The great car insurance con: Premiums soar to record high as prices hiked 50% in a year

Car insurance premiums have rocketed by almost 50 per cent over the past year, with millennials and older drivers hit hardest.

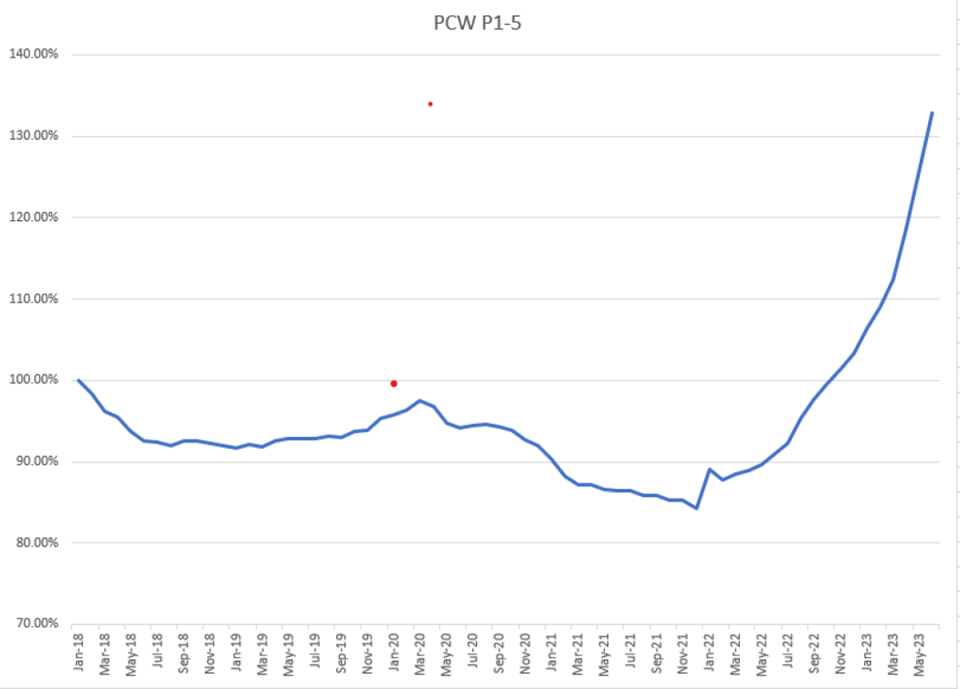

Exclusive data from the analyst Consumer Intelligence, which looks at quotes from Confused.com, Go Compare, Compare the Market and MoneySuperMarket, reveals that average premiums rose by 48 per cent on average in the 12 months to June 2023. Premiums are now at their highest since the start of 2018.

Car insurance is fast becoming one of the most expensive household bills, adding more financial pain at a time of high inflation and surging mortgage rates and rents.

In June, economists Ernst and Young warned that 2022 had been a difficult year for insurers and forecast that premiums would rise 16 per cent by the end of 2023. But the latest figures show that they’ve already soared four times higher.

David Trenner, 67, was last month shocked to discover that Esure was hiking the annual premium for his Renault Clio from £283 to £547 – a 93 per cent increase. “I expected a small increase because of inflation, but not 93 per cent,” he said.

Other drivers with insurers such as LV and Direct Line have also complained about eye-watering increases.

According to Consumer Intelligence, those aged 25 to 39 and 65 and over have been hardest hit by car insurance rises, with average premiums jumping by more than 50 per cent. Drivers in Scotland and London have seen their premiums rise the most.

It comes as executives at the top five firms were handed six- and seven-figure salaries and bonuses last year. Admiral Group gave a total of £2.15m to its chief executive Milena Mondini de Focatiis and £1.23m to chief financial officer Geraint Jones, while Aviva’s chief executive Amanda Blanc earned £5.52m.

Ros Altmann, a Conservative peer and a former government minister, told The Independent that “cost inflation will be a factor but cannot account for the 48 per cent [overall increase]”. She said a lack of transparency in insurers’ risk models and an increase in claims following the pandemic were also likely to be reasons.

But she conceded that not much could be done, adding: “I am not sure what regulators can do, as their last interventions have generally resulted in rising premiums for most people. Those who used to shop around diligently to take advantage of low-price initial offers cannot now do so.”

The Financial Conduct Authority (FCA) said the growing cost of repairs had caused motor insurance prices to spike, but Tim Kelly, an insurance expert and owner of the website MotorClaimGuru.co.uk, said some insurers were hiking prices to increase profits after the Covid pandemic.

“There is a lot of smoke and mirrors going on. Through Covid, insurers made massive profits. Now we have come out of Covid into a very different economic climate, insurers want their profit and are not absorbing the increased cost of inflation. In short, consumers are the losers and insurers are the winners,” he said.

An FCA spokesperson added: “We will continue to monitor the market to make sure customers are getting a fair deal from their providers.”

Why have premiums gone up?

Insurers say the main culprit is inflation. Rising energy bills and the higher cost of paint and materials have added to the cost of repairs, which have increased by 33 per cent, according to the Association of British Insurers. Courtesy car costs are increasing by around 30 per cent, while inflation has also pushed up the cost of personal injury claims, it said.

Catherine Carey, head of marketing at Consumer Intelligence, said: “As a result of this inflation and lagging premium increases in 2022, the motor insurance market reported large losses. Insurers are now adjusting prices to recoup these losses and reflect the ongoing impact of inflation.”

Meanwhile, the cost of living crisis has seen insurance fraud explode. Motor insurance fraud was the most common type of opportunistic fraud referred to the City of London Police’s Insurance Fraud Enforcement Department between March 2022 and April 2023.

“By exaggerating claims or providing false information when applying for insurance, fraudulent customers are pushing up the cost of insurance for everyone else,” said Ms Carey.

Another factor is changes to regulation. The so-called loyalty penalty was banned at the start of 2022, meaning insurers must not charge more to existing customers than they do to new ones.

According to James Daley, managing director of the consumer group Fairer Finance, this has increased prices for everyone – particularly those who shopped around for a cheaper policy every year.

“Premiums have been driven up by two main factors – inflation and changes to regulation. The cost of car repairs and car parts has risen just like everything else over the past year – as has the cost of personal injury claims. All of this pushes up the cost of insurance,” he said.

Experts say behavioural changes are also having an impact. Two years ago, the number of claims was lower than normal due to fewer people driving during the pandemic. But now people are back to their usual routines, the number of claims is increasing again – and so are premiums.

The growing number of electric vehicles may be playing a part too, as repairs to these can be a lot higher than to a standard car. The insurer LV added that “new high-tech vehicles equipped with sensors, cameras and high-voltage systems are raising the cost of replacement parts and also require specialist labour to fit”.

Direct Line said it priced customers’ policies “based on our view of risk, the rating factors we use and inflation”.

Who is seeing the biggest increase?

Those aged 25 to 39 and 65 and over have been hit with the highest level of car insurance inflation, with average rises of 52 per cent and 50 per cent respectively.

The under-25s, who traditionally suffer the most expensive premiums, have seen the lowest level of increase, at 38 per cent. This could be due to the availability of telematics policies, which log drivers’ speed and braking distance to assess their crash risk, and have kept a lid on prices for young drivers.

Motorists can also experience price rises because of where they live. London and Scotland have seen the biggest increases, with quotes for new policies rising by 53 per cent. The North East had the smallest average increase of 43 per cent, followed by the North West at 45 per cent.

These figures are based on quotes for new customers across the four price-comparison websites.

However, an analysis of the first five quotes returned on a comparison site, which consumers typically pick from, shows a slightly different story. This reveals that 25- to 39-year-olds face the highest car insurance inflation (47 per cent) followed by 17- to 24-year-olds and the 65-plus group (both 46 per cent).

The hike in premiums for older customers could be due to the rising number of drivers aged 80 and over, which has soared by 18 per cent over the past two years to reach 1.7 million, according to the DVLA. Elderly drivers may be seen as higher risk, pushing up the average price for the 65-plus category.