GoPro (GPRO) Q1 Earnings Beat Estimates, Revenues Up Y/Y

GoPro, Inc. GPRO reported impressive first-quarter 2021 results, with both the bottom line and top line surpassing their respective Zacks Consensus Estimate. Higher subscription revenues and solid sales across all regions on the back of subscriber growth amid the current volatile environment drove GoPro’s quarterly performance.

Bottom Line

On a GAAP basis, net loss in the March quarter was $10.2 million or loss of 7 cents per share compared with net loss of $63.5 million or loss of 43 cents per share in the prior-year quarter. The year-over-year improvement was mainly driven by narrower operating loss.

Quarterly non-GAAP net income came in at $4.8 million or 3 cents per share against net loss of $49.6 million or loss of 34 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 3 cents.

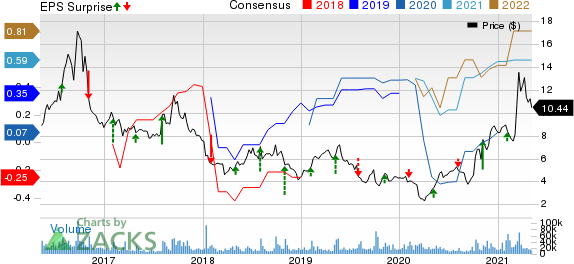

GoPro, Inc. Price, Consensus and EPS Surprise

GoPro, Inc. price-consensus-eps-surprise-chart | GoPro, Inc. Quote

Revenues

GoPro generated revenues of $203.7 million, up 70.6% from $119.4 million in the year-ago quarter. The surge in revenues was mainly driven by robust sales of premium products across all regions and channels, coupled with an accretive subscriber base, despite adversities stemming from the COVID-19 pandemic. The top line surpassed the consensus estimate of $187 million.

Further, the company witnessed an upward sell-through trend of nearly 700,000 GoPro camera units in the reported quarter. Encouraged by higher subscription revenues, GoPro expects to tap 2 million subscribers by the year end. The company launched Quik App subscription for smartphone users in first-quarter 2021.

Region wise, revenues from the Americas came in at $106.7 million (52.3% of total revenues), up 86.2% from $57.3 million in the year-ago quarter. Revenues from Europe, Middle East and Africa (EMEA) were $49.8 million (24.5%), up 67.7% from $29.7 million, and Asia and Pacific (APAC) generated $47.2 million (23.2%), up 45.7% from $32.4 million.

On the basis of channels, revenues from Gopro.com were $82.1 million (40.3% of total revenues), up 224.5% from $25.3 million. The year-over-year increase was primarily driven by higher direct-to-consumer revenues via GoPro.com. With more than 90% of the camera purchases at GoPro.com, the company aims to bolster its margins with continued investments to enhance shopper experience on the back of robust website engagement and conversion. Revenues from Retail channel came in at $121.6 million (59.7%), up 29.2% from $94.1 million year over year.

GoPro shipped 556,000 camera units during the reported quarter, up 63% year over year. The company had $111.8 million in inventory compared with $172 million in the year-ago quarter. The year-over-year inventory reductions were mainly driven by an upward sell-through trend across all regions.

Other Quarterly Details

Gross profit was $78.7 million, up 104.8% year over year. Total operating expenses were $82.2 million compared with $94.5 million in the year-ago quarter. The reduction was mainly led by lower sales and marketing, and general and administrative expenses. Operating loss narrowed to $3.5 million from $56.1 million.

GoPro has shifted its focus to a more subscription-centric, consumer-direct business model. Impressively, cameras with prices above $300 contributed 95% to revenues in the reported quarter, reflecting burgeoning demand for GoPro’s premium products.

Cash Flow & Liquidity

During the first three months of 2021, GoPro utilized $25.5 million of net cash for operating activities compared with $68.3 million of cash utilization in the year-ago period. As of Mar 31, 2021, the company had $296.8 million in cash and cash equivalents with $221.9 million of long-term debt.

Q2 Guidance

GoPro provided guidance for second-quarter 2021. Revenues are estimated to be $230 million +/- $10 million, while adjusted gross margins are expected to be 38% +/- 50 basis points. Sell-through of GoPro camera units is expected to be in the range of 800,000 to 850,000. Adjusted earnings are anticipated to be 4 cents +/- 1 cent per share.

Moving Ahead

Despite the uncertainties stemming from the pandemic, GoPro delivered an impressive performance on the back of a dynamic business model. Although the action video camera maker’s upcoming results might get affected by the COVID-19 pandemic, GoPro is confident that any kind of operational changes will not hurt its 2021 product roadmap.

GoPro’s direct-to-consumer and subscription-centric strategy continues to not only expand margins but also increase subscriber base with lowered channel inventories and efficient working capital management. It believes that a more direct-to-consumer-centric approach with a lower operating expense model is better aligned with the present business climate as well as is accretive to the average selling price of products and gross margin. This, in turn, will enable the company to tap potential opportunities, which augurs well for long-term growth.

Zacks Rank & Stocks to Consider

GoPro currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader industry are Fox Corporation FOXA, Dolby Laboratories, Inc. DLB and Sonos, Inc. SONO. While Fox Corporation sports a Zacks Rank #1 (Strong Buy), Dolby and Sonos carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fox Corporation delivered a trailing four-quarter earnings surprise of 86.1%, on average.

Dolby delivered a trailing four-quarter earnings surprise of 82.3%, on average.

Sonos delivered a trailing four-quarter earnings surprise of 157.2%, on average.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dolby Laboratories (DLB) : Free Stock Analysis Report

GoPro, Inc. (GPRO) : Free Stock Analysis Report

Sonos, Inc. (SONO) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research