GoodRx Holdings Inc (GDRX) Reports Mixed Results for Q4 and Full Year 2023

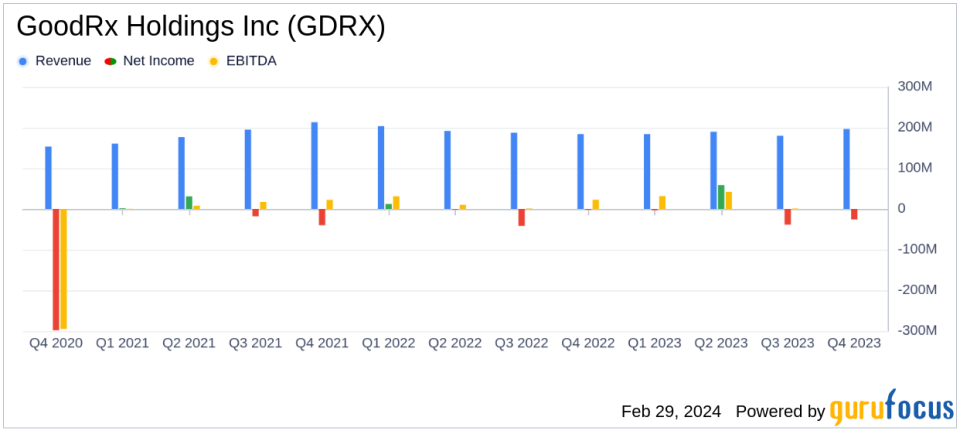

Revenue: Q4 revenue increased by 7% to $196.6 million, with full-year revenue reaching $750.3 million.

Net Loss: Q4 net loss widened to $25.9 million, while the full-year net loss was $8.9 million.

Adjusted EBITDA: Q4 Adjusted EBITDA rose to $57.3 million, with a margin of 29.1%.

Operating Cash Flow: Net cash provided by operating activities for the full year was $138.3 million.

Consumer Base: Over 7 million consumers used GoodRx's prescription-related offerings by the end of Q4.

Stock Repurchase: GoodRx repurchased $77.8 million in shares in Q4, with a new repurchase program authorized for up to $450.0 million.

Guidance: Management anticipates Q1 2024 revenue to be between $195-$198 million, with full-year 2024 revenue projected at approximately $800 million.

On February 29, 2024, GoodRx Holdings Inc (NASDAQ:GDRX) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, known for its digital healthcare platform that offers prescription savings in the U.S., reported a 7% increase in Q4 revenue to $196.6 million, while the full-year revenue reached $750.3 million. Despite the revenue growth, GoodRx experienced a net loss of $25.9 million in Q4 and $8.9 million for the full year.

GoodRx's Adjusted EBITDA for Q4 was $57.3 million, reflecting a margin of 29.1%, and the full-year Adjusted EBITDA stood at $217.4 million with a margin of 28.6%. The company ended the year with a strong consumer base, with over 7 million consumers using its prescription-related offerings.

Financial Performance and Challenges

The company's financial achievements are underscored by its Adjusted Net Income of $31.1 million in Q4 and $114.6 million for the full year. These figures are significant for a healthcare services company, indicating the potential for profitability despite the reported net losses. GoodRx's performance is particularly important as it reflects the company's ability to grow its revenue streams and maintain a solid Adjusted EBITDA margin in a competitive healthcare market.

However, GoodRx also faced challenges, including a decrease in subscription revenue due to the anticipated sunset of its partnership subscription program, Kroger Savings Club, and the impact of a restructuring plan on its pharma manufacturer solutions offering. These challenges may lead to problems if not addressed, as they could affect the company's ability to sustain revenue growth and profitability.

Key Financial Metrics

GoodRx's financial stability is further evidenced by its cash and cash equivalents of $672.3 million as of December 31, 2023, and a disciplined approach to capital allocation. The company's share repurchase activity, including the new repurchase program, highlights its commitment to creating shareholder value.

Looking ahead, GoodRx provided guidance for the first quarter and full year of 2024, with expected revenue growth and an Adjusted EBITDA margin potentially reaching up to 30%. The company's management remains focused on driving prescription-savings events and expanding its value proposition to sustain topline growth.

For a detailed view of GoodRx's financials, including income statements, balance sheets, and cash flow statements, please refer to the full 8-K filing.

Analysis and Outlook

GoodRx's Q4 and full-year 2023 results present a mixed picture, with revenue growth offset by net losses. The company's strategic focus on creating value for consumers and driving prescription-savings events is expected to continue fueling growth. However, the challenges posed by the restructuring of its pharma manufacturer solutions and the sunset of the Kroger Savings Club subscription program will need to be navigated carefully.

The company's strong cash position and disciplined capital allocation strategy, including share repurchases, suggest confidence in its long-term growth prospects. As GoodRx looks to the future, investors will be watching closely to see how the company leverages its platform and consumer base to achieve sustainable profitability.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from GoodRx Holdings Inc for further details.

This article first appeared on GuruFocus.