Great Lakes (GLDD) Wins Contract for Port Arthur LNG Phase 1

Great Lakes Dredge & Dock Corporation GLDD has received the Port Arthur LNG Phase 1 project Marine Dredging and Disposal contract from Bechtel Energy, Inc.

Shares of this leading dredging service provider in the United States gained 1.5% during the trading session and 3.6% in the after-hour trading session on Aug 23.

Bechtel Energy is a prominent global engineering, construction, and procurement firm overseeing the Port Arthur LNG Phase 1 project in collaboration with Sempra Infrastructure. This project in Southeast Texas encompasses a natural gas liquefaction and export terminal strategically positioned along the Gulf of Mexico. Its infrastructure will feature two natural gas liquefaction trains boasting a combined capacity of approximately 13 million tonnes per annum, along with the construction of new natural gas pipelines, to facilitate efficient gas delivery to the terminal.

GLDD's role in this contract is to dredge the Port Arthur LNG Berthing Pocket within the Port Arthur Ship Canal. This pocket, in tandem with a turning basin, will provide LNG vessels with safe berthing, loading, and departure capabilities. Furthermore, a substantial portion of the dredged materials will be strategically placed in Beneficial Use of Dredged Material areas, contributing to the restoration and enhancement of marshlands within a local wildlife refuge. GLDD is poised to commence this project later this year.

This contract bolsters GLDD's backlog level, pushing their recent pending awards and work beyond the $1 billion mark. GLDD's proven track record and unwavering commitment to safety position them perfectly to support growth of LNG exports in the United States. This growth is pivotal in maintaining energy affordability while advancing sustainability goals, making GLDD's involvement in the Port Arthur LNG Phase 1 project a strategic win for the company and the nation's energy landscape.

Strong Bidding: A Boon

Great Lakes is the largest provider of dredging services in the United States. The company mainly banks on strong domestic dredging operations, high equipment utilization, solid project execution and savings from restructuring.

On Jun 30, 2023, the company had $434.6 million in dredging backlog compared with $377.1 million on Dec 31, 2022. Low bids and options pending award totaled $487.3 million as of Jun 30, 2023.

During the first six-month period ending on Jun 30, 2023, the total bid market amounted to $930.4 million for GLDD. Notably, Great Lakes secured a substantial 33.6% share of this market. This impressive growth in the bid market can be attributed to the robust state of the capital market. Specifically, this market has already witnessed the submission of six bids for port improvement projects, encompassing Freeport, San Juan, Norfolk, and Jacksonville.

For the first half of 2023, the cumulative capital bid market for port improvement projects reached $315.1 million. Astonishingly, Great Lakes emerged as the victor in 55.7% of the market year to date (YTD). Looking ahead, the company anticipates that budgeted appropriations will provide crucial support for funding several port improvement projects that had been postponed. These projects include Sabine, Houston, Corpus Christi, and additional phases of Norfolk, all of which are expected to go to bid before the conclusion of 2023.

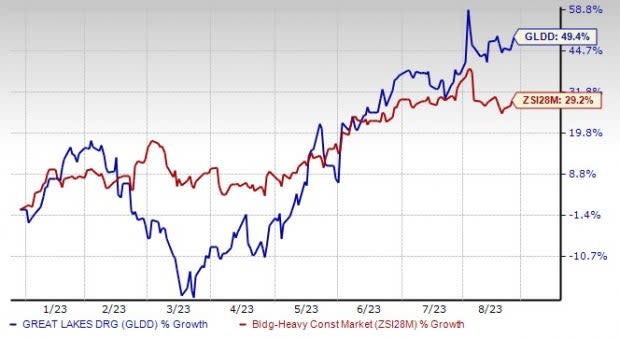

Image Source: Zacks Investment Research

GLDD stock has gained 49.4% year to date compared with the Zacks Building Products - Heavy Construction industry’s 29.2% rise.

We believe the company’s strong bidding ability and project execution, along with improved market conditions, fleet adjustment and cost-reduction initiatives, will boost its performance in 2023 and beyond.

Zacks Rank & Key Picks

Currently, GLDD carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Zacks Construction sector are:

Sterling Infrastructure, Inc. STRL provides transportation, e-infrastructure and building solutions. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $4.09 per share from $3.52 in the past seven days.

Shares of STRL have gained 143.3% YTD. STRL’s expected earnings growth rate for 2023 is 29.4% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Willdan Group WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry. Shares of WLDN have gained 34.1% YTD.

Willdan Group presently flaunts a Zacks Rank #1. WLDN’s expected earnings growth rate for 2023 is 50%. The Zacks Consensus Estimate for WLDN’s 2023 earnings has moved north to $1.32 per share from $1.25 in the past 30 days.

Fluor Corporation FLR benefits from its diverse presence in various markets, which allows it to reduce the impact of market fluctuations. The company adopts a strategic approach by maintaining a well-balanced business portfolio, enabling it to prioritize stable markets while taking advantage of opportunities in cyclical markets when the timing is appropriate. The Zacks Consensus Estimate for FLR’s 2023 earnings has moved north to $1.98 per share from $1.74 in the past 30 days.

FLR presently sports a Zacks Rank #1. Shares of FLR have lost 4.5% YTD. Its expected earnings growth rate for 2023 is 141.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Great Lakes Dredge & Dock Corporation (GLDD) : Free Stock Analysis Report