Graco (GGG) Rides on End-Market Strength, Capacity Expansion

Graco Inc. GGG is gaining from robust end-market activity. Also, strong demand trends for new and existing products are expected to be beneficial for the company in the quarters ahead.

Robust product categories such as liquid finishing and sealant and adhesive equipment are benefiting GGG’s Industrial segment. A solid backlog in powder equipment systems also bodes well. Graco expects the segment to benefit from new product introductions in the second half of 2023.

Continued sales growth in vehicle service, industrial lubrication, process transfer pumps, environmental, and semiconductors is driving the company’s Process segment. New product launches and robust project activity in lubrication, environmental and process pumps are also aiding the segment. Strength in pro paint and high-performance coatings and foam businesses are supporting the Contractor segment’s revenues.

Investments in product innovation and capacity expansion should drive Graco’s growth. In 2023, the company anticipates capital expenditures of approximately $200 million with $130 million for facility expansion projects at its Minnesota, South Dakota, Switzerland and Romania facilities.

Also, the company launched the first electric-powered airless gun Ultra QuickShot in 2023 which is designed to provide quick and premium quality results for professional painting contractors. The introduction of the ES 500 Stencil rig, LineLazer ES 500 electric battery-powered airless striper, Contractor King air-powered protective coatings sprayer and the Silver Plus HP spray guns, plus others in 2022 is also worth mentioning.

Graco’s efforts to reward its shareholders through dividend payments and share repurchases are encouraging. The company remunerated its shareholders with dividends of $142.1 million in 2022. This reflects an increase of 11.8% from the previous year. Share repurchases were $233.4 million in the year. In the first three months of 2023, Graco paid out dividends worth $39.4 million to its shareholders, up 10.1% from the previous year. It also repurchased common stocks worth $7.8 million in the same period.

However, Graco is experiencing headwinds from increased product costs, triggered by supply-chain woes and high input costs. Also, the company’s extensive presence across international markets and its operations are subject to risks associated with unfavorable movement in foreign currencies and geopolitical issues. In first-quarter 2023, foreign currency translation had a negative impact of 3% on the Industrial, 2% on the Process and 2% on the Contractor segments’ sales.

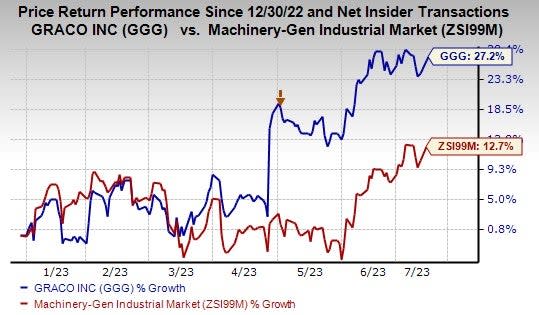

In the year-to-date period, shares of this Zacks Rank #1 (Strong Buy) company have gained 27.2% compared with the industry’s 12.7% rise.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked companies from the Industrial Products sector are discussed below:

Greif, Inc. GEF presently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks.

GEF delivered a trailing four-quarter earnings surprise of 7.7%, on average. GEF’s earnings estimates have increased 12.6% for fiscal 2023 (ending October 2023) in the past 60 days. Its shares have risen 5.3% in the year-to-date period.

Allegion plc ALLE currently carries a Zacks Rank #2 (Buy). ALLE’s earnings surprise in the last four quarters was 12.5%, on average.

In the past 60 days, Allegion’s earnings estimates have remained steady for 2023. The stock has gained 15.3% in the year-to-date period.

A. O. Smith Corporation AOS presently carries a Zacks Rank of 2. AOS’ earnings surprise in the last four quarters was 8%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings estimates have remained steady for 2023. The stock has gained 26.1% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report