GoodRx Holdings (NASDAQ:GDRX) shareholders have endured a 29% loss from investing in the stock a year ago

GoodRx Holdings, Inc. (NASDAQ:GDRX) shareholders should be happy to see the share price up 17% in the last month. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 29% in one year, under-performing the market.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for GoodRx Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

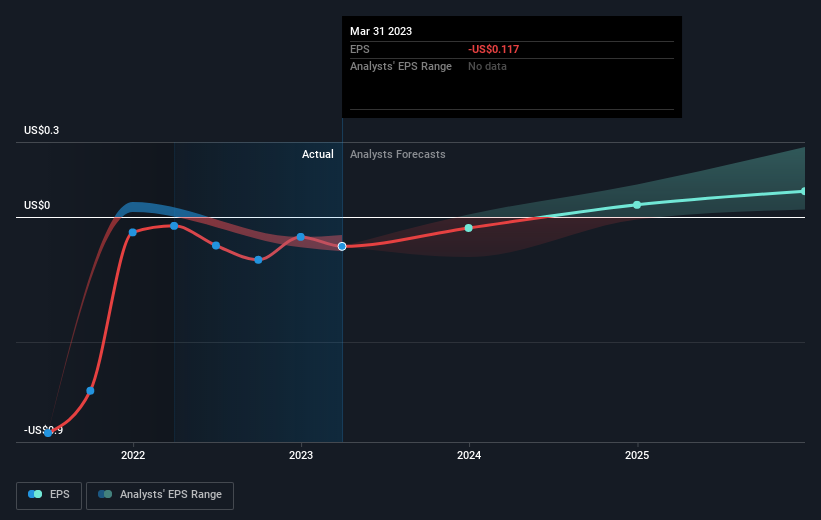

Unfortunately GoodRx Holdings reported an EPS drop of 231% for the last year. Readers should not this outcome was influenced by the impact of extraordinary items on EPS. And indeed the company lost money over the last twelve months. The share price fall of 29% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on GoodRx Holdings' earnings, revenue and cash flow.

A Different Perspective

While GoodRx Holdings shareholders are down 29% for the year, the market itself is up 4.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 2.0% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You could get a better understanding of GoodRx Holdings' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here