‘There’s Good Value in the Market Now’: J.P. Morgan Suggests 2 Stocks to Buy — Including One With 80% Upside

After most of the year saw the stock market on the rise, the markets are going through a volatile period. J.P. Morgan’s U.S. Head of Investment Strategy Jacob Manoukian claims each such period has its own unique character and this one has been defined by U.S. Treasury yields. Last week, interest rates on 10-year U.S. government debt climbed to 4.88%, amounting to a 16-year high, before pulling back to 4.65%.

“Treasury yields are like the foundation that the rest of financial markets are built on,” says Manoukian. “When the foundation is shaking, it is hard for other segments to find their footing.”

The result has been a sell-off period, but where some see only pain in the pullback, Manoukian makes the case there’s “good value in the market now.”

“Earnings expectations are still climbing, while the drawdown has brought valuations back in line with the 10-year average level. From here, we think earnings season, positive seasonal trends and stabilizing bond yields will help equities start to rally again. Looking out, we think the chances are better than not that the S&P 500 makes a new all-time high by the middle of next year due to decent earnings growth and valuation expansion as inflation fades further,” Manoukian opined.

So, with that positive outlook in tow, the question is, which equities should investors be loading up on at present? The analysts at JPMorgan have been busy seeking them out and have homed in on two stocks they see as primed to take off, including one with 80% upside. Let’s take a closer look.

Apellis Pharmaceuticals (APLS)

The first stock on our JPMorgan-backed list is Apellis Pharmaceuticals, a biotech firm operating at both the commercial and clinical stages. The company is developing new therapeutic agents, ‘first new class of complement medicine in 15 years,’ that act through the C3 pathway, the complement system of the larger immune system. The complement cascade, which starts with the C3 protein, clears damaged cells and pathogens out the body, and when it becomes overactive it causes disease conditions through the destruction of healthy cells and tissues.

The company’s focus is on diseases of the retina and nervous system that have high unmet medical needs – that is, there are few or no effective treatment options available. Apellis is targeting the C3 pathway as a therapeutic starting point, and has a wide-ranging project pipeline. The company’s research is heavy on the pre-clinical development stages, but also has two drugs approved and on the market for commercialization, as well as several late-stage clinical trials.

Apellis’ approved drugs are two different formulations of pegcetacoplan. Empaveli, the company’s first drug on the market, is a treatment for adults suffering from paroxysmal nocturnal hemoglobinuria (PNH) and was approved in May of 2021. In 2022, the first full year that the drug was available for patients, Apellis realized $65.1 million in net product revenues from its US sales.

The second commercial-stage drug is syfovre, another pegcetacoplan injection formulation. This one is used to treat geographic atrophy (GA), a severe retinal condition that leads to blindness. Syfovre was approved in February of this year, and showed early success in the marketplace. There were serious concerns during the summer, however, over the occurrence of eye inflammation as a side effect. The stock plunged as far as 71% when the concerns were raised, but has since begun a modest rebound. Analysts have noted that similar drugs also showed vasculitis as a side effect, and that syfovre has shown a less severe incidence that other approved drugs.

In a recent piece of good news, for Apellis and syfovre, early Q3 sales data for syfovre were better than expected, anticipated to reach $74 million, easily exceeding the $51 million consensus estimate.

Strong sales data were only one part of JPMorgan analyst Anupam Rama’s upgrade on APLS shares, from Neutral to Overweight (i.e., Buy). Rama is upbeat on the overall potential of pegcetacoplan, and writes, “We believe Apellis’ lead asset, pegcetacoplan, represents a differentiated asset in the complement space, with opportunities in a broad range of ophthalmology, hematology, neurology, and nephrology indications. With the recent approvals of Syfovre in GA and Empaveli in PNH, the company has made strong progress on the overall pipeline. Indeed, we view Syfovre as a ~$3B peak potential drug, even with conservative assumptions.”

Looking ahead, Rama does not ignore the concerns regarding syfovre, but believes that the drug will prove successful in the long run: “Of note, the company does need to work through physician perception of Syfovre, given recent disclosures of cases of retinal vasculitis and this could take time (there is risk of disclosure of additional headline with more cases). That said, physicians continue to use the product driven growth and we anticipate a fundamental and sentiment shift driving upside in APLS shares.”

These comments back up Rama’s $81 price target on APLS, which implies a robust one-year upside potential of ~82% for the stock. (To watch Rama’s track record, click here)

The general Wall Street sentiment here is also bullish, as shown by the 14 recent analyst reviews – which include 12 Buys and 2 Holds for a Strong Buy consensus rating. The stock is currently priced at $44.40, and its $68.17 average price target suggests it will gain 53% in the next 12 months. (See APLS stock forecast)

Live Oak Bancshares (LOB)

The second stock we’ll look at is Live Oak Bancshares, a holding company and owner of the Live Oak Bank. Live Oak is a North Carolina-based bank with a focus on the small-business loan market, particularly loans backed up by the US government through the Small Business Administration. In fact, per data from fiscal year 2022, Live Oak was the nation’s largest SBA loan administrator, counting by dollar volume.

On the operational end, Live Oak is a cloud-based digital bank offering services in all 50 states. The bank’s customer base is primarily composed of small businesses, but the company also offers personal banking services to individual customers. Banking services include high-yield savings accounts and CDs, as well as online and mobile access – all without online or monthly banking fees. Accounts with Live Oak are insured through the FDIC.

Looking at performance, Live Oak brought in $108.46 million in revenues in 2Q23, the last reported quarter, surpassing the forecast by $1.4 million. At the company’s bottom line, Live Oak reported an EPS of 39 cents per diluted share, coming in 7 cents ahead of the estimates.

Looking ahead to the 3Q23 results, consensus is calling for revenues of $116.3 million and an EPS of 48 cents per share.

Shares in Live Oak hit a peak in August of this year, and have since fallen by more than 24%. However, JPMorgan Steven Alexopoulos believes the pullback could be the right time for investors to hop onboard.

“The recent sell-off provides us with the entry point that we were waiting for. While LOB shares have underperformed over the past month in response to a rising 10-year yield, not only do we see a rising 10-year yield as providing a tailwind to the bank sector and LOB, but what’s more is that for LOB specifically, we see several near-term catalysts lined up to drive the stock toward our $40 price target,” Alexopoulos opined.

Getting into some of Live Oak’s particular strengths, Alexopoulos wrote, “With Live Oak marrying (1) an industry vertical approach, (2) its tech savviness, and (3) differentiated service culture, we see Live Oak being positioned to lead the peer group in the metrics that have been associated with outperformance. Coupling this with the valuation of the stock having come in materially, we upgrade LOB shares to Overweight.”

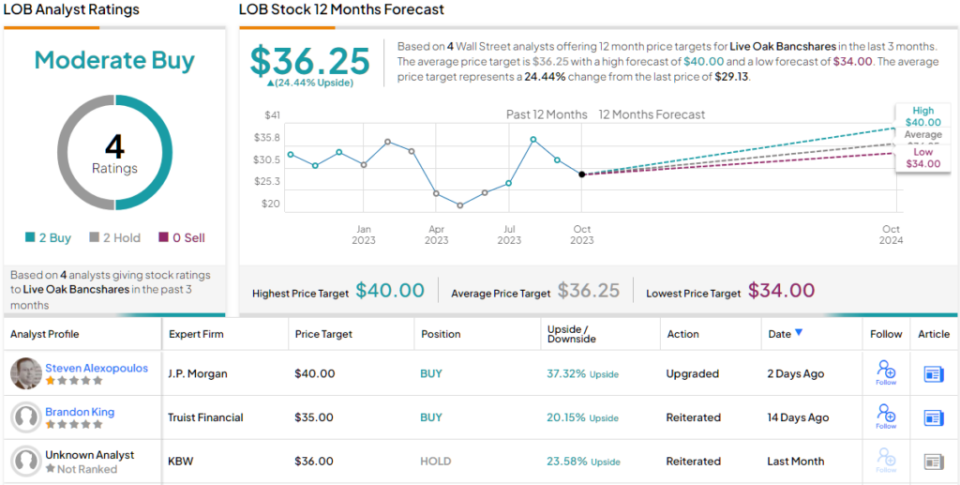

Alexopoulos’ Overweight (i.e. Buy) rating comes along with a $40 price target that suggests the stock will appreciate by 37% in the year ahead. (To watch Alexopoulos’ track record, click here)

Overall, LOB shares hold a Moderate Buy rating from the analyst consensus, based on an even split among the Street’s analysts – 2 to Buy and 2 to Hold. The stock is trading for $29.13 and its $36.25 average price target implies an upside potential of 24% on the one-year time frame. (See LOB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.