Great Lakes (GLDD) Receives Third Rock Installation Contract

Great Lakes Dredge & Dock Corporation GLDD won a third rock installation contract, solidifying its entry into the U.S. offshore wind market. The scope of the project includes procurement of rocks from the U.S. supply chain, transportation to and from the project site, and subsea installation of rocks to support the wind farm's infrastructure.

GLDD will perform subsea rock cable protection work on an offshore wind project off the East Coast of the United States. For this, Great Lakes will use the first Jones Act-compliant subsea rock installation vessel — the Acadia. Also, it will be purchasing rocks from domestic quarries and loading them at U.S. ports. The Acadia is currently under construction at the Philly Shipyard in the United States to execute the project.

Operations on the project are estimated to begin in 2025, subject to the client’s final investment decision.

On Dec 4, its shares jumped 3.47% following the news.

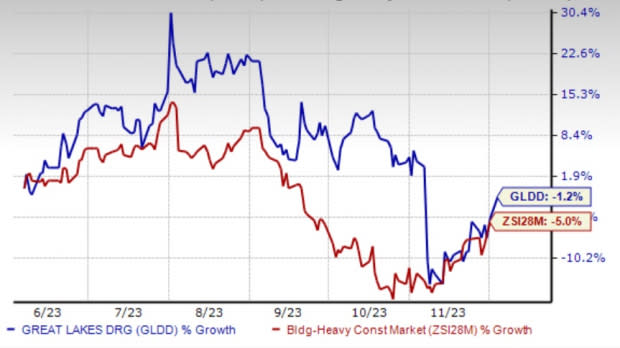

Share Price Performance

Great Lakes has outperformed the Zacks Engineering - R and D Services industry in the past six months.

Image Source: Zacks Investment Research

Great Lakes is the largest provider of dredging services in the United States. The company mainly banks on strong domestic dredging operations, high equipment utilization, solid project execution and savings from restructuring.

Recently, Great Lakes reported third-quarter 2023 results, which were impacted by vessel drydocks and idle equipment due to market delays from 2022 and the first half of 2023.

Despite facing these challenges, GLDD continued to bid on projects and build a solid backlog for the fourth quarter and full-year 2024. Great Lakes ended the third quarter with $1.03 billion of total backlog versus $377.1 million at 2022-end and $452.6 million at third-quarter 2022-end. Of the reported backlog, capital projects comprised of 71.2%.

We believe the company’s strong bidding ability and project execution, along with improved market conditions, fleet adjustment and cost reduction initiatives, will boost its performance in 2024 and beyond.

Zacks Rank & Key Picks

Currently, GLDD carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the Zacks Construction sector have been discussed below.

EMCOR Group, Inc. EME presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 25%, on average. The Zacks Consensus Estimate for EME’s 2023 earnings indicates an improvement of 52.8% from the prior-year level.

Dycom Industries, Inc. DY, based in Palm Beach Gardens, FL, is a specialty contracting service provider in the United States. The company has been benefiting from the higher demand for network bandwidth and mobile broadband, extended geographic reach and proficient program management and network planning services. Yet, persistent challenges associated with the automotive and equipment supply chains are causes of concern.

Dycom carries a Zacks Rank #2 (Buy) at present. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 154.3%. Earnings per share for fiscal 2024 are expected to grow 62.6%.

Granite Construction, Inc. GVA, which sports a Zacks Rank #1 at present, is the largest diversified infrastructure company in the United States. It has been banking on strategic initiatives, inorganic moves and strong bidding activities.

The consensus mark for GVA’s 2023 earnings is expected to increase 35.1% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Great Lakes Dredge & Dock Corporation (GLDD) : Free Stock Analysis Report

Granite Construction Incorporated (GVA) : Free Stock Analysis Report