Goosehead Insurance Inc's Meteoric Rise: Unpacking the 15% Surge in Just 3 Months

Goosehead Insurance Inc (NASDAQ:GSHD), a leading player in the insurance industry, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $1.82 billion, with its stock price currently at $74.72. Over the past week, the stock price has seen a gain of 2.24%, and over the past three months, it has risen by an impressive 15.23%. This performance is noteworthy, especially considering the company's GF Value and GF Valuation.

Understanding Goosehead Insurance Inc's GF Value and Valuation

The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, Goosehead Insurance Inc's GF Value stands at $130.78, a decrease from its past GF Value of $154.24 three months ago. Despite this decrease, the company's GF Valuation remains 'Significantly Undervalued', the same as it was three months ago. This suggests that the stock is trading at a price significantly lower than its intrinsic value, indicating potential for future growth.

Introduction to Goosehead Insurance Inc

Goosehead Insurance Inc operates as an insurance agency, offering a wide range of insurance products including homeowner's insurance, auto insurance, specialty lines insurance, commercial lines insurance, and life insurance. The company has a strong presence in Texas, California, Illinois, Florida, and other regions. Its robust portfolio and geographical reach have played a significant role in its impressive stock performance.

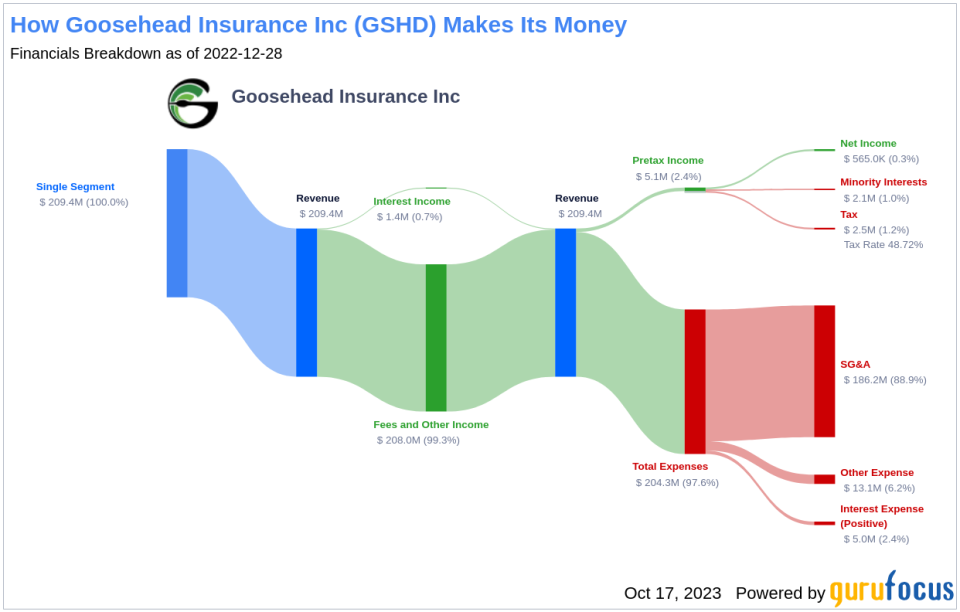

Profitability Analysis of Goosehead Insurance Inc

Goosehead Insurance Inc's Profitability Rank is 7/10, indicating a strong profitability compared to its industry peers. The company's ROE, ROA, and ROIC figures further underscore its profitability. Its ROE of 50.64% is better than 96.73% of 490 companies in the industry. Similarly, its ROA of 1.92% is better than 54.86% of 494 companies, and its ROIC of 6.36% is better than 81.92% of 354 companies. Over the past 10 years, the company has been profitable for 5 years, better than 15.73% of 483 companies.

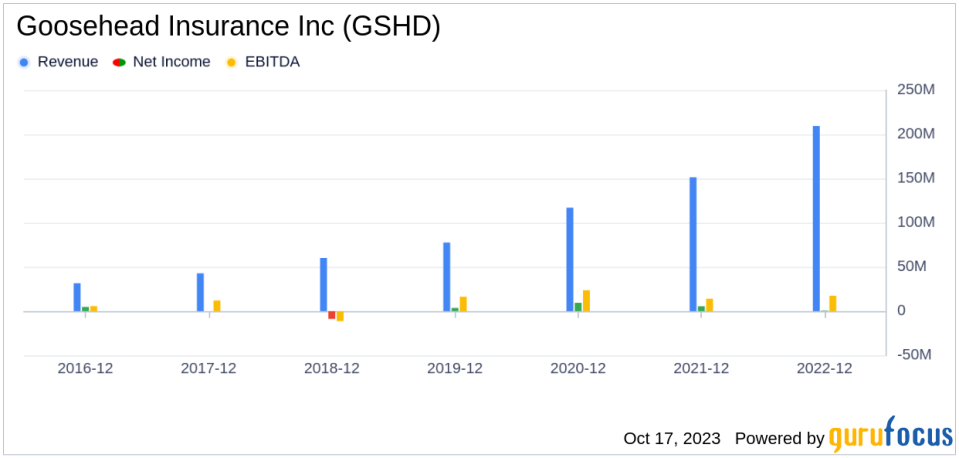

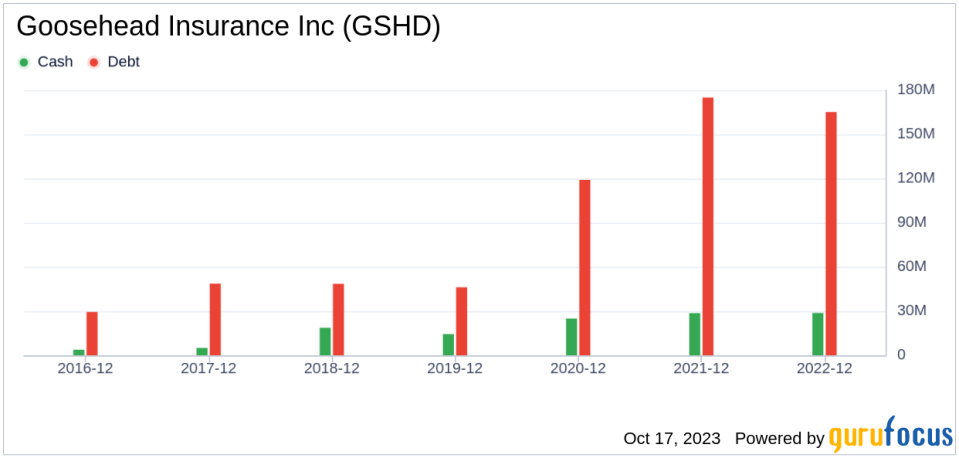

Growth Analysis of Goosehead Insurance Inc

Goosehead Insurance Inc's Growth Rank is 7/10, indicating strong growth compared to its industry peers. The company's 3-Year Revenue Growth Rate per Share is 26.00%, better than 91.72% of 459 companies, and its 5-Year Revenue Growth Rate per Share is 41.20%, better than 97.7% of 435 companies. The company's future total revenue growth rate is estimated to be 30.49%, better than 98.13% of 107 companies. However, its 3-Year EPS without NRI Growth Rate is -48.50%, only better than 4.61% of 369 companies.

Major Holders of Goosehead Insurance Inc Stock

Chuck Akre (Trades, Portfolio) is the top holder of Goosehead Insurance Inc's stock, holding 243,672 shares, which represents 1.02% of the company's shares. The second-largest holder is Steven Cohen (Trades, Portfolio), who holds 37,208 shares, representing 0.16% of the company's shares.

Competitors of Goosehead Insurance Inc

Goosehead Insurance Inc faces competition from several companies within the insurance industry. Its top three competitors are International General Insurance Holdings Ltd(NASDAQ:IGIC) with a market cap of $506.941 million, Sundance Strategies Inc(SUND) with a market cap of $21.118 million, and FG Financial Group Inc(NASDAQ:FGF) with a market cap of $14.837 million.

Conclusion

In conclusion, Goosehead Insurance Inc's impressive stock performance, strong profitability, and robust growth make it a compelling choice for investors. Despite facing competition from other players in the insurance industry, the company's 'Significantly Undervalued' GF Valuation suggests potential for future growth. However, investors should also consider the company's 3-Year EPS without NRI Growth Rate, which is lower than most of its peers. As always, it is recommended to conduct thorough research and consider various factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.