Great Lakes (GLDD) Wins Key Dredging Contracts Worth $177M

Great Lakes Dredge & Dock Corporation GLDD, the leading U.S. dredging services provider, has clinched contracts worth $177 million, bolstering its position as a key player in coastal protection and maintenance projects. These contracts are set to have a significant impact on the Great Lakes and the regions they serve.

Shares of GLDD gained 3% during the trading session on Sep 19 and 1.2% in the after-hour trading session on the same day.

Among the projects that have been awarded, one notable project is the Orange Beach, Gulf State Park, Gulf Shores Engineered Beach Renourishment Project in Alabama, valued at $32.8 million. This initiative aims to restore the city's beaches after hurricane damage, benefiting both infrastructure and local wildlife conservation.

Another crucial contract is the $27.1 million Fire Island Inlet to Montauk Inlet Rehabilitation Project in New York, funded by the U.S. Army Corps of Engineers. It involves dredging sand to replenish beaches, enhancing shoreline resilience.

In Louisiana, the Mississippi River Southwest Pass Maintenance Dredging Project ($22.1 million) and the Atchafalaya River Maintenance Dredging Project ($20.6 million) will maintain navigable waterways, promoting commerce and safety.

Furthermore, the Naval Submarine Base Kings Bay – Entrance Channel Dredging Project in Florida (valued at $18.6 million), the Beach Nourishment of Cape May Inlet to Lower Township Project in New Jersey (valued at $16.2 million), and the Mississippi River Southwest Pass and Calcasieu River Bar Channel Dredging Project in Texas (valued at $16.1 million) will further contribute to coastal protection and maintenance. Also, other capital and maintenance projects totaled $23.5 million.

These contracts bring Great Lakes' dredging backlog to approximately $1.1 billion so far this year. GLDD's involvement in these projects demonstrates its commitment to enhancing environmental and infrastructure resilience, supporting coastal communities, and bolstering the nation's coastlines. By securing these contracts, Great Lakes continues to play a pivotal role in safeguarding America's coastlines, infrastructure, and natural habitats.

Share Price Performance

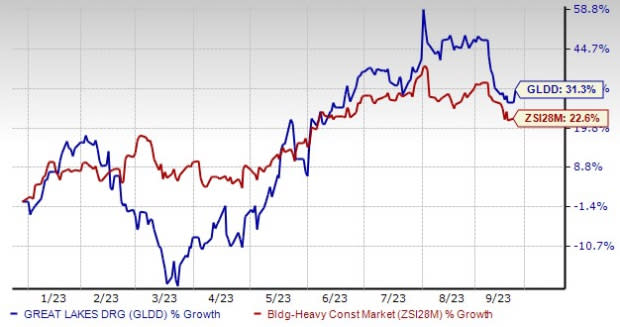

GLDD stock has gained 31.3% year to date, outperforming the Zacks Building Products - Heavy Construction industry’s 22.6% rise.

Image Source: Zacks Investment Research

Looking ahead, the company anticipates that budgeted appropriations will provide crucial support for funding several port improvement projects that had been postponed. These projects include Sabine, Houston, Corpus Christi, and additional phases of Norfolk, all of which are expected to go to bid before the conclusion of 2023. For the first half of 2023, the cumulative capital bid market for port improvement projects reached $315.1 million.

On Jun 30, 2023, the company had $434.6 million in dredging backlog compared with $377.1 million on Dec 31, 2022. Low bids and options pending award totaled $487.3 million as of Jun 30, 2023.

We anticipate that the company's robust capacity for competitive bidding and effective project management, coupled with favorable market dynamics, fleet optimization, and cost-saving measures, will drive its performance positively in 2023 and into the future.

Zacks Rank & Key Picks

Currently, GLDD carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Zacks Construction sector are:

Sterling Infrastructure, Inc. STRL provides transportation, e-infrastructure and building solutions. The Zacks Consensus Estimate for STRL’s 2023 earnings has moved north to $4.09 per share from $3.52 in the past 60 days.

Shares of STRL have gained 126.5% year to date (YTD). STRL’s expected earnings growth rate for 2023 is 29.4% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Willdan Group WLDN is a nationwide provider of professional, technical and consulting services to utilities, government agencies and private industry. Shares of WLDN have gained 15.2% YTD.

Willdan Group presently flaunts a Zacks Rank #1. WLDN’s expected earnings growth rate for 2023 is 50%. The Zacks Consensus Estimate for WLDN’s 2023 earnings has moved north to $1.32 per share from $1.23 in the past 60 days.

Fluor Corporation FLR benefits from its diverse presence in various markets, which allows it to reduce the impact of market fluctuations. The company adopts a strategic approach by maintaining a well-balanced business portfolio, enabling it to prioritize stable markets while taking advantage of opportunities in cyclical markets when the timing is appropriate. The Zacks Consensus Estimate for FLR’s 2023 earnings has moved north to $1.98 per share from $1.74 in the past 60 days.

FLR presently sports a Zacks Rank #1. Shares of FLR have gained 10.2% YTD. Its expected earnings growth rate for 2023 is 141.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Great Lakes Dredge & Dock Corporation (GLDD) : Free Stock Analysis Report