Grainger (GWW) Set to Report Q4 Earnings: What's in Store?

W.W. Grainger, Inc. GWW is scheduled to report fourth-quarter 2023 results on Feb 2, before the opening bell.

Q4 Estimates

The Zacks Consensus Estimate for GWW’s fourth-quarter revenues is pegged at $4.05 billion, indicating growth of 6.4% from the year-ago quarter’s reported figure. Organic growth for the quarter is expected to be 6.2%. The consensus mark for earnings per share is pegged at $8.03, implying an improvement of 12.5% from the prior-year quarter's level.

W.W. Grainger, Inc. Price and EPS Surprise

W.W. Grainger, Inc. price-eps-surprise | W.W. Grainger, Inc. Quote

Q3 Results

In the last reported quarter, Grainger’s earnings surpassed the Zacks Consensus Estimate, while revenues missed the same. The top and bottom lines increased year over year. GWW's earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 6.2%.

What the Zacks Model Indicates

Our proven model doesn’t conclusively predict an earnings beat for Grainger this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Earnings ESP: Grainger has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Grainger currently carries a Zacks Rank #3.

Factors to Note

Grainger has been witnessing strong growth in core and non-pandemic product sales for the past few quarters. The company’s product mix has been stabilizing, as customers are returning to normal operations post-pandemic.

Also, GWW has been focusing on improving the end-to-end customer experience by making investments in its e-commerce and digital capabilities, and executing improvement initiatives within its supply chain. These factors are likely to have contributed to the company’s fourth-quarter performance. We expect organic daily sales growth to be 6.4% for the quarter.

The company’s High-Touch Solutions North America segment is expected to have benefited from strength in commercial, transportation and heavy manufacturing, strong revenue growth across its North American regions, and an expansion in large and midsize customers. Our model projects quarterly organic daily sales to grow 7.1% from the year-ago quarter's level.

Management has been witnessing market-beating growth in the High-Touch Solutions market compared with the U.S. MRO (maintenance, repair and operating) market. This outperformance can be attributed to strategic activities, such as building advantaged MRO solutions, delivering unparalleled customer services, and offering differentiated sales and services.

We expect the segment’s revenues to be $3,290 million for the fourth quarter of 2023, up 7.1% from the fourth-quarter 2022 levels.

GWW’s Endless Assortment segment is likely to have benefited from strong customer acquisition and repeat business in the quarter to be reported. Our model predicts quarterly organic daily sales to grow 3.3% from the prior-year levels.

Customer growth at MonotaRO is expected to have positively impacted the segment’s revenues. Our model predicts the Endless Assortment segment’s revenues to be $692 million, up 3.3% from the prior-year quarter’s reported figure.

However, GWW has been witnessing elevated material and freight costs for some time. This, coupled with higher operating costs and incremental SG&A expenses due to higher technology investments, is likely to have negatively impacted its margins in the quarter under review.

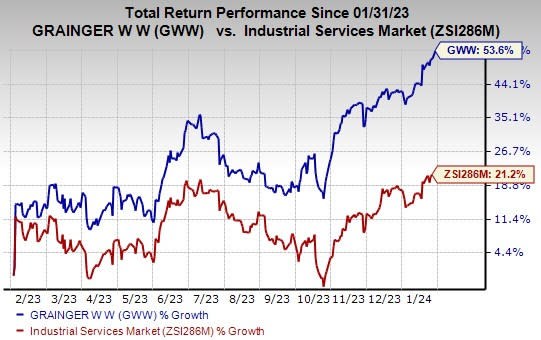

Price Performance

Grainger's shares have risen 53.6% in a year compared with the industry’s growth of 21.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some Industrial Products stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases.

Kubota Corporation KUBTY, which is expected to release fourth-quarter 2023 earnings soon, has an Earnings ESP of +6.94% and a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for KUBTY’s earnings for the fourth quarter is pegged at 72 cents per share. The consensus estimate for quarterly earnings has moved 7% north in the past 60 days. It has a trailing four-quarter earnings surprise of 31.2%, on average.

Reliance Steel & Aluminum Co. RS, which is set to release earnings on Feb 15, has an Earnings ESP of +3.35% and a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for RS’ fourth-quarter earnings is pegged at $3.88 per share, which remained unchanged in the past 60 days. RS has a trailing four-quarter earnings surprise of 10.6%, on average.

Ingersoll Rand Inc. IR, which is scheduled to release earnings on Feb 15, currently has an Earnings ESP of +0.98% and a Zacks Rank of 3.

The consensus estimate for Ingersoll Rand’s fourth-quarter earnings is pegged at 76 cents per share, which remained unchanged in the past 60 days. It has a trailing four-quarter earnings surprise of 16.1%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Kubota Corp. (KUBTY) : Free Stock Analysis Report