How to Find Great Value Stocks to Buy Now

The sellers turned up the heat again on Tuesday, preventing the S&P 500 and the Nasdaq from quickly rebounding back to their 21-day moving averages. The substantial moves lower through mid-day trading could signal more volatility in the coming days heading into the release of key inflation data on Thursday morning.

The Moody’s downgrade of 10 regional banks helped spark the selling on Tuesday. The market is also continuing to digest the nearly constant wave of earnings results to see what to expect from various parts of the economy in the back half of 2023.

Image Source: Zacks Investment Research

Thankfully, the earnings picture has held up really well, with nearly 90% of the S&P 500 having reported already. The next major market mover will likely be July inflation data. Wall Street estimates call for YoY CPI at 3.3% in July vs. 3% in June.

Given the potentially pivotal inflation data on Thursday and the possibility of more selling in the near term, investors might want to focus on stocks that offer a compelling combination of strong value and improving earnings outlooks.

Screen Basics

The screen we are digging into today comes loaded with the Research Wizard and aims to sort through highly-ranked Zacks stocks to find some of the top value names.

This value-focused screen searches only for stocks that boast Zacks Rank #1 (Strong Buys) or #2 (Buys). It also focuses on stocks with price-to-earnings (P/E) ratios under the median for its industry.

The screen also looks for stocks with price-to-sales (P/S) ratios under the median for its industry to help lock in relative value compared to its peers, since basing it off the wider market is not always the most useful tool.

The screen then digs into quarterly earnings rates above the median for its industry. This particular Zacks screen also uses a special blend of upgrades and estimates revisions to select the best seven stocks in this list.

The screen basics are listed below…

Only Zacks Rank #1 (Strong Buy) or #2 (Buy) Stocks

P/E (using 12-month EPS) - Under the Median for its Industry

P/S - Under the Median for its Industry

Percentage Change Act. EPS Q(0)/Q(-1)

Rating Change and Revisions Factors (to help narrow the list to the 7 best stocks in this list)

This strategy comes loaded with the Research Wizard and it is called bt_sow_value_method1. It can be found in the SoW (Screen of the Week) folder.

The screen is pretty simple, yet powerful. Here are two of the seven stocks that made it through this week's screen…

Ryder System, Inc. (R)

Ryder System is a major player in the logistics and transportation world. Ryder helps manage and support essential fleet and supply chain functions for roughly 50,000 customers. Ryder breaks down its business into three core categories: Fleet Management Solutions, Supply Chain Solutions, and Dedicated Transportation Solutions.

Ryder topped our Q2 earnings estimates in late July and boosted its bottom-line guidance. R faces a tough-to-compete-against stretch of top and bottom-line growth. But its positive earnings revisions help it land a Zacks Rank #2 (Buy) right now, alongside its “A” grades for Value and Momentum and “B” for Growth in our Style Scores system. Plus, its Transportation - Equipment and Leasing unit currently ranks in the top 4% of over 250 Zacks industries.

Image Source: Zacks Investment Research

Ryder announced in mid-July that it boosted its dividend by 15%, with its next payout due on September 15 to shareholders of record on August 21. The company has now paid dividends for 47 years in a row. Ryder’s $0.71 a share quarterly payout yields around 2.8% at the moment.

Ryder shares are up 30% over the last five years vs. its Zacks sector’s 10%. R stock has also climbed by 160% in the last three years and 21% in the past three months to trade near fresh all-time highs. Despite that strength, Ryder stock trades at a 40% discount to its sector and 30% below its highly-ranked industry at 8.7X forward 12-month earnings. This also represents a 28% discount against Ryder’s own 10-year median.

Celestica (CLS)

Celestica’s business is centered on design, manufacturing, hardware platform, and supply chain solutions. The company’s services include design and engineering, logistics and fulfillment, product licensing services, testing and quality, and beyond. Celestica’s clients operate in various areas of the economy such as communications, aerospace and defense, healthcare tech, industrial and smart energy, and more.

Celestica in November 2021 completed its acquisition of Singapore-based PCI Private Limited. The deal brought a leading electronics manufacturing services provider in Asia into Celestica’s mix. CLS topped our Q2 earnings and revenue estimates on July 26 and boosted its outlook. Celestica is projected to post 20% adjusted earnings growth in 2023 and another 9% higher earnings next year.

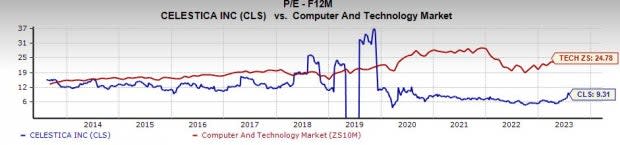

Image Source: Zacks Investment Research

Celestica’s recent positive earnings revisions help it grab a Zacks Rank #1 (Strong Buy) right now. CLS is part of the Zacks Electronics - Manufacturing Services industry alongside Jabil (JBL) and others, which ranks in the top 5% of over 250 Zacks industries right now.

CLS shares have soared 150% in the last three years to top its industry’s 130%. This run includes a 95% surge in the past three months. Despite the climb, Celestica trades at a 14% discount to its three-year highs and 18% below its industry.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance/.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Celestica, Inc. (CLS) : Free Stock Analysis Report