Granite Construction Inc (GVA) Reports Solid Revenue Growth and Strong Operating Cash Flow in ...

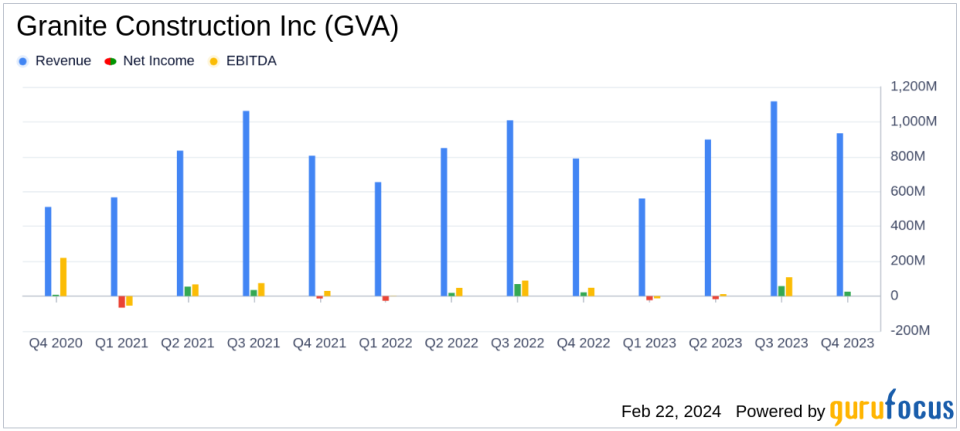

Revenue Growth: Q4 revenue increased by 18% year-over-year to $934 million, and FY 2023 revenue rose to $3.5 billion, up from $3.3 billion in the prior year.

Earnings Per Share (EPS): Q4 diluted EPS stood at $0.55, with adjusted diluted EPS of $0.82. FY 2023 reported a diluted EPS of $0.97, with adjusted EPS reaching $3.14.

Operating Cash Flow: A significant sequential increase in operating cash flow by $150 million.

Committed and Awarded Projects (CAP): CAP reached $5.5 billion, marking a $1.1 billion increase year-over-year.

Adjusted EBITDA: Q4 adjusted EBITDA grew to $74 million from $50 million in the same period last year, while FY 2023 adjusted EBITDA reached $269 million, up from $210 million.

On February 22, 2024, Granite Construction Inc (NYSE:GVA) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. GVA, a leading infrastructure company in the United States, specializes in heavy civil infrastructure projects and materials production. The company's diverse portfolio includes roads, highways, bridges, airports, and residential development services.

Financial Performance Highlights

Granite Construction Inc (NYSE:GVA) reported a robust increase in revenue for both the fourth quarter and the full year of 2023. The company's Q4 revenue surged to $934 million, an 18% increase compared to the same period in the prior year, while full-year revenue climbed to $3.5 billion from $3.3 billion. This growth reflects GVA's strategic focus on organic growth and the successful execution of its strategic plan.

Despite facing challenges from legacy projects such as the Tappan Zee and I-64 High Rise Bridge Projects, which impacted gross profit margins, GVA's overall financial achievements are noteworthy. The company's operating cash flow saw a remarkable $150 million sequential increase, and its Committed and Awarded Projects (CAP) grew by $1.1 billion year-over-year, indicating a strong future project pipeline and the potential for sustained revenue growth.

Adjusted net income for Q4 stood at $36 million, or $0.82 per diluted share, compared to $25 million, or $0.56 per diluted share, in the same period of the previous year. For the full year, adjusted net income reached $140 million, or $3.14 per diluted share, up from $104 million, or $2.31 per diluted share, in the prior year. These figures underscore GVA's ability to enhance shareholder value through strategic initiatives and operational efficiency.

Segment Performance and Outlook

The Construction segment reported a 19.3% increase in revenue for Q4, led by significant growth in the California and Mountain groups. The Materials segment also saw a 12.8% rise in Q4 revenue, driven by sales from newly acquired facilities and higher product prices. However, gross profit margins in the Materials segment faced pressure due to a gross loss from new operations and the impact of purchase accounting.

Looking ahead, GVA's guidance for 2024 remains positive, with expected revenue in the range of $3.8 billion to $4.0 billion and an adjusted EBITDA margin between 9.0% and 11.0%. The company anticipates further improvements in operating cash flow and aims to continue capitalizing on its high-quality CAP and robust market conditions.

Granite Construction's President and CEO, Kyle Larkin, expressed confidence in the company's direction, stating:

"The quarters strong results, however, were tempered by impacts from the legacy Tappan Zee and I-64 projects. Looking back on 2023, it was a transformative year for Granite as we delivered on our strategic plan. We met our expectations for organic revenue growth and achieved our adjusted EBITDA margin range."

Granite Construction Inc's solid Q4 and FY 2023 performance, despite some project-specific setbacks, demonstrates the company's resilience and strategic execution. With a strong project pipeline and a focus on core construction skills honed over a century, GVA is well-positioned for continued growth and profitability in the years ahead.

For more detailed financial information and future updates on Granite Construction Inc (NYSE:GVA), investors and interested parties are encouraged to visit the company's Investor Relations website and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from Granite Construction Inc for further details.

This article first appeared on GuruFocus.