Graco (GGG) Q2 Earnings Miss Estimates, Revenues Rise Y/Y

Graco Inc.’s GGG second-quarter 2023 adjusted earnings of 75 cents per share missed the Zacks Consensus Estimate of adjusted earnings of 78 cents per share. The bottom line improved 10.3% year over year.

GGG’s net sales of $560 million also underperformed the consensus estimate of $573 million. The top line increased 2% year over year driven by double-digit growth in the Process segment.

On a regional basis, quarterly sales generated from the Americas grew 2%. In Europe, the Middle East and Africa (EMEA) region, sales increased 7% year over year. However, sales from the Asia Pacific decreased 4% year over year.

Segmental Details

Revenues in the Industrial segment totaled $163.5 million (contributing to 29.2% of the quarter’s sales), rising 3% year over year, driven by solid growth in the Americas and EMEA regions. Our estimate for segmental revenues was $163.2 million. Adverse foreign currency translations lowered sales by 1%. Core sales grew 4% year over year.

Revenues in the Process segment grossed $140.5 million (contributing to 25.2% of the quarter’s sales), increasing 13% year over year. Our estimate for segmental revenues was $136.1 million. The improvement came on the back of a 14% rise in core sales, driven by growth in the automatic lubrication, vehicle service and semiconductor product applications.

Revenues in the Contractor segment totaled $255.6 million (contributing to 45.6% of the quarter’s sales), down 4% year over year due to slower economic activity in construction markets in the Americas and Asia Pacific. Our estimate for segmental revenues was $269 million. Core sales declined 3% in the quarter.

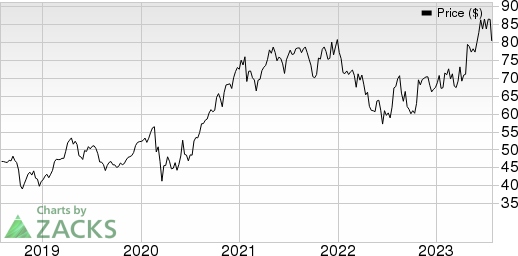

Graco Inc. Price, Consensus and EPS Surprise

Graco Inc. price-consensus-eps-surprise-chart | Graco Inc. Quote

Margin Profile

In the second quarter, Graco’s cost of sales declined 4% year over year to $268.2 million. Gross profit increased 8.3% to $291.4 million, while the margin increased 3.1 percentage points. The favorable effects of realized pricing and product and channel mix benefited the margin’s performance.

Operating income increased 6% year over year to $157.1 million. The operating margin increased 1 percentage point from the year-ago quarter. Interest expenses in the quarter totaled $1.8 million, compared with $1.7 million reported in the year-ago period. The adjusted effective tax rate in the quarter was 16%.

Balance Sheet and Cash Flow

Exiting the second quarter, Graco had cash and cash equivalents of $520.6 million, compared with $339.2 million at the end of 2022.

Graco generated net cash of $282.3 million from operating activities in the first six months of 2023, compared with $135 million generated in the year-ago period. Capital used for purchasing property, plant and equipment totaled $92.2 million, compared with $88.9 million in the year-ago period.

GGG paid out dividends worth $79 million to its shareholders in the first six months of 2023, up 10.7% from the previous year. Graco repurchased common stocks worth $7.8 million in the first six months of 2023.

Outlook

The company expects low single-digit organic revenue growth on a constant-currency basis for 2023.

Zacks Rank & Stocks to Consider

GGG currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Greif, Inc. GEF presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

GEF delivered a trailing four-quarter earnings surprise of 7.7%, on average. GEF’s earnings estimates have increased 13.4% for fiscal 2023 in the past 60 days. Its shares have risen 5.4% in the past year.

Caterpillar Inc. CAT presently carries a Zacks Rank #2 (Buy). CAT’s earnings surprise in the last four quarters was 14.3%, on average.

In the past 60 days, estimates for Caterpillar’s earnings have increased 1.3% for 2023. The stock has gained 37.5% in the past year.

IDEX Corporation IEX presently carries a Zacks Rank of 2. IEX’s earnings surprise in the last four quarters was 3.5%, on average.

In the past 60 days, estimates for IDEX’s earnings have remained steady for 2023. The stock has gained 6.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report