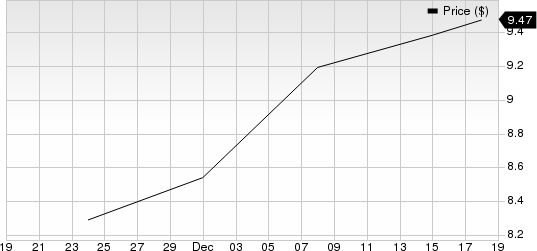

Green Dot (GDOT) Rises 17% in a Month: Here's What to Know

Green Dot Corporation GDOT has had an impressive run over the past month. The stock has gained 17.1%, significantly outperforming the 4.6% rise of the industry it belongs to and the 3.4% rally of the Zacks S&P 500 composite.

Factors That Augur Well

Green Dot remains focused on ensuring the long-term growth of its businesses. The company’s efforts toward the acquisition of long-term users of its products, improving brands and image, building market adoption and awareness of products, and increasing card usage and customer retention have been positive. Its sales and marketing efforts remain focused on a broad group, ranging from never-banked to fully-banked consumers.

Green Dot Corporation Price

Green Dot Corporation price | Green Dot Corporation Quote

Green Dot is expanding its addressable market with the help of its BaaS account programs. The company partnered with some top consumer and technology companies, including Amazon and Apple, to design and develop their fintech banking solutions through its BaaS platform. These solutions are then made available by these companies to their consumers and partners again through integration with the program, eventually expanding the company’s spectrum of consumers.

Green Dot’s long-standing relationship with Walmartremains a key driver of its operating revenues. It designs and delivers Walmart MoneyCard products and provides program support that includes network IT, website functionality, regulatory and legal compliance, customer service and loss management. It also sells certain Walmart-branded open-loop gift cards. Walmart provides Green Dot with shelf space to offer Green Dot-branded and GoBank checking account products.

The company’s operating revenues derived from products and services offered through Walmart represented 21%, 24% and 27% of total operating revenues for 2022, 2021 and 2020, respectively.

Zacks Rank and Stocks to Consider

Green Dot currently carries a Zacks Rank #3 (Hold).

Investors can consider the following better-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

FTI Consulting FCN also carries a Zacks Rank #2 at present. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, indicating 3.3% year-over-year growth.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report