Graham Holdings Co Reports Mixed 2023 Financial Results Amid Segment Fluctuations

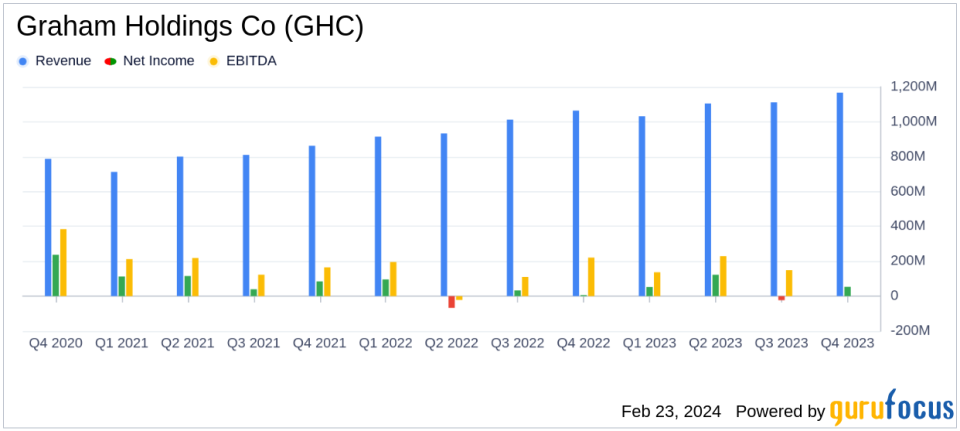

Revenue: Increased by 12% to $4.41 billion in 2023 from $3.92 billion in 2022.

Operating Income: Decreased to $69.4 million in 2023 from $83.9 million in 2022.

Net Income: Rose significantly to $205.3 million in 2023, or $43.82 per share, from $67.1 million, or $13.79 per share, in 2022.

Adjusted Operating Cash Flow: Declined to $338.3 million in 2023 from $377.6 million in 2022.

Debt and Cash Position: Borrowings increased to $811.8 million at the end of 2023, up from $726.4 million in 2022, with cash and investments totaling $898.9 million.

Stock Repurchases: GHC bought back 100,263 shares at a cost of $62.1 million in Q4 2023.

Pension Plan: The company reported a pension surplus of $2.11 billion at the end of 2023, up from $1.66 billion in 2022.

Graham Holdings Co (NYSE:GHC) released its 8-K filing on February 23, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The diversified education and media company, which operates in segments including Kaplan International, Higher Education, Supplemental Education, Television Broadcasting, Manufacturing, Healthcare, and Automotive, saw a 12% increase in annual revenue, driven by growth in education, healthcare, and automotive segments. However, operating income for the year decreased due to impairment charges and declines in television broadcasting and manufacturing.

Segment Performance and Financial Highlights

The education division, primarily Kaplan International, reported a revenue increase of 9% in Q4 2023, although operating income saw a slight decline. The healthcare segment experienced a substantial 34% revenue growth in Q4, attributed to growth at CSI and acquisitions made in 2022. GHC's automotive segment also saw a revenue increase due to dealership acquisitions and sales growth.

Despite these gains, the television broadcasting segment faced a 19% revenue decrease in Q4, primarily due to a significant drop in political advertising revenue. The manufacturing segment also reported a 14% revenue decline in Q4, with lower product demand across several sectors.

GHC's overall net income for 2023 showed a remarkable increase to $205.3 million, up from $67.1 million in 2022. This rise was influenced by several non-operating items, including gains on marketable equity securities and adjustments to pension-related expenses.

Financial Position and Shareholder Returns

The company's debt increased year-over-year, with borrowings standing at $811.8 million at the end of 2023. Nonetheless, GHC maintained a strong liquidity position with cash and investments totaling $898.9 million. In Q4 2023, GHC continued its shareholder return policy by repurchasing over 100,000 shares, and it still has authorization to buy back additional shares.

The company's pension plan surplus grew significantly, reflecting a strong balance sheet and potential for future investment in growth initiatives or further shareholder returns.

Outlook and Strategic Moves

While GHC did not provide specific forward-looking statements, the mixed results across its segments highlight the challenges and opportunities facing the company. The growth in education and healthcare suggests resilience in these sectors, which could be key drivers for future performance. However, the volatility in broadcasting and manufacturing underscores the need for strategic adjustments to navigate market fluctuations.

GHC's commitment to shareholder returns through stock repurchases, coupled with a solid financial position, may appeal to value investors looking for stable companies with a proactive approach to capital allocation.

In conclusion, Graham Holdings Co's 2023 financial results present a picture of a company navigating through segment-specific challenges while leveraging growth opportunities in its education and healthcare divisions. The company's robust balance sheet and commitment to shareholder value remain central to its financial strategy.

Explore the complete 8-K earnings release (here) from Graham Holdings Co for further details.

This article first appeared on GuruFocus.