Green Plains (GPRE) Inks Merger Deal With Green Plains Partners

Green Plains Inc. GPRE and Green Plains Partners LP GPP have entered into a merger agreement. Per the deal, Green Plains will acquire all publicly held common units of Green Plains Partners that are not already owned by Green Plains and its affiliates. This acquisition will be completed using Green Plains common stock and cash.

Green Plains Partners, a fee-based limited partnership, was formed by Green Plains in 2015. Green Plains currently owns a 48.8% limited partner interest and a 2.0% general partner interest in Green Plains Partners. It offers fuel storage and transportation services by owning, operating, developing and acquiring ethanol and fuel storage terminals, transportation assets and other related assets and businesses.

Under the terms of the agreement, each outstanding common unit of the Green Plains Partners not owned by Green Plains and its affiliates will be converted into the right to receive 0.405 shares of Green Plains common stock and $2.00 in cash.

Additionally, unitholders will receive an amount of cash equivalent to unpaid distributions from the last quarter in which a distribution was made until the closing date, as determined by the merger agreement (without interest).

Excluding the unpaid distribution amount, this merger consideration equates to approximately $15.69 per partnership common unit as of September 15, 2023. This represents a premium of 20% over the closing price of the common units of $13.08 on May 3, 2023 – the day prior to Green Plains' initial offer to acquire all publicly held common units of the partnership that it did not already own,

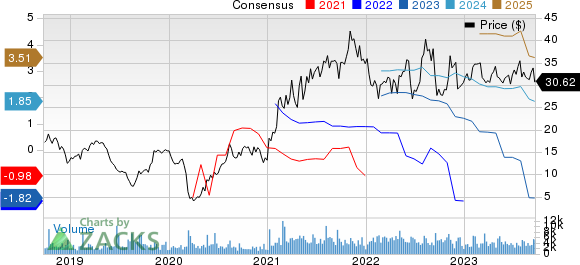

Green Plains, Inc. Price and Consensus

Green Plains, Inc. price-consensus-chart | Green Plains, Inc. Quote

The merger is slated to close in the fourth quarter of 2023, subject to approval by the majority of outstanding common unitholders of the partnership.

This proposed merger will result in several advantages, including simplifying Green Plains’ corporate structure and governance, driving immediate earnings and cash flow benefits and lowering SG&A expenses tied to the partnership. It will also help improve the combined enterprise's credit quality and align strategic interests between Green Plains shareholders and the partnership’s unitholders by regaining full ownership and control over Green Plains’ total platform, including terminal operations.

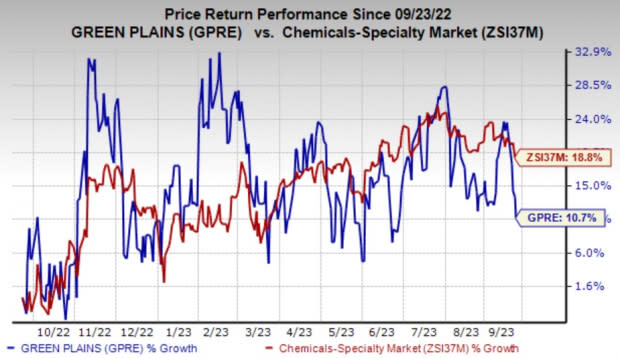

Green Plains’ shares have risen 10.7% in the past year compared with the industry's 18.8% rise in the same period.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Green Plains currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and Alamos Gold Inc. AGI, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48, indicating a year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 106.4% in the past year.

The earnings estimate for Alamos’ current year is pegged at 43 cents, indicating a year-over-year growth of 53.6%. The Zacks Consensus Estimate for AGI current-year earnings has been revised 7.5% upward in the past 60 days. The company’s shares have risen roughly 85.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Green Plains, Inc. (GPRE) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Green Plains Partners LP (GPP) : Free Stock Analysis Report