Green Dot Corp (GDOT) Faces Regulatory Challenges Despite Revenue Growth

Total Operating Revenues: Increased by 4% year-over-year to $1.50 billion in 2023.

Net Income: Experienced a significant decline of 90% to $6.72 million in 2023.

Adjusted EBITDA: Decreased by 28% to $170.87 million in 2023.

Non-GAAP EPS: Dropped by 37% to $1.62 in 2023.

Regulatory Concerns: Accrued $20 million for a proposed consent order related to compliance risk management.

2024 Financial Guidance: Projects modest revenue growth and a slight increase in adjusted EBITDA.

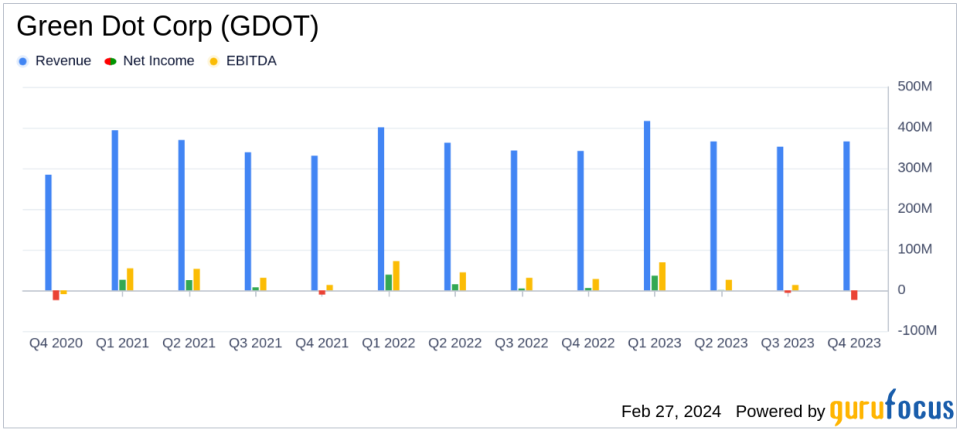

On February 27, 2024, Green Dot Corp (NYSE:GDOT) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The financial technology company, known for providing inclusive banking and payment solutions, reported a year-over-year increase in total operating revenues to $1.50 billion, up 4% from the previous year. However, net income saw a drastic drop of 90%, settling at $6.72 million for the year.

Adjusted EBITDA, a key metric for evaluating the company's operational efficiency, also experienced a decline, falling 28% to $170.87 million. Non-GAAP earnings per share (EPS) followed suit, decreasing by 37% to $1.62. These figures reflect the challenges faced by the company, including higher interest rates, client de-conversions, and significant investments in strategic initiatives such as processor conversions.

Green Dot's CEO, George Gresham, acknowledged the pivotal nature of 2023, citing the completion of processor conversion and cost streamlining efforts. He expressed optimism for 2024, anticipating revenue and adjusted EBITDA growth driven by a robust business pipeline and new partnerships.

"2023 was a pivotal year as we completed our processor conversion, streamlined costs and announced new partners in our BaaS and retail channels," said George Gresham, Chief Executive Officer of Green Dot. "Looking forward with a more powerful and efficient foundation and a strong business pipeline, I believe we are poised to improve our revenue and adjusted EBITDA growth as we move through 2024."

Despite the positive outlook for growth, Green Dot is currently navigating regulatory challenges. The company has received a proposed consent order from the Federal Reserve Board concerning compliance risk management, including consumer compliance and anti-money laundering regulations. In response, Green Dot has accrued an estimated liability of $20 million related to the consent order in the fourth quarter of 2023.

For 2024, Green Dot has set financial guidance with expectations of non-GAAP total operating revenues between $1.55 billion and $1.60 billion, marking an approximate 6% increase at the mid-point. Adjusted EBITDA is projected to be between $170 million and $180 million, a slight uptick from the previous year. However, non-GAAP EPS is anticipated to decrease by 6% at the mid-point.

Green Dot's balance sheet remains solid with approximately $55 million in unencumbered cash at the holding company level as of December 31, 2023. The company's focus on growth and operational efficiency, coupled with its strategic initiatives, positions it to navigate the current economic landscape and regulatory environment.

Investors and stakeholders will be watching closely to see how Green Dot's strategies unfold in the coming year, especially in light of the potential impact of the proposed consent order and the company's ability to maintain its growth trajectory amidst evolving regulatory demands.

For more detailed information, including financial statements and key metrics, please refer to the full 8-K filing on the SEC website.

Green Dot Corporation will be hosting a conference call to discuss the fourth quarter and full year 2023 financial results, providing an opportunity for investors to gain further insights into the company's performance and future prospects.

For those interested in Green Dot's innovative financial solutions and the impact of its strategic decisions on the fintech industry, stay tuned to GuruFocus.com for continued coverage and expert analysis.

Explore the complete 8-K earnings release (here) from Green Dot Corp for further details.

This article first appeared on GuruFocus.