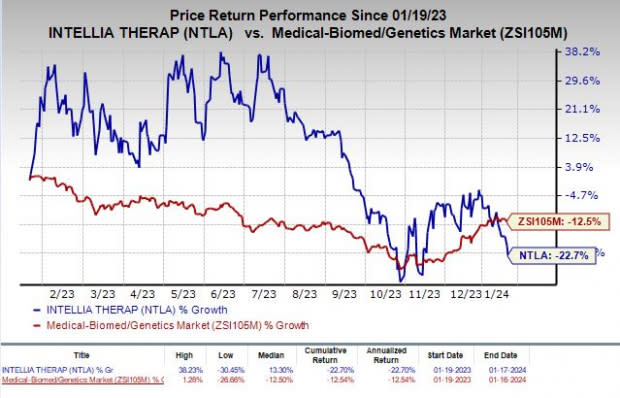

Intellia’s stock has plunged 22.7% in the past year compared with the industry’s decline of 12.5%.

Image Source: Zacks Investment Research

NTLA-2002, Intellia’s second candidate, was the first single-dose CRISPR/Cas9 therapy designed to prevent angioedema attacks in HAE patients to enter clinical studies.

The company has completed enrollment and dosing in the phase II portion of the phase I/II study that evaluated NTLA-2002 in adults with HAE. Pending some regulatory feedback, Intellia is planning to begin a global pivotal phase III study on NTLA-2002 in the second half of 2024.

As part of the strategic priority, Intellia plans to submit a biologics license application for NTLA-2002 in 2026. The company is also looking to reduce its current workforce by almost 15%.

This apart, the company has submitted a clinical trial application to initiate a phase I study on NTLA-3001 for the treatment of AATD-associated lung disease. Patient dosing in the study is expected to begin later in 2024.

This apart, Intellia has entered into collaboration contracts to develop gene editing therapies for the treatment of various indications. The company has also partnered with several other companies to develop novel genomic medicines utilizing the CRISPR/Cas9 technology. Such collaboration deals provide Intellia with the resources to support its ongoing therapeutic development programs.

The company remains focused on launching several studies, including in vivo and ex vivo programs targeting an expanded range of diseases over the next couple of years.

Zacks Rank & Other Stocks to Consider

Intellia currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the healthcare sector are CytomX Therapeutics, Inc. CTMX and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics’ 2024 loss per share have narrowed from 22 cents to 6 cents. In the past year, shares of CTMX have plunged 34.8%.

CytomX Therapeutics beat estimates in three of the last four quarters while missing the same on the remaining occasion. CTMX delivered a four-quarter earnings surprise of 45.44%, on average.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 62 cents to 69 cents. In the past year, shares of PBYI have risen 16.4%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Intellia Therapeutics, Inc. (NTLA) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report