Graham Corp (GHM) Reports Strong Gross Margin Expansion in Q3 Fiscal 2024

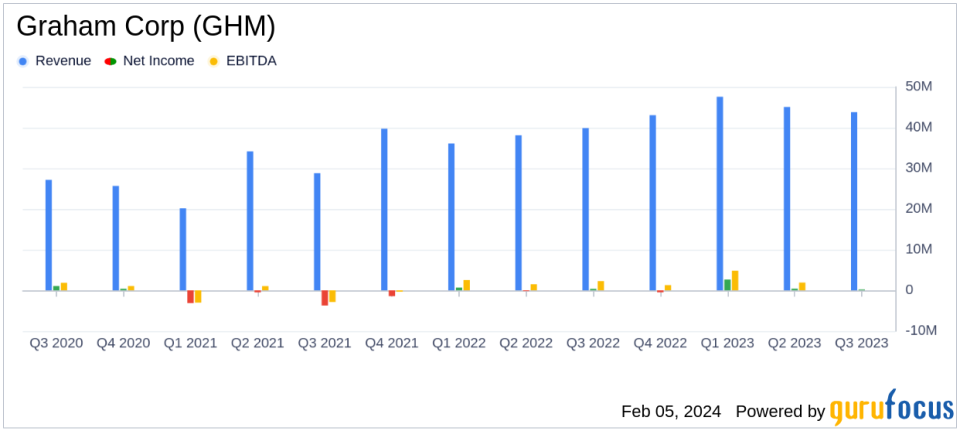

Net Sales: Increased by 10% to $43.8 million in Q3 FY24.

Gross Margin: Expanded by 660 basis points to 22.2%.

Operating Income: Grew by 36% to $0.9 million.

Net Income: Decreased by 55% to $0.2 million; Adjusted net income rose by 183% to $2.4 million.

Backlog: Reached a record $399.2 million, up 36% over the prior-year period.

Adjusted EBITDA: Increased by 72% to $3.9 million.

Guidance: Fiscal 2024 net sales forecast increased to $175 million to $185 million.

Graham Corp (NYSE:GHM) released its 8-K filing on February 5, 2024, detailing financial results for the third quarter of fiscal year 2024, which ended December 31, 2023. The company, a global leader in the design and manufacture of critical equipment for various industries, including defense, energy, and chemical/petrochemical, reported a significant expansion in gross margin and a record backlog, despite a decrease in net income.

Graham Corp's net sales saw a 10% increase to $43.8 million, bolstered by the acquisition of P3 Technologies, LLC, and strong sales in the defense market. The gross margin notably expanded by 660 basis points to 22.2%, reflecting higher volume, improved absorption, and better pricing on defense contracts. However, net income saw a decline of 55% to $0.2 million, attributed to debt amendment costs and increased selling, general, and administrative expenses. Adjusted net income, on the other hand, rose by 183% to $2.4 million, showcasing the company's ability to manage costs and improve profitability.

Financial Highlights and Challenges

The company's operating income grew by 36% to $0.9 million, and the adjusted EBITDA increased by 72% to $3.9 million. The adjusted EBITDA margin also improved by 320 basis points. These achievements are significant as they demonstrate Graham Corp's operational efficiency and its ability to convert sales into profits, which is crucial in the competitive industrial products sector.

Despite these financial achievements, Graham Corp faced challenges such as a decrease in net income and increased SG&A expenses, which included performance-based compensation and acquisition-related costs. The company also incurred approximately $0.7 million of debt amendment costs during the quarter.

Cash Management and Outlook

Cash provided by operating activities was $19.5 million for the year-to-date period, an improvement from the prior year, reflecting higher net income and better working capital management. Capital expenditures were adjusted downward due to updated projections, and the company successfully refinanced its debt with a new credit facility, reducing borrowing costs and enhancing financial flexibility.

Orders for the third quarter reached a record $123.3 million, driven by defense contracts and strong aftermarket orders. The backlog reached a record $399.2 million, up 36% over the prior-year period, with P3 contributing approximately $6 million. Graham Corp increased its fiscal 2024 guidance, reflecting confidence in its strategic initiatives and market opportunities.

The company's performance is particularly important as it navigates a dynamic market environment, with the defense and energy sectors playing a critical role in its growth strategy. The record backlog indicates a robust pipeline of future revenue, which is a positive sign for investors and stakeholders.

For more detailed financial information and future outlook, investors and interested parties are encouraged to join the webcast and conference call hosted by GHM's management.

Graham Corp's strategic acquisitions, such as P3 Technologies, and its focus on margin accretive projects have positioned the company for continued growth. The strong cash generation and payoff of debt utilized in the P3 acquisition further solidify its financial stability. With a focus on driving quality top-line growth and improving future earnings power, Graham Corp is poised to capitalize on the opportunities ahead.

"We believe our business is in a much-improved position given the strategic and necessary actions taken over the last few years. As we look forward, we are confident we can continue to execute our strategy and capitalize on the many opportunities in front of us," commented Daniel J. Thoren, President and Chief Executive Officer.

Investors and potential GuruFocus.com members interested in the industrial products sector and companies like Graham Corp (NYSE:GHM) can find more in-depth analysis and up-to-date information on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Graham Corp for further details.

This article first appeared on GuruFocus.