Goosehead Insurance Inc's Meteoric Rise: Unpacking the 26% Surge in Just 3 Months

Goosehead Insurance Inc (NASDAQ:GSHD) has seen a significant surge in its stock price over the past three months. The company's market cap stands at $1.64 billion, with the current stock price at $68.73, marking a 25.55% increase from the past price of $58 three months ago. Over the past week alone, the stock price has seen a gain of 16.07%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of Goosehead Insurance Inc is $129.33, down from the past GF Value of $147.47 three months ago. Despite this decrease, the stock remains significantly undervalued according to the GF Valuation, indicating a potential opportunity for investors.

Company Overview

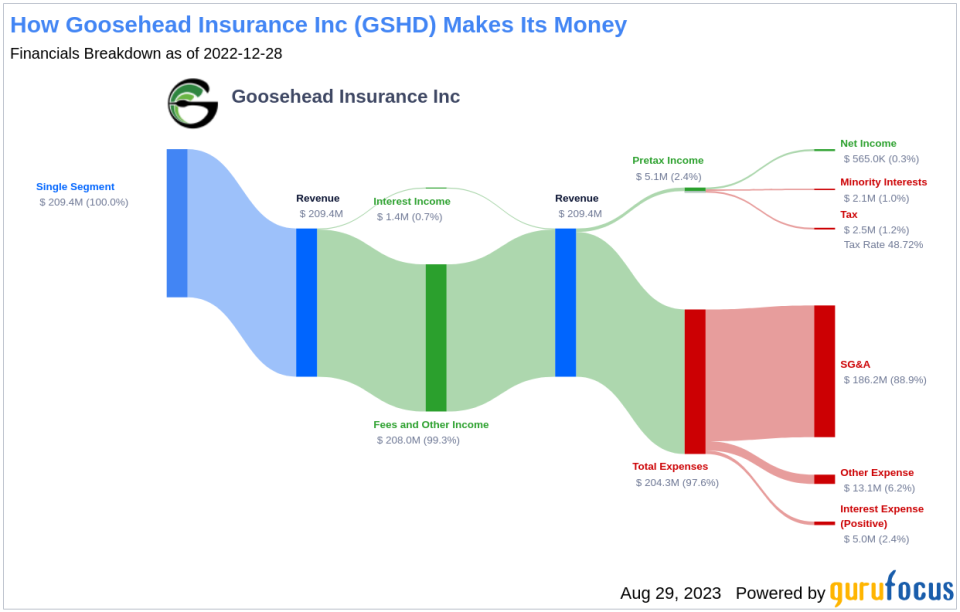

Goosehead Insurance Inc operates as an insurance agency, offering a wide range of insurance products. These include homeowner's insurance, auto insurance, other personal lines products including flood, wind and earthquake insurance, excess liability or umbrella insurance, specialty lines insurance, commercial lines insurance for small businesses, and life insurance. The company operates in various regions, including Texas, California, Illinois, and Florida. The insurance industry is a competitive and dynamic sector, and Goosehead Insurance Inc has managed to carve out a niche for itself through its diverse product offerings and strategic operations.

Profitability Analysis

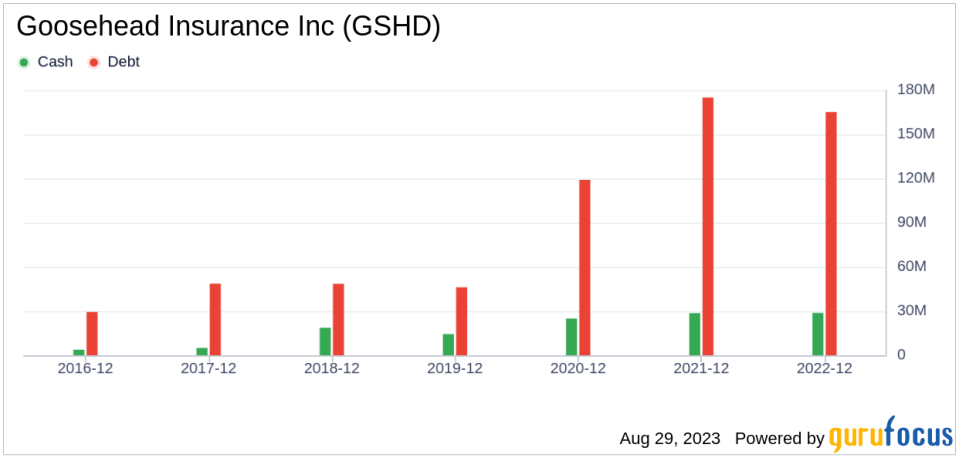

Goosehead Insurance Inc has a Profitability Rank of 7/10, indicating a strong profitability performance compared to other companies in the industry. The company's ROE (Return on Equity) stands at 50.64%, which is better than 96.91% of the 485 companies in the same industry. The ROA (Return on Assets) is 1.92%, better than 56.53% of the 490 companies in the industry. The ROIC (Return on Invested Capital) is 6.36%, better than 82.95% of the 352 companies in the industry. Over the past 10 years, the company has shown profitability for 5 years, which is better than 16.25% of the 480 companies in the industry. These figures indicate a strong profitability performance by Goosehead Insurance Inc.

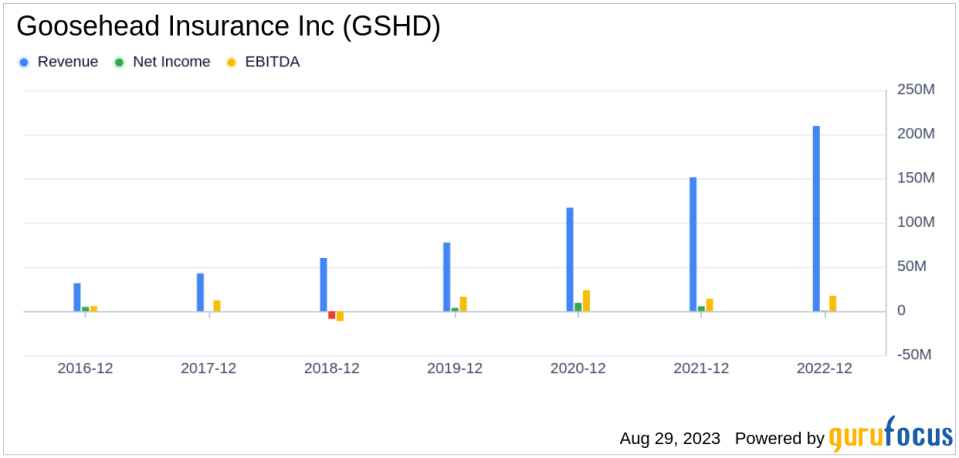

Growth Prospects

Goosehead Insurance Inc has a Growth Rank of 7/10, indicating strong growth prospects. The company's 3-Year Revenue Growth Rate per Share is 26.00%, better than 92.34% of the 457 companies in the industry. The 5-Year Revenue Growth Rate per Share is 41.20%, better than 97.45% of the 431 companies in the industry. The company's Total Revenue Growth Rate for the next 3 to 5 years is estimated to be 30.49%, better than 98.13% of the 107 companies in the industry. However, the 3-Year EPS without NRI Growth Rate is -48.50%, which is only better than 4.4% of the 364 companies in the industry. Despite this, the overall growth prospects of Goosehead Insurance Inc remain strong.

Major Stock Holders

Chuck Akre (Trades, Portfolio) is the top holder of Goosehead Insurance Inc's stock, holding 243,672 shares, which accounts for 1.02% of the company's stock. The second-largest holder is Steven Cohen (Trades, Portfolio), who holds 37,208 shares, accounting for 0.16% of the company's stock.

Competitive Landscape

Goosehead Insurance Inc operates in a competitive industry, with several companies vying for market share. The top three competitors of Goosehead Insurance Inc are International General Insurance Holdings Ltd (NASDAQ:IGIC) with a stock market cap of $495.293 million, Sundance Strategies Inc (SUND) with a stock market cap of $22.771 million, and FG Financial Group Inc (NASDAQ:FGF) with a stock market cap of $13.550 million.

Conclusion

In conclusion, Goosehead Insurance Inc has shown strong performance in terms of stock price growth, profitability, and growth prospects. Despite facing stiff competition in the insurance industry, the company has managed to carve out a niche for itself and deliver strong results. The company's stock remains significantly undervalued according to the GF Valuation, indicating a potential opportunity for investors. However, as with any investment, potential investors should conduct thorough research and consider various factors before making an investment decision.

This article first appeared on GuruFocus.