Green Plains Inc (GPRE) Reports Solid Q4 and Full Year 2023 Results Amid Strategic Shifts

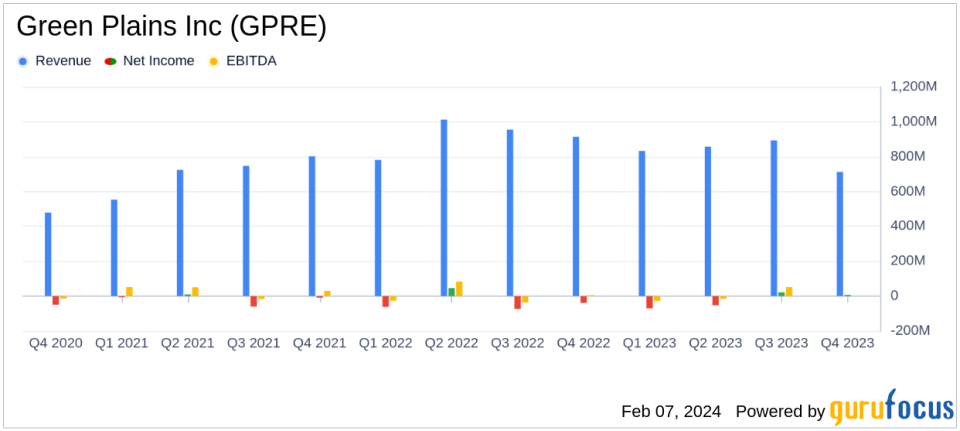

Net Income: $7.2 million, or $0.12 per diluted share in Q4 2023, a significant improvement from a net loss of $38.6 million in Q4 2022.

EBITDA: Increased to $44.7 million in Q4 2023 from $5.7 million in Q4 2022.

Revenue: Decreased to $712.4 million in Q4 2023 from $914.0 million in Q4 2022, reflecting lower average selling prices and volumes.

Liquidity: Strong position with $378.8 million in cash and cash equivalents, and $251.0 million available under a committed revolving credit facility.

Strategic Review: The Board of Directors initiates a comprehensive strategic review process to explore opportunities to enhance value.

Decarbonization: Progress in carbon capture and sequestration (CCS) projects, with operations expected to start in 2025 and 2026.

On February 7, 2024, Green Plains Inc (NASDAQ:GPRE) released its 8-K filing, announcing its financial results for the fourth quarter and full year 2023. The company, a leading biorefining entity specializing in ethanol production and related byproducts, reported a net income of $7.2 million, or $0.12 per diluted share for the fourth quarter, a significant turnaround from the net loss of $38.6 million for the same period in 2022. EBITDA for the quarter was reported at $44.7 million, up from $5.7 million in the prior year's quarter.

Green Plains operates through three segments: ethanol production, agribusiness and energy services, and partnership. The ethanol production segment, which is the primary revenue generator, includes the production of ethanol, grains, and corn oil. The agribusiness and energy services segment encompasses grain procurement and commodity marketing, while the partnership segment provides fuel storage and transportation services.

Performance and Challenges

The company's performance in Q4 2023 was marked by a 95% platform utilization rate, contributing to the improved financial results. The development of 60% protein sales and record renewable corn oil yield were also notable achievements. However, revenues for the quarter decreased to $712.4 million compared to $914.0 million in the same period of the previous year, primarily due to lower average selling prices and volumes sold of ethanol, distillers grains, and renewable corn oil.

Despite the revenue decline, the company's strategic initiatives, including the acquisition of Green Plains Partners LP and the ongoing development of decarbonization strategies, are expected to enhance long-term shareholder value. The company's diversification into carbon capture and sequestration (CCS) projects is particularly significant, with operational commencement anticipated in 2025 and 2026 for facilities in Nebraska, Iowa, and Minnesota.

Financial Achievements and Importance

Green Plains' financial achievements in Q4 2023 underscore the company's resilience and adaptability in a challenging market. The swing to net income profitability and the substantial increase in EBITDA reflect the company's effective cost management and operational efficiency. These achievements are crucial for Green Plains as they provide the financial stability required to continue investing in innovative technologies and sustainable practices, which are increasingly important in the chemicals industry.

Key Financial Metrics

Key financial details from the income statement and balance sheet include:

Net Income: Improved to $7.2 million in Q4 2023 from a net loss of $38.6 million in Q4 2022.

EBITDA: Increased to $44.7 million in Q4 2023 from $5.7 million in Q4 2022.

Revenue: Decreased to $712.4 million in Q4 2023 from $914.0 million in Q4 2022.

Liquidity: $378.8 million in cash and cash equivalents, and $251.0 million available under a committed revolving credit facility.

Total Debt: $599.7 million as of December 31, 2023.

"The last half of 2023 has started to show the results of years of planning and execution to get our asset base and team ready for a further transition to higher-value, higher-margin products," said Todd Becker, President and Chief Executive Officer.

Green Plains' strategic review process initiated by the Board of Directors is a proactive step to evaluate potential opportunities, including acquisitions, divestitures, mergers, or sales, to enhance shareholder value. The company's commitment to innovation and sustainability, as evidenced by its investments in Clean Sugar Technology and Sustainable Aviation Fuel technology, positions it well for future growth.

Conclusion and Analysis

Green Plains Inc (NASDAQ:GPRE) has demonstrated a strong finish to 2023 with its Q4 results. The company's strategic pivot towards value-added products and decarbonization initiatives is expected to drive future growth and profitability. The comprehensive strategic review process initiated by the Board indicates a forward-looking approach to maximizing shareholder value. Investors and stakeholders can look forward to the company's continued progress in its transformation journey.

For more detailed information and analysis on Green Plains Inc (NASDAQ:GPRE)'s financial results, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Green Plains Inc for further details.

This article first appeared on GuruFocus.