Granite Ridge Resources Inc (GRNT) Reports Solid Production Growth and Financial Performance ...

Production Growth: Achieved an 18% increase in Q4 production and a 23% increase for the full year.

Financial Strength: Reported net income of $17.5 million for Q4 and $81.1 million for the full year.

Adjusted EBITDAX: Generated $81.8 million in Q4 and $305.4 million for the full year.

Capital Deployment: Invested $78.4 million in Q4, with a total of $362.9 million for the year.

Asset Transactions: Completed the sale of Permian Basin assets to Vital Energy, Inc. and announced acquisitions and divestitures as part of strategic growth.

2024 Guidance: Expects a 7% production increase at the midpoint from 2023 levels, after asset divestiture adjustments.

On March 7, 2024, Granite Ridge Resources Inc (NYSE:GRNT) released its 8-K filing, detailing its financial and operational results for the fourth quarter and full-year 2023, while also providing an outlook for 2024. The company, a scaled, non-operated oil and gas exploration and production entity, invests in a diversified portfolio of production and top-tier acreage across the Permian and other prolific US basins in partnership with proven operators.

Q4 and Full-Year 2023 Performance Highlights

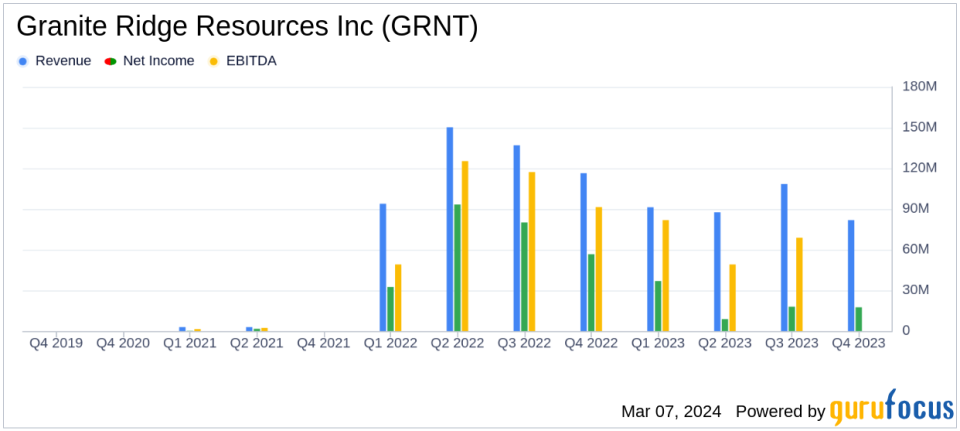

GRNT reported a significant increase in production, with an 18% rise to 26,034 barrels of oil equivalent per day in Q4, and a 23% increase for the full year. This growth in production was complemented by a solid financial performance, with net income reaching $17.5 million, or $0.13 per share, and Adjusted Net Income (non-GAAP) of $26.4 million, or $0.20 per share for the quarter. The full year net income stood at $81.1 million, or $0.61 per diluted share, with Adjusted Net Income (non-GAAP) at $107.1 million, or $0.80 per diluted share.

Adjusted EBITDAX (non-GAAP) for Q4 was $81.8 million, slightly down from $83.2 million in the prior year quarter. However, the full year Adjusted EBITDAX reached $305.4 million. The company also declared a dividend of $0.11 per share of common stock and ended the year with $140.1 million in liquidity.

Strategic Transactions and Operational Activity

GRNT's CEO, Luke Brandenberg, highlighted the company's strategic approach, stating,

We were pleased to end fourth quarter and full year 2023 with an average daily production increase of 18% and 23%, respectively. We also posted a year-over-year increase in proved reserves of 6%. This was a direct result of our successful multi-pronged strategy as we thoughtfully grow the business."

The company completed ten unique transactions in Q4, including acquisitions and a notable divestiture of certain Permian Basin assets to Vital Energy.

Operational activity for the year included placing 314 gross (24.55 net) wells online, with 212 gross (15.99 net) wells in-progress or pending completion by year-end. Proved reserves increased to 53,472 MBoe, up from 50,534 MBoe at the end of 2022.

Financial Position and 2024 Outlook

GRNT's balance sheet remains strong, with total assets amounting to $927.1 million. The company's long-term debt stands at $110 million, with a total stockholders' equity of $671.6 million. Looking ahead, GRNT anticipates a 7% increase in production for 2024, with a guidance of 23,250 to 25,250 Boe per day, after adjusting for the divestiture of assets to Vital Energy.

The company's 2024 guidance also includes development capital expenditures of $230 to $250 million and total capital expenditures of $265 to $285 million. GRNT plans to continue its quarterly cash dividend payment program, supporting shareholder value.

Granite Ridge Resources Inc's strategic transactions, increased production, and solid financial results demonstrate its commitment to growth and shareholder value. With a positive outlook for 2024, GRNT is poised to continue its trajectory in the oil and gas exploration and production industry.

For more detailed information on GRNT's financials and operational results, investors and interested parties are encouraged to review the full 8-K filing.

Granite Ridge Resources Inc will host a conference call to discuss these results and provide further insights into its 2024 guidance and strategic plans.

For further analysis and updates on GRNT and other market-moving financial news, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Granite Ridge Resources Inc for further details.

This article first appeared on GuruFocus.