Graco Inc (GGG) Reports Record Annual Sales and Operating Earnings

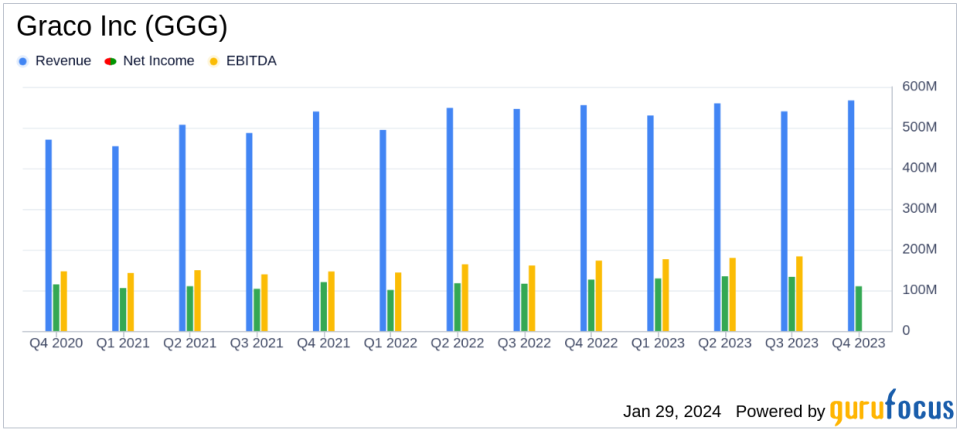

Net Sales: Increased by 2% in Q4 and annually, reaching $566.6 million and $2,195.6 million respectively.

Operating Earnings: Grew by 11% in Q4 and 13% for the full year, with Q4 operating earnings at $169.9 million.

Net Earnings: Declined by 13% in Q4 to $110.0 million, but annual net earnings rose by 10% to $506.5 million.

Diluted EPS: Decreased by 14% in Q4 to $0.64, while adjusted annual EPS increased by 16% to $3.04.

Gross Profit Margin: Improved by approximately 4 percentage points in Q4 due to pricing and lower product costs.

Operating Expenses: Increased by 8% in Q4, reflecting higher product development and growth initiative costs.

Effective Tax Rate: Stood at 14% for Q4 and 17% for the full year, with an adjusted rate of 19% for both periods.

On January 29, 2024, Graco Inc (NYSE:GGG) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 29, 2023. The Minnesota-based leader in fluid management technology reported record sales and operating earnings, with growth across all business segments despite a challenging macroeconomic environment.

Company Overview

Graco specializes in equipment for managing fluids, coatings, and adhesives, particularly those that are difficult to handle. The company operates through three segments: Industrial, Process, and Contractor. Serving diverse end markets such as industrial, automotive, and construction, Graco offers a wide range of products including pumps, valves, meters, and sprayers. In 2022, the company generated approximately $2.1 billion in sales and $573 million in operating income.

Performance Highlights and Challenges

Graco's performance in the fourth quarter was marked by a 2% increase in net sales, with all segments contributing to growth. The company's gross profit margin rate improved significantly, attributed to effective pricing strategies and reduced product costs. However, total operating expenses rose by 8%, driven by increased investment in product development and growth initiatives. This increase in expenses could pose challenges if not matched by continued revenue growth.

Operating earnings as a percentage of sales for the quarter increased to 30%, up 3 percentage points, showcasing Graco's ability to enhance profitability. Nonetheless, net earnings saw a 13% decline in the fourth quarter, primarily due to a non-cash pension settlement loss of $42 million. This loss, connected with the transfer of certain pension obligations, highlights the impact of non-operating expenses on the company's bottom line.

Financial Achievements and Industry Significance

Graco's financial achievements, particularly the record annual sales and operating earnings, underscore the company's resilience and strategic pricing in the face of economic headwinds. The improvement in gross profit margin is particularly noteworthy for an industrial products company, as it reflects the ability to manage costs effectively while maintaining competitive pricing. These achievements are significant as they demonstrate Graco's strong market position and operational efficiency within the Industrial Products industry.

Segment and Regional Performance

The Contractor segment reported a 2% increase in sales for the quarter, driven by new product introductions and strength in protective coatings and spray foam categories. The Industrial segment saw a modest 1% increase in quarterly sales, while the Process segment experienced growth across all businesses and regions. Geographically, sales in the Americas and EMEA contributed positively, while Asia Pacific faced a decline, reflecting varied economic conditions across regions.

Outlook and Management Commentary

Graco's President and CEO, Mark Sheahan, expressed pride in the company's achievements and acknowledged the contributions of employees, customers, and vendors. Looking ahead, Sheahan provided guidance for low single-digit revenue growth on an organic, constant currency basis for 2024, emphasizing the company's focus on new product development, distribution expansion, market entry, and strategic acquisitions.

For a detailed reconciliation of adjusted non-GAAP financial measures to GAAP, and further segment information, readers are encouraged to review the full 8-K filing.

Graco's financial performance reflects a company adept at navigating market fluctuations while capitalizing on growth opportunities. Value investors and potential GuruFocus.com members interested in the industrial sector may find Graco's consistent performance and strategic outlook compelling for further analysis and investment consideration.

Explore the complete 8-K earnings release (here) from Graco Inc for further details.

This article first appeared on GuruFocus.