Goosehead Insurance Inc (GSHD) Reports Strong Growth in 2023 with Net Income Rising Sharply

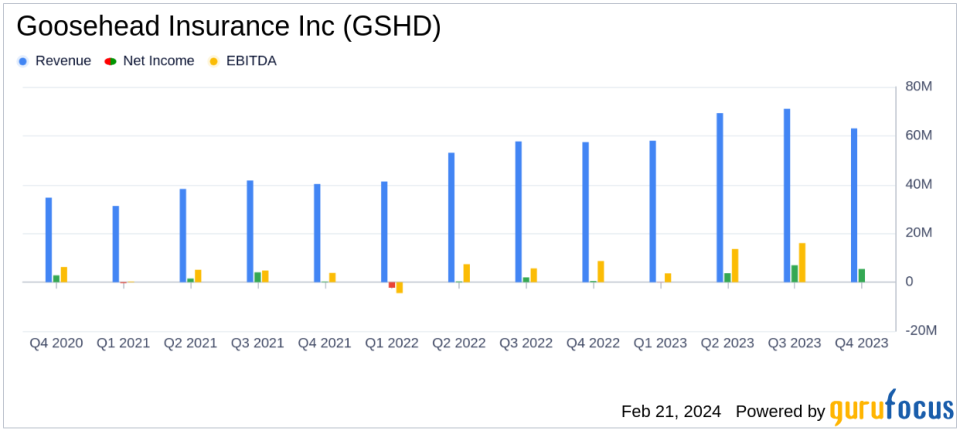

Total Revenue: Increased by 25% year-over-year to $261.3 million.

Core Revenue: Grew by 24% year-over-year to $233.0 million.

Total Written Premium: Jumped by 34% in 2023 to $3.0 billion.

Net Income: Improved significantly to $23.7 million in 2023 from $2.6 million in 2022.

Adjusted EBITDA: Saw a 90% increase to $69.8 million in 2023.

EPS: Earnings per share increased by 650% to $0.15 in Q4 2023.

Adjusted EBITDA Margin: Expanded by 1 percentage point to 22% in Q4 2023.

On February 21, 2024, Goosehead Insurance Inc (NASDAQ:GSHD) released its 8-K filing, detailing a year of robust growth and financial performance. The company, which operates as an independent insurance agency offering a variety of insurance products across multiple states, has reported a significant increase in total revenue and net income for the year ended December 31, 2023.

Financial Performance Highlights

Goosehead Insurance Inc (NASDAQ:GSHD) has demonstrated strong financial performance in 2023, with total revenue growing by 25% to $261.3 million. Core revenue, which is a more consistent measure of the company's revenue stream, increased by 24% to $233.0 million. This growth was attributed to improved productivity, strong client retention, and rising premium rates.

The company's net income saw a remarkable rise to $23.7 million, up from $2.6 million in the previous year. This improvement was driven by robust revenue growth coupled with disciplined expense management. Earnings per share (EPS) for the fourth quarter stood at $0.15, marking a 650% increase, while adjusted EPS, which excludes certain non-recurring items, was $0.28 per share, up by 155%.

Operational Efficiency and Challenges

Goosehead Insurance Inc (NASDAQ:GSHD) has successfully implemented strategic changes aimed at improving productivity and increasing earnings power. The reorganization of Corporate sales leadership and the consolidation of Franchise leadership with Corporate in Q4 2023 resulted in significant productivity gains. However, the company continues to face the challenge of driving new business production growth, particularly within its Franchise network.

Despite these challenges, the company's total written premiums placed for the fourth quarter increased by 29% over the prior-year period to $756.1 million, and policies in force grew by 16% to approximately 1,486,000. These metrics are crucial as they indicate the company's ability to generate future revenue.

Financial Health and Outlook

As of December 31, 2023, Goosehead Insurance Inc (NASDAQ:GSHD) had cash and cash equivalents of $44.0 million and an unused line of credit of $49.8 million, indicating a strong liquidity position. The company's total outstanding term note payable balance was $77.5 million.

Looking ahead to 2024, Goosehead Insurance Inc (NASDAQ:GSHD) expects total written premiums placed to be between $3.70 billion and $3.85 billion, representing organic growth of 25% to 30%. Total revenues are projected to be between $310 million and $320 million, with adjusted EBITDA Margin expected to expand further.

"We had a tremendous 2023 with premium growth of 34%, total revenue growth of 25%, Core revenue growth of 24%, and EBITDA growth of 90% with margin expansion of 900 basis points to 27%," stated Mark E. Jones, Chairman and CEO. "Our overall results this year unfolded according to plan as we have successfully implemented strategic changes to improve productivity and increase earnings power."

The company's performance in 2023 sets a strong foundation for continued growth and profitability, positioning Goosehead Insurance Inc (NASDAQ:GSHD) favorably within the personal lines insurance industry.

Explore the complete 8-K earnings release (here) from Goosehead Insurance Inc for further details.

This article first appeared on GuruFocus.