GrafTech International Ltd (EAF) Faces Challenges Amidst Soft Market Conditions

Net Loss: GrafTech reported a net loss of $255 million for the full year 2023.

Adjusted EBITDA: The company saw a significant decrease in adjusted EBITDA to $20 million for the year.

Sales Volume: Sales volume dropped to 92 thousand metric tons in 2023.

Production Adjustments: Production volume was reduced to align with market demand, resulting in 88 thousand metric tons.

Cost Savings Measures: GrafTech announced a plan expected to save approximately $25 million annually.

Liquidity: The company ended the year with $289 million in liquidity.

Outlook: GrafTech anticipates modest year-over-year improvement in sales volume for 2024.

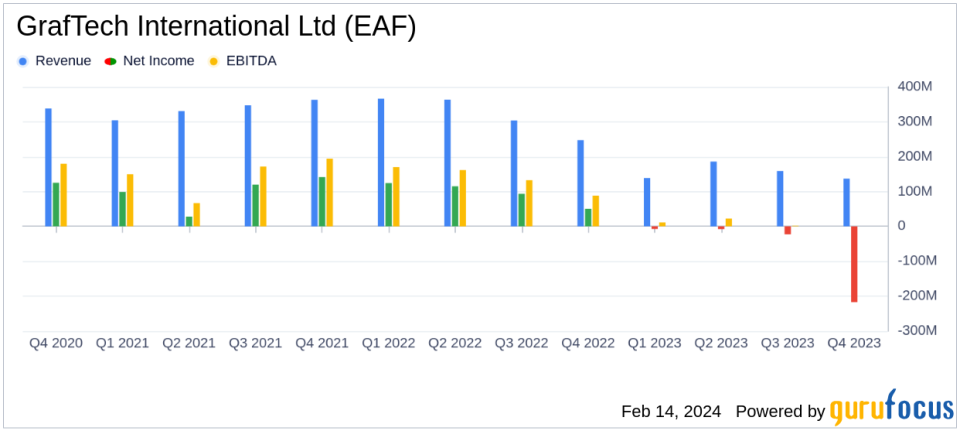

GrafTech International Ltd (NYSE:EAF) released its 8-K filing on February 14, 2024, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading producer of specialized graphite electrodes, faced a challenging year with soft industry demand and increased costs, resulting in a net loss of $255 million, or $0.99 per share, for the full year. Adjusted EBITDA stood at $20 million, a stark contrast to the previous year's $536 million.

GrafTech's sales volume for 2023 was 92 thousand metric tons, with a production volume of 88 thousand metric tons. Despite these challenges, the company managed to generate positive free cash flow for the year, thanks to a disciplined approach to working capital management and cost reduction efforts. The company's cost rationalization and footprint optimization plan, announced in response to the ongoing market softness, is expected to yield annualized cost savings of approximately $25 million once fully implemented.

Financial Performance Breakdown

For the fourth quarter of 2023, GrafTech reported net sales of $137 million, a 45% decrease from the same period in the previous year. The net loss for the quarter was $217 million, or $0.85 per share, including significant charges such as a goodwill impairment of $171 million. Adjusted EBITDA was negative $22 million, influenced by the lower sales volume and higher costs per metric ton.

The company's balance sheet as of December 31, 2023, shows a liquidity position of $289 million, with $112 million available under its revolving credit facility and $177 million in cash and cash equivalents. Gross debt stood at $950 million, resulting in a net debt of approximately $773 million.

Looking ahead, GrafTech expects continued weakness in the graphite electrode market but is optimistic about a modest improvement in sales volume for 2024. The company's strategic actions aim to align production with market demand and reduce costs, positioning GrafTech to capitalize on long-term growth opportunities as the steel industry moves towards decarbonization.

For further details and insights into GrafTech International Ltd (NYSE:EAF)'s financial performance and strategic initiatives, investors are encouraged to review the full 8-K filing.

For inquiries, please contact Michael Dillon at 216-676-2000 or investor.relations@graftech.com.

Explore the complete 8-K earnings release (here) from GrafTech International Ltd for further details.

This article first appeared on GuruFocus.