Green Brick Partners Inc Reports Stellar Year-End Earnings with Record EPS

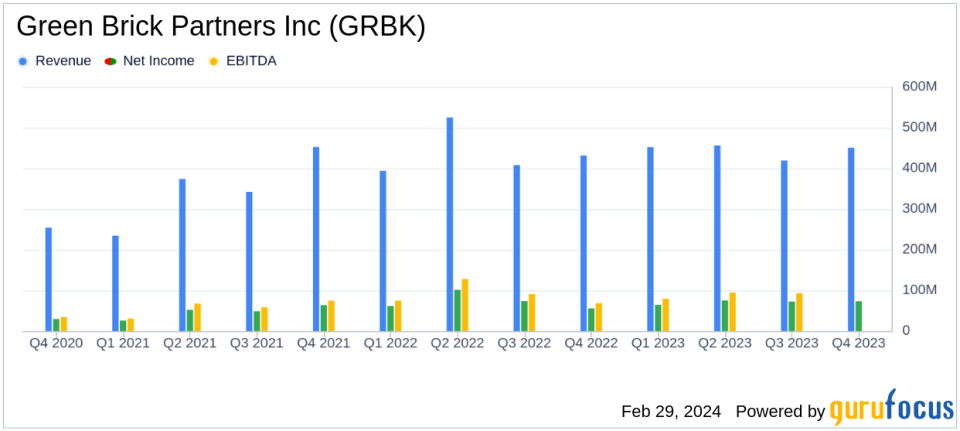

Net Income: Q4 net income up 31.5% YoY, full year net income slightly down by 2.5%.

Diluted EPS: Record high annual diluted EPS of $6.14, up 2% YoY; Q4 diluted EPS increased by 33.9% YoY to $1.58.

Revenue: Total annual revenues reached $1.8 billion, a modest increase of 1.1% YoY.

Gross Margin: Homebuilding gross margin for Q4 rose to 31.4%, a significant increase of 520 basis points YoY.

New Home Orders: Net new home orders surged by 60.5% for the quarter and 70.1% for the full year.

Debt Ratios: Debt to total capital at 21.1% and net debt to total capital at 11.4%, showcasing strong financial health.

On February 29, 2024, Green Brick Partners Inc (NYSE:GRBK) released its 8-K filing, announcing its fourth quarter and full year 2023 results. The company, a diversified homebuilding and land development firm operating primarily in Texas and Georgia, reported a record diluted earnings per share (EPS) of $6.14 for the year, with total revenues reaching $1.8 billion.

Green Brick Partners Inc is known for its strategic land acquisition and development, as well as its construction and sales operations across its various segments. The majority of its revenue stems from its central builder operations, particularly in Texas, where it has recently expanded into Houston.

Financial Performance and Market Position

The company's financial achievements for the year are noteworthy, especially considering the competitive and cyclical nature of the homebuilding industry. The record high annual diluted EPS represents a 2% increase from the previous year, while the fourth quarter diluted EPS saw a significant jump of 33.9% year-over-year to $1.58. This performance is indicative of Green Brick Partners' ability to maintain profitability and shareholder value in a challenging market.

Green Brick's homebuilding gross margin for the fourth quarter was particularly impressive at 31.4%, up 520 basis points from the previous year. This margin expansion is a testament to the company's operational efficiency and pricing power in its markets. The net new home orders, which grew by 60.5% for the quarter and 70.1% year-over-year, reflect strong demand for Green Brick's homes and the company's successful market positioning.

Balance Sheet and Cash Flow Insights

The company's balance sheet remains robust, with a low debt to total capital ratio of 21.1% and an even lower net debt to total capital ratio of 11.4%. These ratios are among the lowest in the public homebuilder sector and demonstrate Green Brick's financial discipline and strong liquidity position.

"Our industry leading results would not have been possible without a fantastic team effort combined with our financial discipline and investment grade balance sheet," said Jim Brickman, CEO and Co-Founder of Green Brick Partners.

Green Brick's strategic land acquisitions, particularly the recent entry into the Houston market, are expected to contribute to future growth. The company's backlog of $555 million at the end of 2023, a 50.4% increase year-over-year, provides a solid foundation for 2024.

Looking Ahead

As Green Brick Partners Inc looks to the future, the company appears well-positioned to continue delivering strong returns on equity, with a return on equity of 24.9% for the full year. The expansion into Houston and the continued demand in its primary markets of Dallas-Fort Worth and Atlanta suggest a promising outlook for the company.

"As we look ahead, we believe we are well positioned to continue delivering one of the best risk-adjusted returns on equity in the industry," Mr. Brickman concluded.

For value investors and potential GuruFocus.com members, Green Brick Partners Inc represents a company with a solid track record of financial performance, strategic market positioning, and disciplined growth. The full earnings report and further details can be accessed through the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Green Brick Partners Inc for further details.

This article first appeared on GuruFocus.